While bearish liquidations have dominated the past week, several signals now suggest that ETH may be approaching a bottom and setting up for a rebound.

Analysts Point to $3,800 as Key Level

Market strategist Michaël van de Poppe believes that Ethereum’s downside momentum is close to exhausting itself. In his latest outlook, he identified the $3,800 zone as the critical area where ETH is likely to stabilize.

He suggested that another 5% drop from current levels could complete the move before a recovery begins, emphasizing that the green zone on his chart represents the area to watch for a rebound.

ETH has already retraced from highs above $4,800 earlier this month, and traders are closely monitoring whether $3,800 – $3,900 will act as a solid base for renewed momentum.

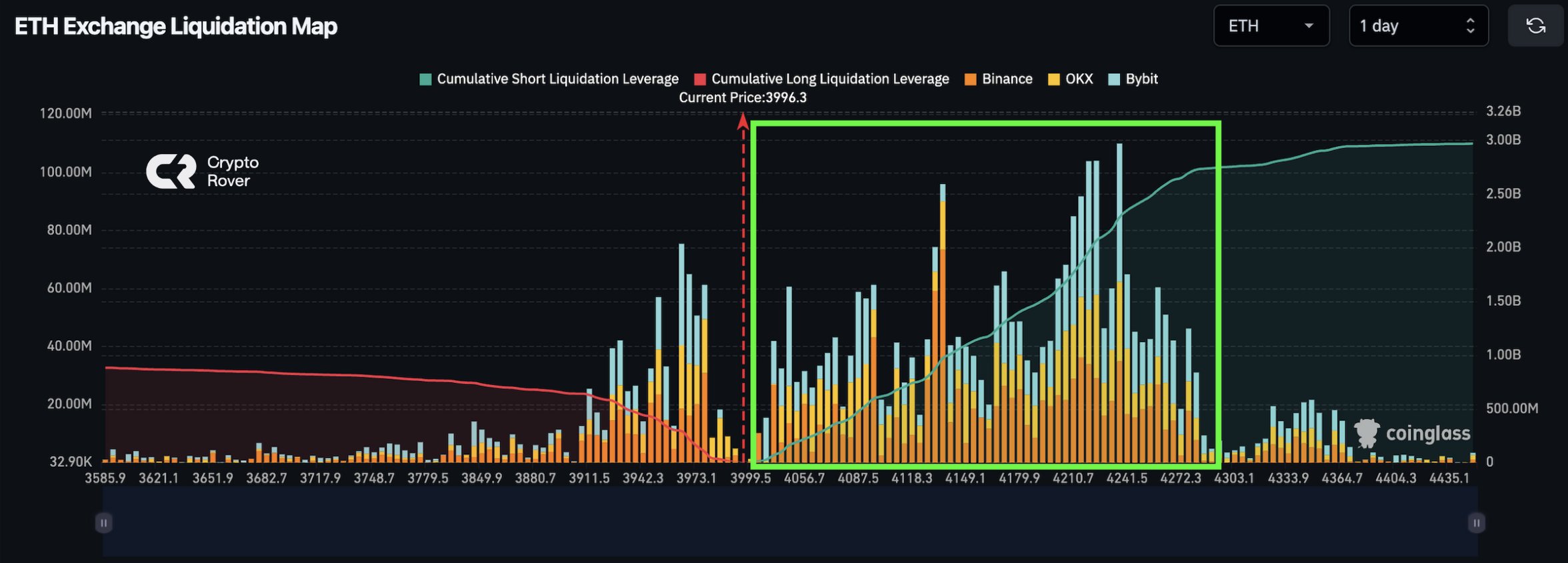

Liquidity Dynamics Favor a Short Squeeze

On-chain data paints an interesting picture of the current liquidation environment. Crypto Rover highlighted that long positions have been flushed out, with the majority of liquidity now sitting above the current market price.

This means that while bulls have been cleared out during the recent correction, the opportunity now exists for bears to be squeezed if the market pushes higher.

Such setups often occur in crypto markets when leverage becomes imbalanced, and liquidation clusters create fuel for sharp price reversals. If ETH starts moving upward, these short liquidations could accelerate the rally.

Funding Rates Turn Negative – A Historical Signal

Another key indicator comes from futures markets. Funding rates on ETH have flipped into negative territory, meaning that short traders are paying longs to maintain their positions. Historically, this scenario has often marked local bottoms.

Crypto Rover pointed out that past instances where funding rates went negative while liquidations spiked were followed by strong rallies. He described the setup as a “bottom signal,” suggesting that history may be about to repeat itself if ETH can hold its ground near current levels.

