The surge comes as Ethereum (ETH) posts its strongest price action in months, reviving investor appetite for ETH exposure through regulated investment products.

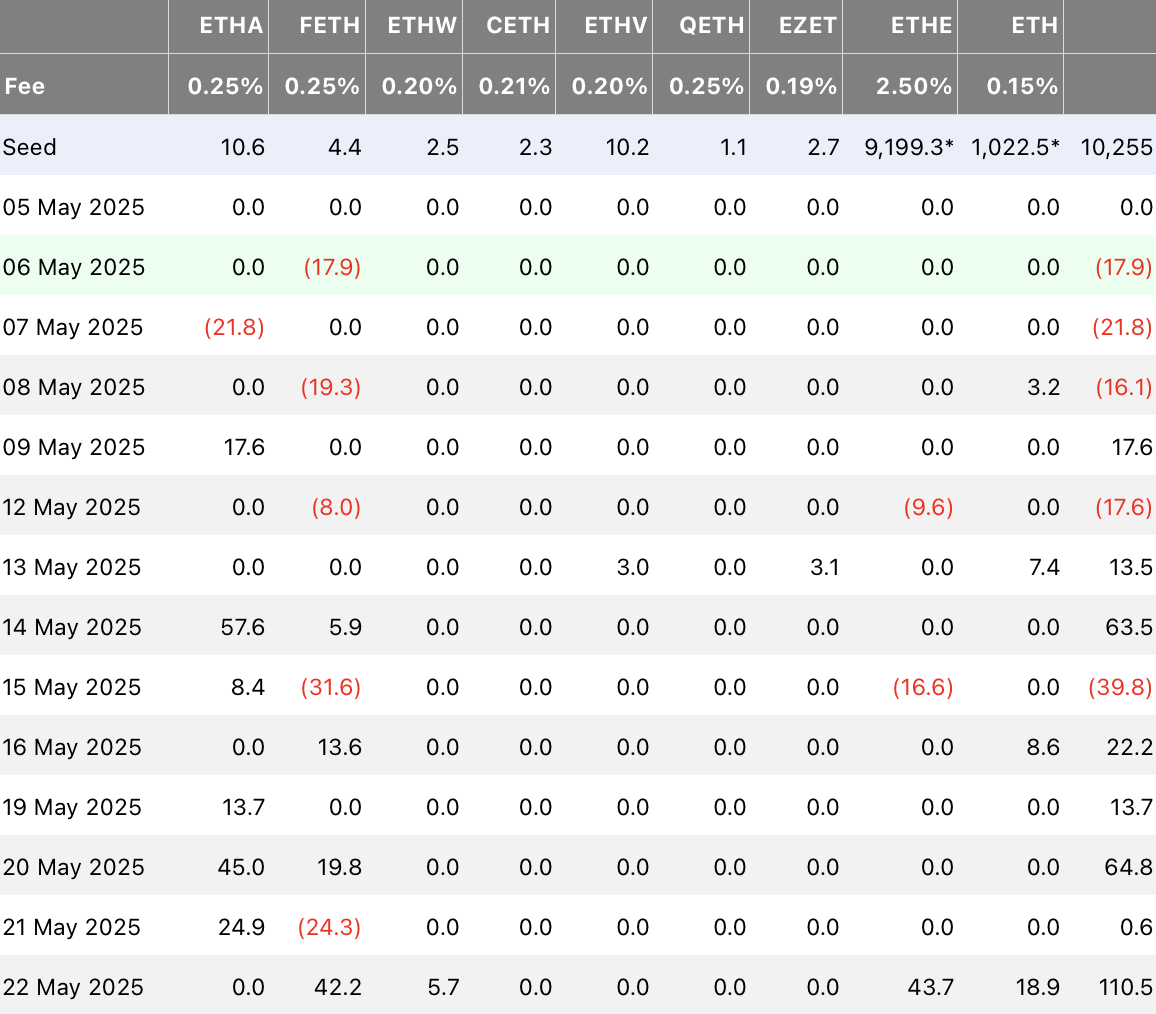

Leading the day’s inflows were Grayscale’s ETHE, which brought in $43.7 million, and Fidelity’s FETH, which followed closely with $42.2 million. Grayscale’s secondary ETH product added another $18.9 million, while Bitwise’s ETHW attracted $5.7 million. Other ETFs, including BlackRock’s ETHA, recorded no new inflows for the day.

The spike marks the fifth consecutive day of net positive flows, with Ethereum ETFs accumulating $211.8 million during that streak. Year-to-date inflows have now reached $61.9 million, while total cumulative flows for all spot Ethereum ETFs stand at $2.7 billion.

The renewed momentum suggests rising institutional interest as Ethereum’s fundamentals strengthen and its price shows signs of breaking out. Analysts view these ETF inflows as a critical signal of growing market confidence, especially in the lead-up to further regulatory developments around ETH-based investment products.

With Bitcoin ETFs grabbing headlines for record-breaking inflows, Ethereum’s quieter but steady climb may now be turning heads — especially as capital rotation into altcoins gains traction.

As Ethereum reclaims investor attention, spot ETFs are becoming the preferred entry point for those seeking direct, compliant exposure to the second-largest cryptocurrency.

The post Ethereum ETFs See $110.5M in Daily Inflows: Largest Since February as Bullish Momentum Builds appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·