While many market participants have turned away from Ethereum (ETH) in recent months, the latest insights from on-chain analytics firm Alphractal suggest that a shift could be underway.

Despite ongoing selling pressure and lackluster sentiment, deeper indicators reveal early signs of a potential reversal.

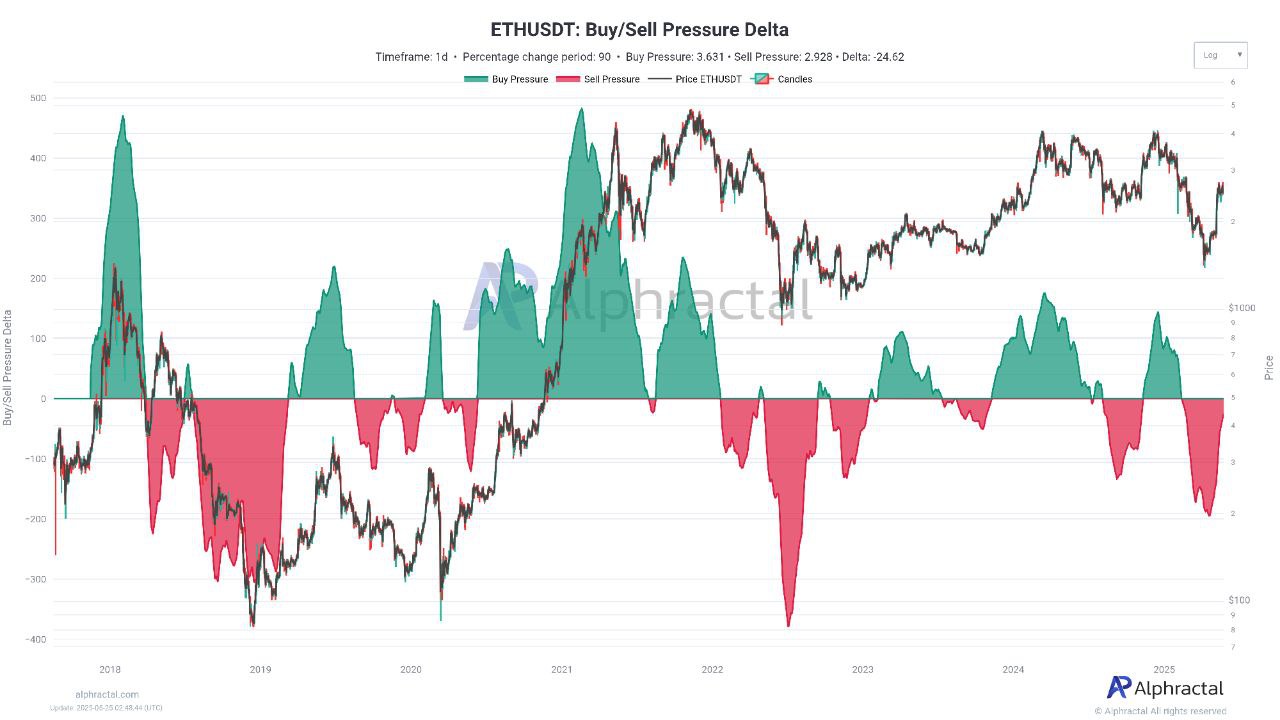

Selling Pressure Slowing Down

Alphractal’s Buy/Sell Pressure Delta reveals that Ethereum remains under net selling pressure. The delta is still negative, reflecting a market dominated by short-term sellers.

However, this trend is beginning to flatten out — an early signal that the tide may be changing. Historically, such a pattern has often preceded price recoveries, as exhausted selling gives way to accumulation.

