Over the past 24 hours, ETH has seen choppy action, briefly touching $2,575 before pulling back, as shown in the latest CoinMarketCap intraday chart.

Technical analyst Ted Pillows points to an “inverse head and shoulders” pattern forming on ETH’s longer-term chart.

According to his analysis, a clean breakout above $2,700 could send Ethereum soaring toward $3,000, calling it a classic bullish reversal setup.

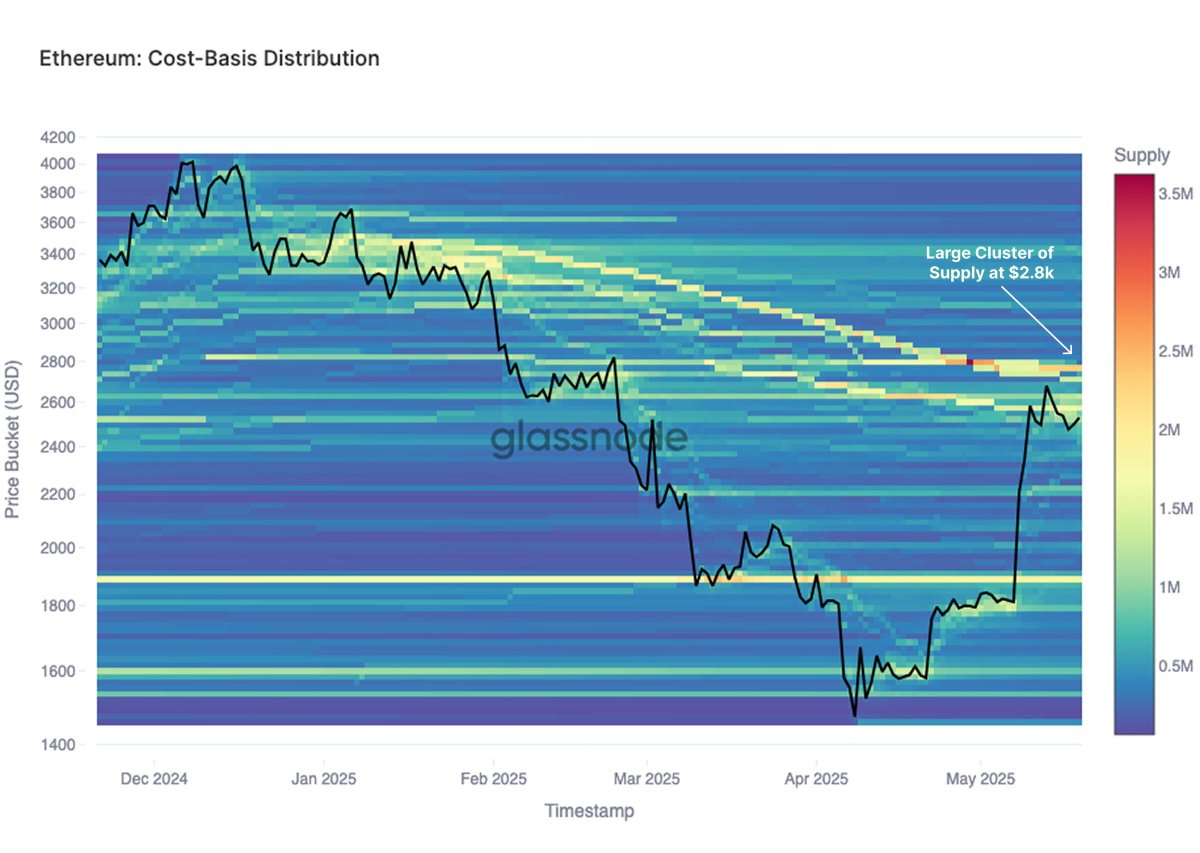

However, on-chain data from Glassnode suggests ETH may face stiff resistance at that same $2,800 level. A significant number of wallets acquired ETH at that price, creating what Glassnode calls a “large cluster of supply.”

If ETH approaches this zone, many holders may look to sell at breakeven, adding potential sell pressure.

The next few days will be crucial. If ETH can decisively break through $2,700 and absorb the supply wall around $2,800, bullish momentum could reignite. Until then, the market appears to be in wait-and-see mode, with both bulls and bears closely watching for a catalyst.

The post Ethereum Eyes $2,700 as Bulls and Bears Watch Key Levels appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·