TLDR

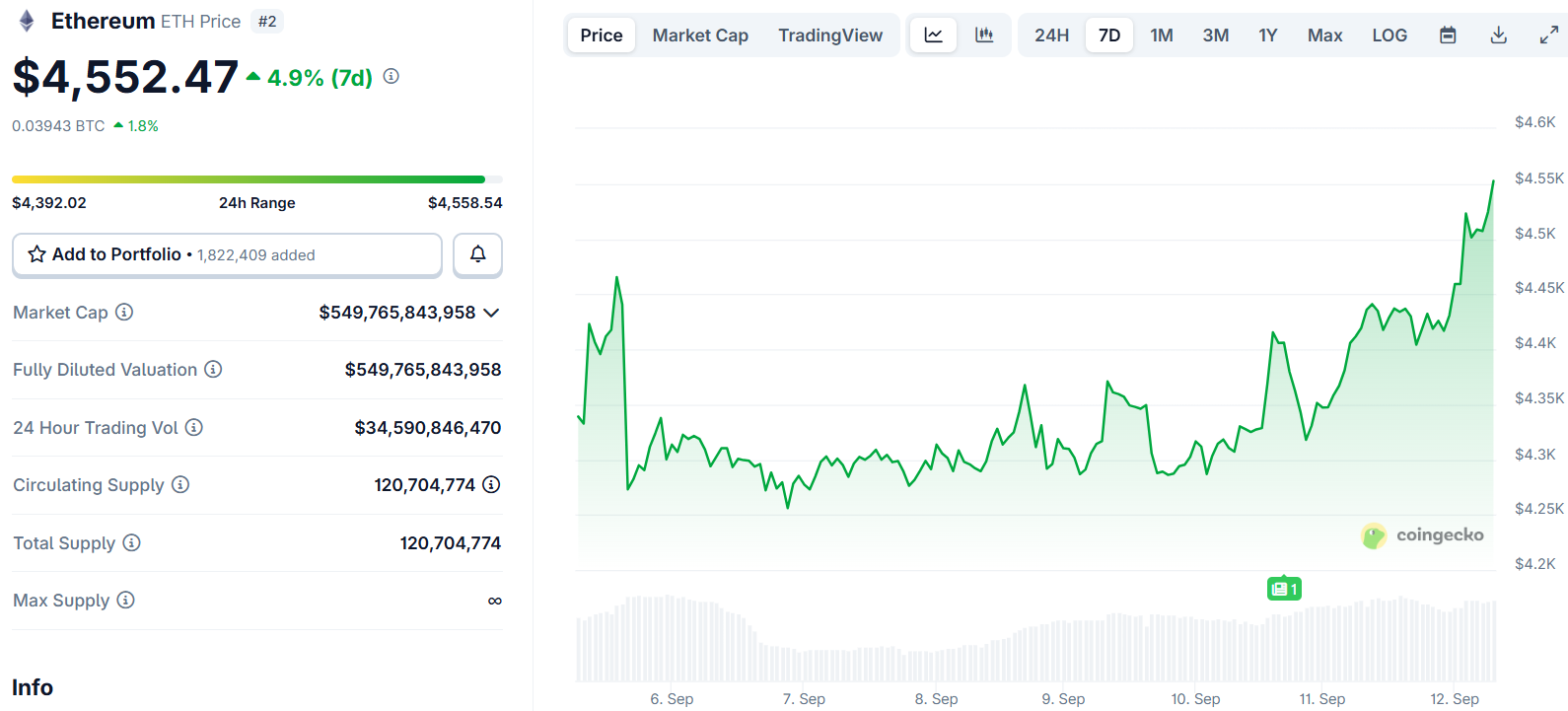

Roughly 1.7 million ETH worth $7.5 billion accumulated in the $4,300-$4,400 range creating strong support Bitmine Immersion purchased over $1.1 billion worth of ETH in recent weeks, expanding holdings beyond 2.1 million ETH SharpLink Gaming moved $379 million USDC toward Galaxy Digital, signaling potential further Ethereum accumulation CME open interest hits all-time highs with heavy institutional participation in short-term contracts Analysts predict ETH could reach $6,500-$7,000 by year-end if price breaks above $4,500 resistanceEthereum price continues trading between $4,200 and $4,500 throughout September while showing signs of institutional accumulation underneath the surface. ETH currently trades at $4,411, holding above previous resistance levels.

