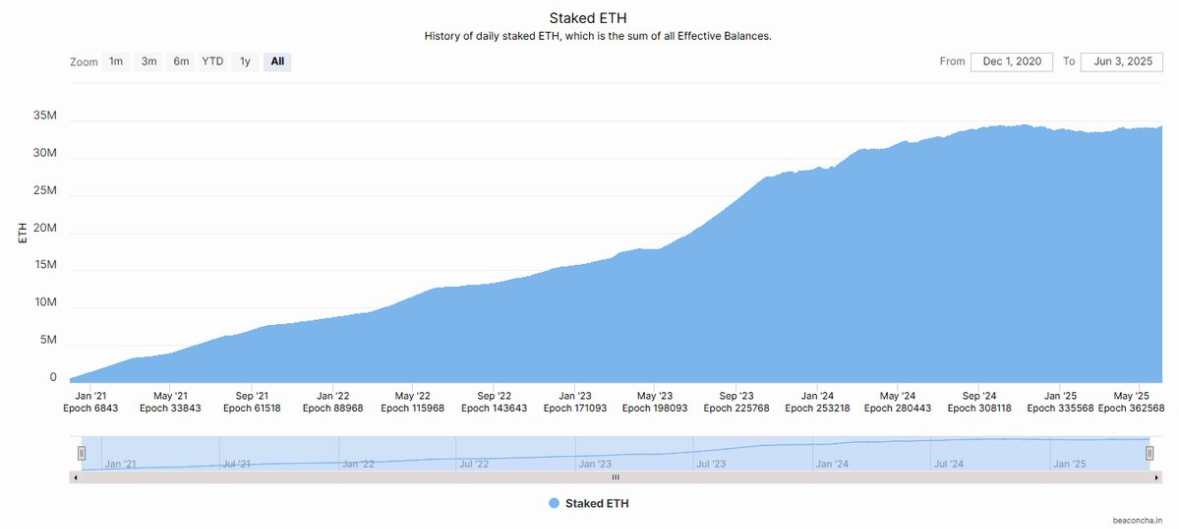

Ethereum staking has reached ATH levels, with more than 32.8 million ETH — valued at over $100 billion — now locked and removed from active circulation, according to crypto trader Merlijn The Trader.

The milestone comes as much of the market’s attention remains fixated on speculative meme coins and short-term volatility. In contrast, long-term holders and institutional players appear to be engaging in quiet accumulation, reinforcing ETH’s role as a core Layer 1 asset.

“While the herd chases memecoins, smart money stacks and locks Ethereum,” Merlijn noted in a June 7 post on X.

Supply Squeeze Building?

With over $100B+ in ETH staked, a massive portion of the total supply is now effectively illiquid. This ongoing reduction in tradable ETH could add upward pressure to price in the long term, especially if demand rises during the next market leg up.

The staking data, illustrated by a chart from Beaconcha.in, shows a steady and uninterrupted rise in staked ETH balances since December 2020, with acceleration through 2024 and into mid-2025.

Strategic Implications

As Ethereum transitions deeper into proof-of-stake dynamics, staking participation reflects growing network security and long-term investor conviction. With staking yields, institutional adoption, and layer-2 scaling all evolving, the Ethereum ecosystem may be quietly setting the foundation for a renewed breakout.

“Don’t sleep through the quiet accumulation,” Merlijn warned.

The post Ethereum Staking Reaches Record Highs as 32.8M ETH Locked Away appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·