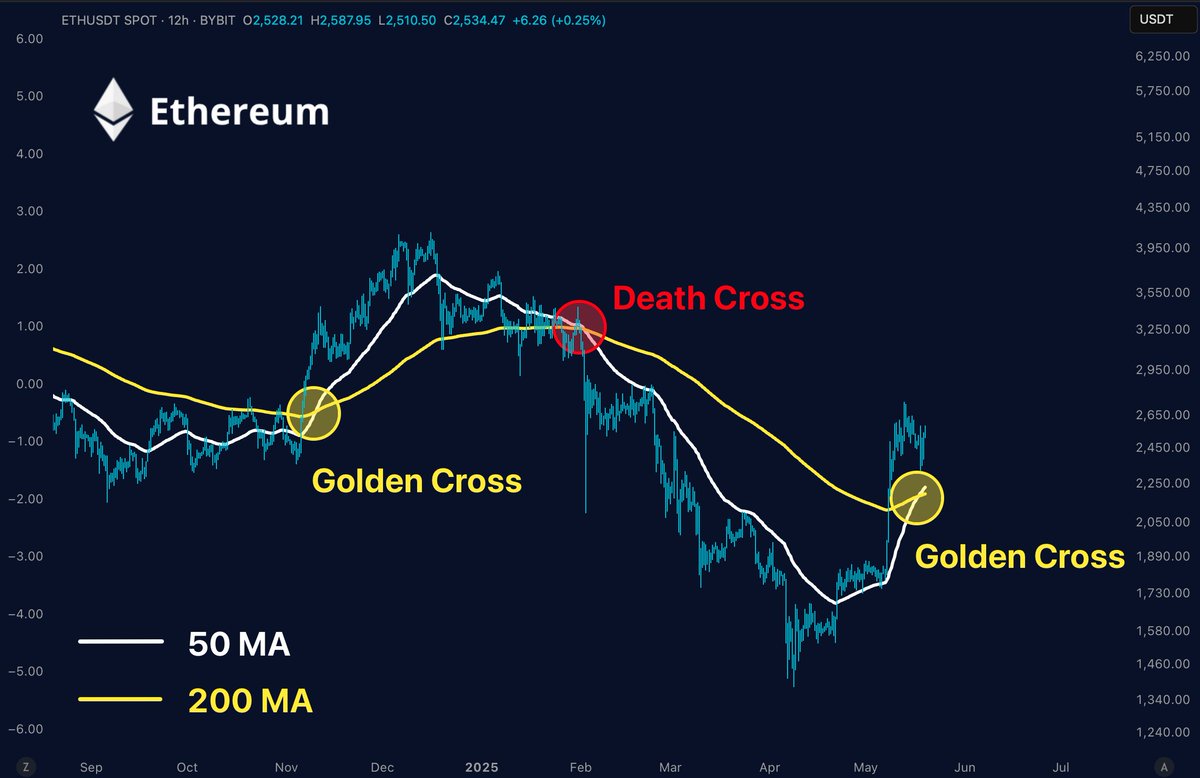

According to crypto analyst Merlijn The Trader, this bullish setup—where the 50-day moving average (MA) crosses above the 200-day MA—previously preceded a powerful rally in ETH. Now, it’s back.

What Is a Golden Cross?

A Golden Cross is one of the most closely watched bullish technical patterns in trading. It occurs when a short-term moving average (typically the 50 MA) rises above a long-term moving average (usually the 200 MA).

This suggests a shift in momentum from bearish to bullish—and historically, it’s been a strong signal for price surges.

This suggests a shift in momentum from bearish to bullish—and historically, it’s been a strong signal for price surges.

Why It Matters for Ethereum

Looking at the chart, Ethereum’s last Golden Cross—marked in late 2024—kicked off a rally that saw ETH soar past $4,000. After a corrective phase and a bearish Death Cross earlier in 2025, the trend appears to be reversing once more. The most recent Golden Cross formed just weeks ago, with Ethereum currently trading around $2,500.

If history is any guide, the road to $3,000 ETH could be wide open.

Market Momentum and Macro Trends

The setup is emerging at a time when the broader crypto market is gaining steam. Institutional interest in Bitcoin is spilling over to Ethereum, with the possibility of spot ETH ETFs and major protocol upgrades on the horizon. Combine that with favorable on-chain metrics and improving sentiment, and the case for further upside becomes compelling.

READ MORE:

JPMorgan Finally Lets Clients Buy Bitcoin

The Bottom Line

Golden Crosses don’t guarantee a rally—but in crypto markets, they often mark major turning points. With Ethereum now flashing the same signal that preceded its previous breakout, traders and investors alike would be wise to keep their eyes on the chart.

The post Ethereum Flashes a Golden Cross: Is $3,000 Next? appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·