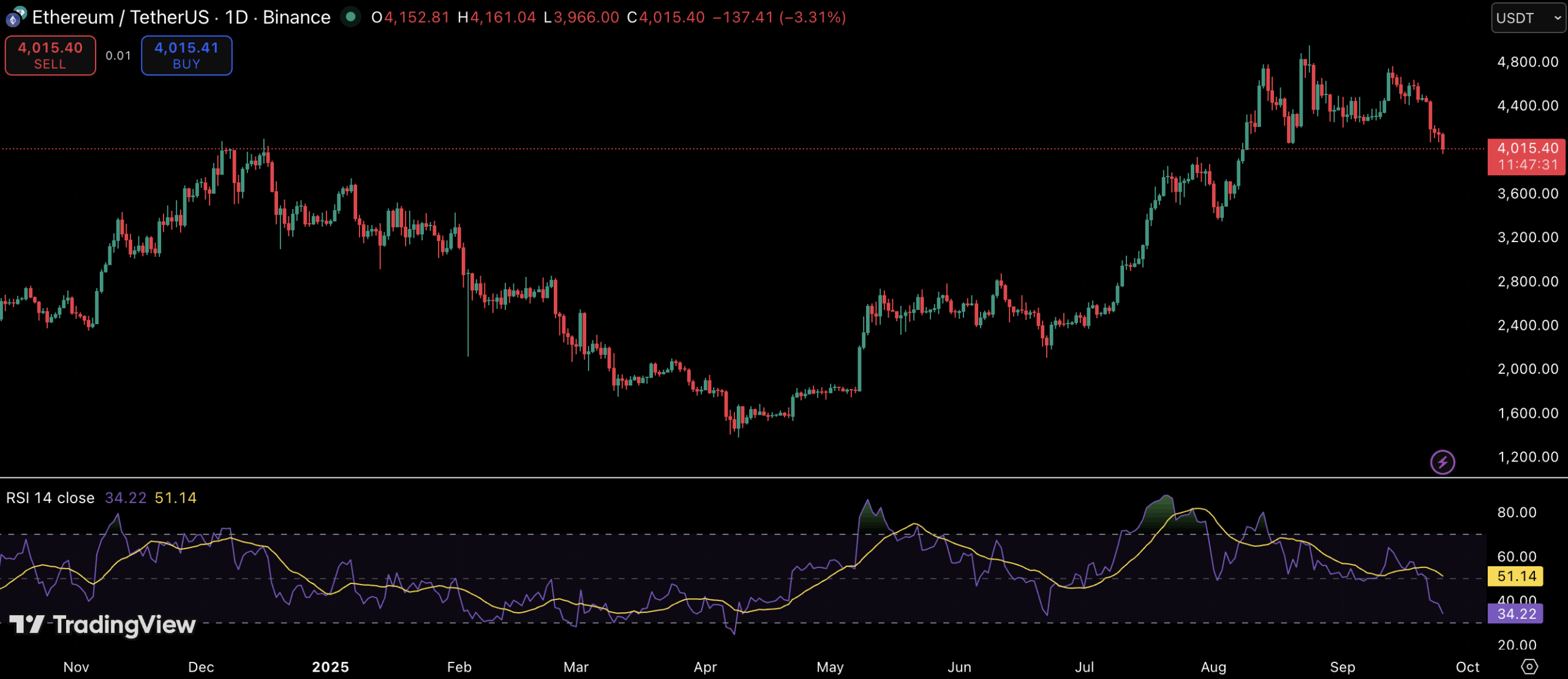

Technical Indicators Show Oversold Conditions

Ethereum’s daily chart also provides signs that the market could be nearing exhaustion on the downside. The Relative Strength Index (RSI) has fallen to 34, approaching the oversold threshold of 30. This indicates that selling pressure is becoming stretched and that the probability of a bounce is increasing.

Price action around $3,800 – $3,900 will be crucial. If ETH can hold this zone, traders may look for a move back toward resistance levels at $4,200 and beyond. A failure to maintain support, however, could open the door to deeper corrections toward $3,600.

Macro Environment Adds to the Pressure

Ethereum’s recent decline has also been influenced by broader market sentiment. Crypto markets have experienced elevated volatility in September, with liquidation cascades driving sudden price swings across major assets. Bitcoin’s own retreat from highs above $46,000 has amplified pressure on altcoins, including ETH.

Despite this, long-term sentiment remains intact, with analysts noting that Ethereum continues to play a central role in decentralized finance (DeFi), tokenization, and the buildup toward potential spot ETF approvals. These factors provide a stronger fundamental backdrop that could help ETH recover once short-term technical pressures subside.

What Comes Next for Ethereum?

With Ethereum hovering near $4,000, traders are watching whether the $3,800 zone will serve as the decisive bottom. The combination of negative funding rates, liquidation dynamics, and oversold RSI levels suggests that a reversal may be near.

If ETH can reclaim $4,200 in the coming sessions, it would validate the idea that the correction has run its course and that bears could soon face liquidation pressure of their own. However, a breakdown below $3,800 would likely extend the pullback toward deeper support levels around $3,600.

For now, Ethereum’s next move hinges on whether the market treats this latest sell-off as a final flush before continuation — or the beginning of a broader correction cycle.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Ethereum Price: Bears at Risk as Liquidity Builds Above $4K appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·