Ethereum (ETH) Price

Ethereum (ETH) Price

Data from CryptoQuant reveals substantial accumulation activity around the $4,300-$4,400 price zone. Approximately 1.7 million ETH valued at $7.5 billion has been absorbed into accumulation addresses at this level. Many withdrawals from centralized exchanges reflect an average cost basis near $4,300.

Exchange flow analysis shows Binance handled the largest outflows during this accumulation phase. Addresses depositing ETH onto Binance show an average cost basis closer to $3,150. This suggests different positioning strategies between long-term holders and active traders.

Institutional Demand Surges

Institutional flows are reshaping the current market dynamics. Open interest on CME has surged to all-time highs with heavy concentration in short-term maturities ranging from one to three months. Longer-term maturities spanning three to six months are also building, reflecting stronger confidence in Ethereum’s outlook.

Bitmine Immersion recently purchased 46,255 ETH worth over $200 million. This expansion brought total holdings beyond 2.1 million ETH. The purchase came days after revealing another 202,469 ETH acquisition, lifting weekly accumulation close to $881 million.

SharpLink Gaming shifted 379 million USDC toward Galaxy Digital. This move hints at another wave of Ethereum accumulation from institutional players. Such aggressive positioning by large treasuries reduces supply pressure on exchanges.

On-chain data shows these inflows coinciding with cooling U.S. inflation data. This has given institutions further confidence to increase their Ethereum positions. The combination of technical breakouts and treasury expansions reinforces demand.

Technical Analysis Points to Breakout

The $4,500 level remains the key inflection point for Ethereum. A decisive break above this resistance could quickly shift momentum back toward ETH. Lower time frames continue showing indecision as the asset ranges between $4,200 and $4,500.

The risk of a lower liquidity sweep remains present. Key downside levels sit around $4,200 with a demand zone between $4,000 and $4,100 positioned just below. If price action remains weak going into Q4, a dip toward these zones is possible.

Crypto analyst Pelin Ay noted that institutional demand and derivatives positioning suggest further upside potential. The analyst expects ETH could reach the $6,800 resistance level by year-end. This view aligns with the broader institutional accumulation trend.

$ETH: THE BEAST IS WAKING UP.

MACD just flipped green.

3 years of pressure coiled and ready to detonate

Monthly candle says only one word: BULLISH.

Clear $4,500 and Ethereum goes parabolic.

This is where legends front-run. Tourists chase. pic.twitter.com/a7sYcTN7Up

— Merlijn The Trader (@MerlijnTrader) September 11, 2025

Crypto trader Merlijn believes the likelihood of an immediate rally remains higher. The trader noted the MACD indicator just flipped green after three years of pressure. A clear break above $4,500 could trigger parabolic movement according to this analysis.

Historical patterns show similar breaks after long accumulation cycles have preceded rapid price expansions. The current setup resembles 2017 and 2021 cycles where rallies followed prolonged consolidation periods. If history repeats, ETH price could move aggressively once the breakout stabilizes.

Source: TradingView

Source: TradingView

The outlined trajectory suggests Ethereum may be entering a phase of vertical growth. Analysts project a potential run toward $7,000 based on current institutional backing and technical formations. Bitmine and SharpLink accumulation provide the institutional layer supporting this outlook.

Ethereum price now trades in an environment shaped by both technical breakout structures and massive institutional backing, with recent purchases totaling over $1.1 billion from major players.

The post Ethereum (ETH) Price: Whales Go on $7.5 Billion Buying Spree as $7K Targets Emerge appeared first on CoinCentral.

3 months ago

35

3 months ago

35

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·