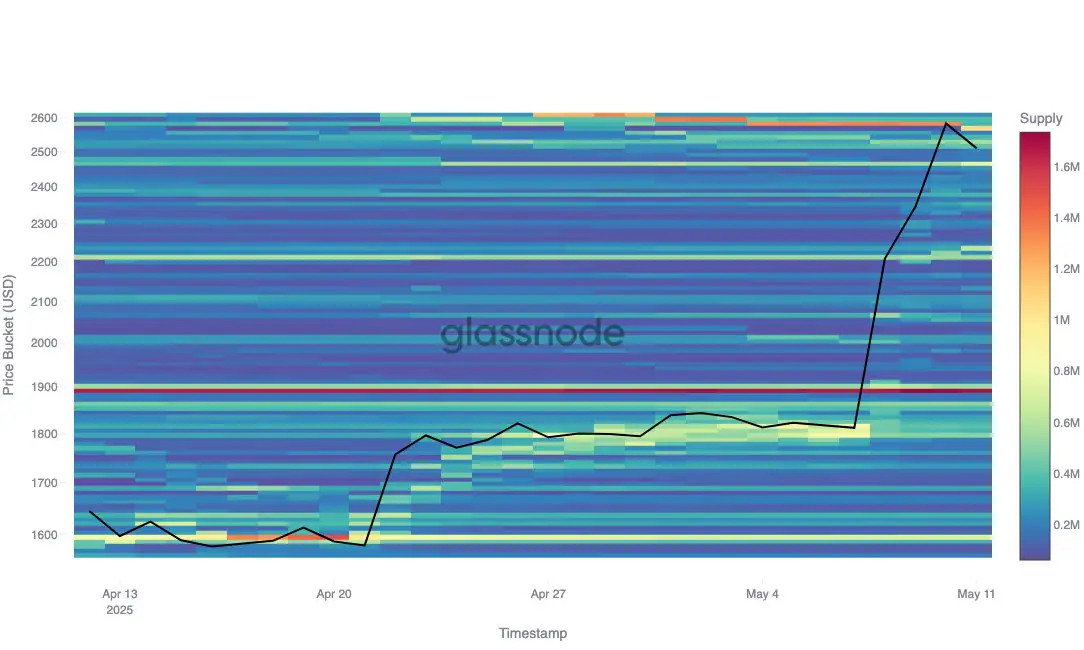

Ethereum’s recent surge from $1,800 to $2,500 was fueled by low supply concentration across that price range, according to on-chain data from Glassnode. The rally, however, encountered strong resistance near $2,580, a level where approximately 1.3 million ETH was previously held.

As ETH’s price approached this level, supply sharply dropped to 1 million ETH, indicating that many holders sold off at or near their cost basis—a classic sign of distribution behavior.

This suggests that profit-taking contributed to the pause in upward momentum.

Why It Matters

This kind of supply concentration at specific price levels acts as psychological and technical resistance, where holders who were underwater or breakeven exit their positions.

Breaking above $2.58K convincingly could pave the way for stronger upside—but until then, it’s a key watch zone for traders.

The post Ethereum Rally Faces Resistance at $2.58K as Holders Take Profits appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·