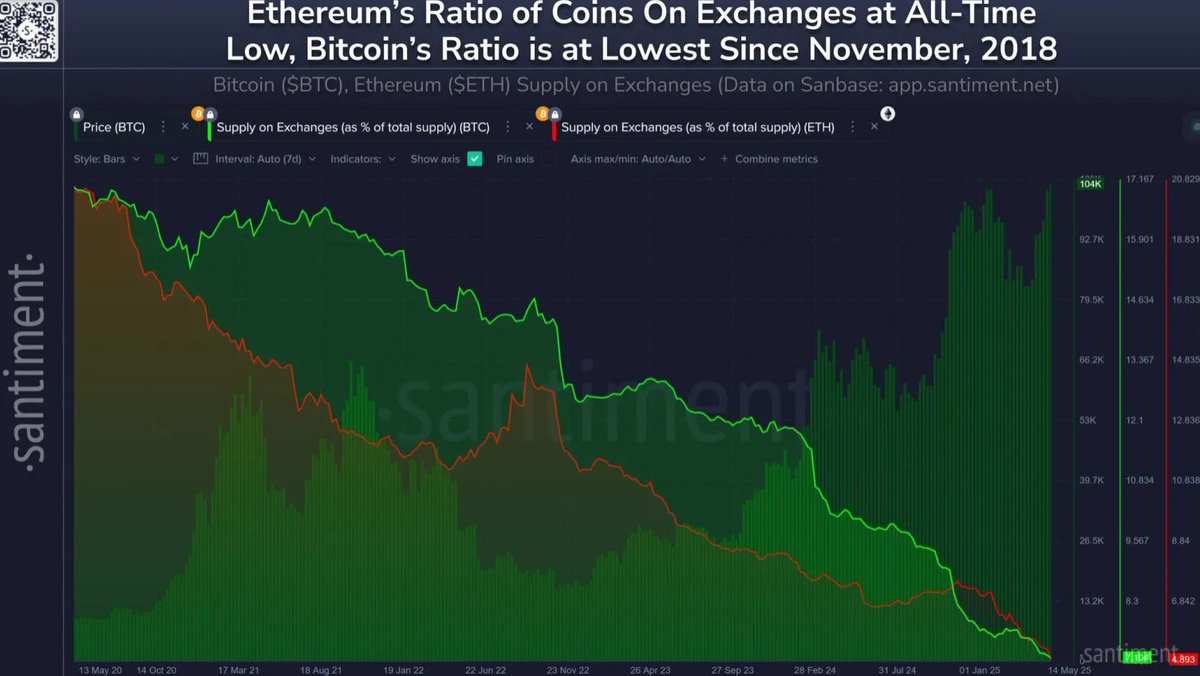

This milestone underscores a broader trend of dwindling exchange balances for ETH, and it may carry significant implications for market sentiment and price action.

The chart shows a steep and consistent decline in the ratio of ETH held on exchanges—a pattern that has accelerated over the past year. Meanwhile, Bitcoin (BTC) follows a similar but more moderate trajectory, with its exchange supply now at its lowest since November 2018.

This trend is widely interpreted as bullish: fewer coins on exchanges generally means reduced selling pressure. When holders move assets off exchanges, it’s often a signal that they intend to hold them long-term, rather than sell or trade.

As investor confidence in Ethereum’s long-term prospects grows—driven by staking, Layer 2 development, and increasing institutional interest—this data could be a reflection of an evolving investment mindset.

In summary, the record-low ETH supply on exchanges suggests a tightening market and may point to an incoming supply squeeze, should demand continue to rise.

The post Ethereum Supply on Exchanges Hits All-Time Low—A Bullish Signal? appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·