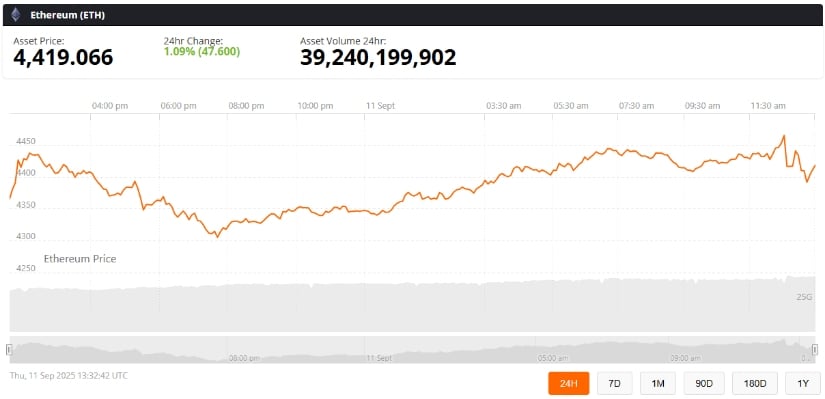

According to Brave New Coin (BNC), the Ethereum price today is $4,419, up 1.09% in the past 24 hours, with trading volume exceeding $39.24 billion. ETH is consolidating above the $4,300 support zone, with bulls pressing against resistance near $4,496–$4,536, as analysts eye a potential rally toward $5,000 in the short term and $7,000 in the coming months.

Ethereum Price Holds Range Support

On the 4-hour chart, ETH price continues to trade between $4,300 and $4,500. Repeated defenses at the $4,268–$4,300 zone, bolstered by the 100 and 200 EMAs, have created a solid accumulation base for buyers.

Ethereum (ETH) was trading at around $4,419, up 1.09% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

Momentum indicators are turning positive. The RSI has climbed to 58, showing improving strength after weeks of sideways action. A recent break above a descending trendline suggests renewed bullish intent. If Ethereum clears the $4,536 ceiling, analysts believe a sustained breakout could follow.

Fibonacci Levels Highlight Key Barriers

Ethereum technical analysis shows that ETH is currently grappling with the 0.382 Fibonacci retracement at $4,496. A decisive close above this level would set the stage for higher targets at $4,584 (0.5 retracement) and $4,672 (0.618 retracement).

However, Ethereum must first confirm dominance above $4,427, where the Supertrend resistance still lingers. Failure to hold $4,387 could re-expose $4,268, with deeper losses pointing toward $4,211 if selling pressure accelerates.

Analysts Draw Cycle Comparisons

Market strategist Ted Pillows compared Ethereum’s current structure to Bitcoin’s 2020–21 accumulation phase. “ETH is showing signs of entering a mid-cycle correction, much like BTC before its explosive breakout,” he noted.

Ethereum (ETH) blasts past $4,400 with momentum surging—analysts and traders now eye $5K as the next major milestone! Source: @Karman_1s via X

Pillows suggested that Ethereum could rally toward $8,000–$10,000 in the next three to four months, although he cautioned that short-term retracements are still possible. His analysis echoes other technical traders, such as @crypto_goos, who predicted a $7,000 target following the recent breakout above $4,400. Meanwhile, @Karman_1s set a nearer-term goal of $5,000 based on a descending triangle breakout pattern.

Institutional and Long-Term Drivers

Beyond technicals, institutional demand is providing a strong backbone for Ethereum’s long-term outlook. Blockchain data revealed that BitMine recently purchased $204 million worth of ETH, aiming to control 5% of the total supply. With its treasury now valued at $9.2 billion, BitMine is signaling strong conviction in Ethereum’s growth trajectory.

BitMine pours $204M into ETH—big money is still betting on Ethereum! Source: @TedPillows via X

Fundstrat’s Tom Lee also projected a 10–15 year supercycle for Ethereum, driven by Wall Street adoption and AI integration. “We see Ethereum becoming a cornerstone asset for institutional portfolios,” Lee explained, linking its growth to network interoperability upgrades expected to boost adoption further.

ETF Developments: SEC Delays BlackRock Ethereum Proposal

In regulatory news, the SEC delayed decisions on several crypto ETF applications this week, including BlackRock’s Ethereum staking ETF. While the postponement caused some disappointment, Bloomberg analyst James Seyffart reiterated that October remains the key window for approvals.

The SEC is reportedly developing a standardized listing framework for crypto ETFs. If implemented, this would streamline the process and potentially fast-track future Ethereum ETF approvals, a move that could further enhance institutional inflows.

Looking Ahead: Will Ethereum Go Up?

The current ETH price action shows a market at a crossroads. Rising on-chain inflows, bullish cycle comparisons, and institutional accumulation all support a breakout scenario. Yet, risks remain from macroeconomic pressures and geopolitical tensions that could send Ethereum back toward $3,800–$4,200 if momentum fades.

ETH breakout confirmed! Momentum is building, and bulls are aiming to send Ethereum soaring all the way to $7,000! Source: @crypto_goos via X

As long as Ethereum holds above $4,300, the short-term bias leans bullish. A decisive close above $4,536 would confirm strength and could fuel a rally toward $5,000 in the short term, with $7,000 emerging as a longer-term target.

2 months ago

19

2 months ago

19

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·