Growing whale activity, institutional accumulation, and technical setups hint that the second-largest cryptocurrency could be preparing for a decisive breakout after weeks of sideways trading.

Recent data from analysts and on-chain trackers reveal that large investors are betting heavily on a recovery in the Ethereum price, even as short-term momentum remains cautious. The combination of leveraged long positions and strong defense of key support levels has revived optimism among traders anticipating a move toward the $4,900–$8,000 range.

Institutional Confidence Amid Consolidation

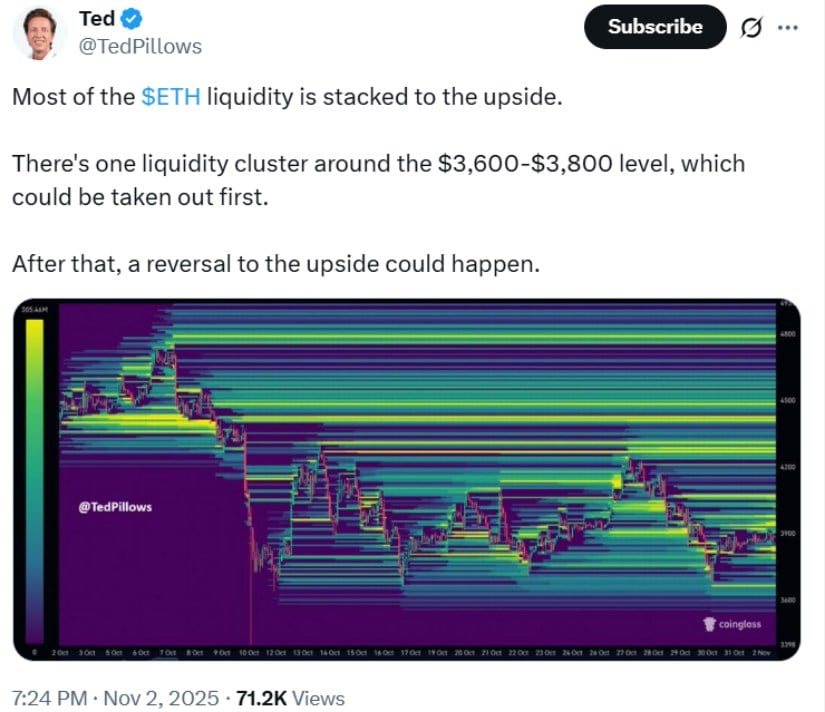

The current ETH price continues to fluctuate around the $3,600–$3,800 range, forming a consolidation structure that has drawn heightened attention from professional traders and long-term holders. Despite recent volatility, institutional positioning suggests confidence in the longer-term Ethereum outlook.

Most of Ethereum’s liquidity is concentrated above, with key support near $3,600–$3,800 potentially triggering an initial dip before a possible upward reversal. Source: Ted via X

Analysts tracking liquidity levels on major exchanges highlight a possible liquidity sweep below $3,750 before buyers attempt to reclaim momentum. This scenario would allow Ethereum to dip into deep-order pockets, trigger stop orders, and then possibly reverse toward higher resistance.

Meanwhile, treasury and corporate wallets reportedly added more than half a million ETH during October, even as the token experienced a sharp monthly decline. That continued accumulation signals belief that the value of Ethereum remains poised for recovery.

Whale Activity Suggests Potential Upside

Large wallets are increasingly placing leverage behind a bullish recovery. Other whale wallets are showing renewed enthusiasm by expanding their long exposure near current price zones. Market sentiment among major holders is shifting from caution to calculated optimism—a key indicator often watched in Ethereum price analysis.

Other whale wallets are also showing renewed enthusiasm by expanding their long exposure near current price zones. Market sentiment among major holders is shifting from caution to calculated optimism—a key indicator often watched in Ethereum price analysis.

Technical Landscape: Major Levels in Focus

The Ethereum price today continues to hover near key technical levels, and traders are closely watching both support and resistance thresholds. On the downside, primary demand lies between $3,500 and $3,600, an area where buyers have repeatedly stepped in to prevent deeper losses. In case this critical zone fails to hold, Ethereum may face a more significant pullback to the range of $3,200 to $3,000.

Ethereum holds $3,500–$3,600 support; a rebound may reach $4,200–$4,400, while a drop below $3,500 could test $3,200. Source: Ali-Traders-Pro on TradingView

On the upside, resistance is solid near $3,900 to $4,200, where there have consistently been heavy sell orders to cap rallies. A legitimate movement through this level could send prices toward $4,900, a level that closely corresponds to major historic resistance and very strong profit-taking interest from traders.

Technical indicators at the moment reflect caution. Ethereum changes hands below its 100-hour moving average, and both the RSI and MACD slightly lean bearish, signaling consolidation and neutral-to-negative short-term sentiment. Of course, if buyers can manage to protect the current lows and volumes start to increase, the setup could flip quickly in favor of a bullish reversal, setting up conditions for further upside.

Bullish and Bearish Scenarios

If support around $3,600 continues to hold and whale accumulation persists, Ethereum could retest resistance near $4,900—a zone that coincides with the former Ethereum all-time high price from 2021. According to some market analysts, this setup could herald an extended rally toward the $8,000 mark on the back of fresh optimism in the broader crypto market and a potential Ethereum bull run.

The ideal scenario envisions Ethereum bouncing from $3,800, breaking past $4,900, and climbing toward $8,000. Source: Ali Martinez via X

On the other hand, a decisive breakdown below $3,500 would place the current trading range in jeopardy. That could further open the door to more significant selling pressure, which drives the ETH price into a deeper correction toward $3,200 or lower, signaling a short-term shift in sentiment and weakening technical structure.

Final Thoughts

For investors who follow Ethereum price predictions, the next few weeks may prove telling. Whale accumulation, stronger treasury holdings, and persistent defense of key support levels—all justify a possible upside shift. However, price confirmation is vital, as the Ethereum price forecast depends on reclaiming resistance zones.

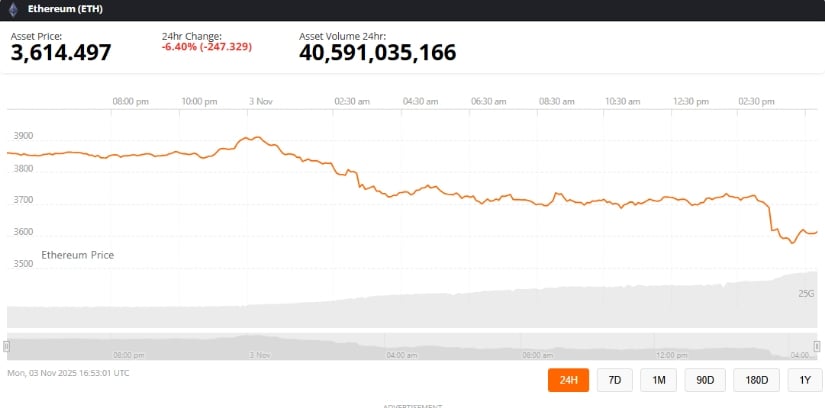

Ethereum was trading at around $3614.49, down 6.40% in the last 24 hours at press time. Source: Brave New Coin

This means that short-term volatility may persist, but a clear breakout above $4,000–$4,200 could mark the beginning of a new upward phase. Traders believe that the next rally may appear sooner than expected when momentum coincides with institutional flows and improving sentiment in both Bitcoin and Ethereum markets.

1 day ago

4

1 day ago

4

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·