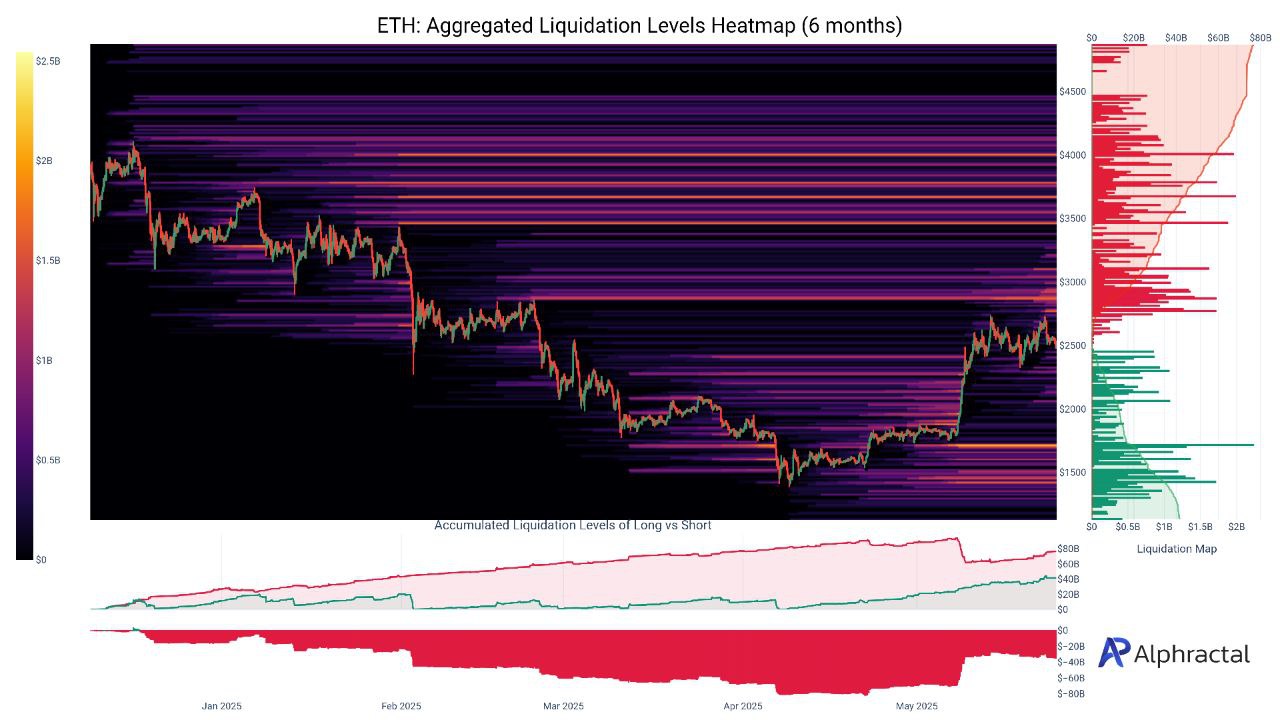

Volatility Is Brewing

The Aggregated Liquidation Levels Heatmap shows a buildup of liquidity around key levels. A dense cluster of short liquidations near $4,400 suggests that a sharp move upward could trigger a cascade of short covers, fueling momentum.

Meanwhile, long liquidations are stacked just below $1,700, highlighting a potential downside trigger. This dual-sided setup implies that volatility is not just expected — it’s likely imminent.

Risk/Reward Profile Improving

Alphractal’s Sharpe Ratio chart is beginning to tell a more optimistic story. After a prolonged period of low risk-adjusted returns, the ratio is now climbing. This indicates that Ethereum’s current price movements are offering better rewards for the risk taken — a favorable condition for long-term investors.

While the Sharpe Ratio hasn’t reached bullish extremes, it’s beginning to echo the behavior seen in earlier phases of strong bull runs.

Ethereum in a Strategic Risk Zone

The Normalized Risk Metric (NRM) currently sits at 0.3969, placing Ethereum in a moderate-risk territory. This is far from the overheated conditions seen at cycle peaks, and instead reflects a more balanced, less euphoric environment.

Historically, this range has marked periods where patient capital enters the market, setting the stage for the next major move.

Conclusion: Caution at the Surface, Opportunity Beneath

While Ethereum may not be commanding the market’s attention right now, Alphractal’s data reveals a more promising outlook. Selling pressure is slowing, volatility is likely, and risk-adjusted returns are improving. These quiet periods — often overlooked — have a history of offering the best risk-reward setups for informed investors.

The market may have cooled, but Ethereum’s potential is heating up. As always, staying ahead means following the data — not the crowd.

The post Ethereum May Be Overlooked — But the Data Points to a Turning Point appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·