The surge highlights growing institutional interest in Ethereum, marking the 18th consecutive day of positive flows into ETH-based exchange-traded products.

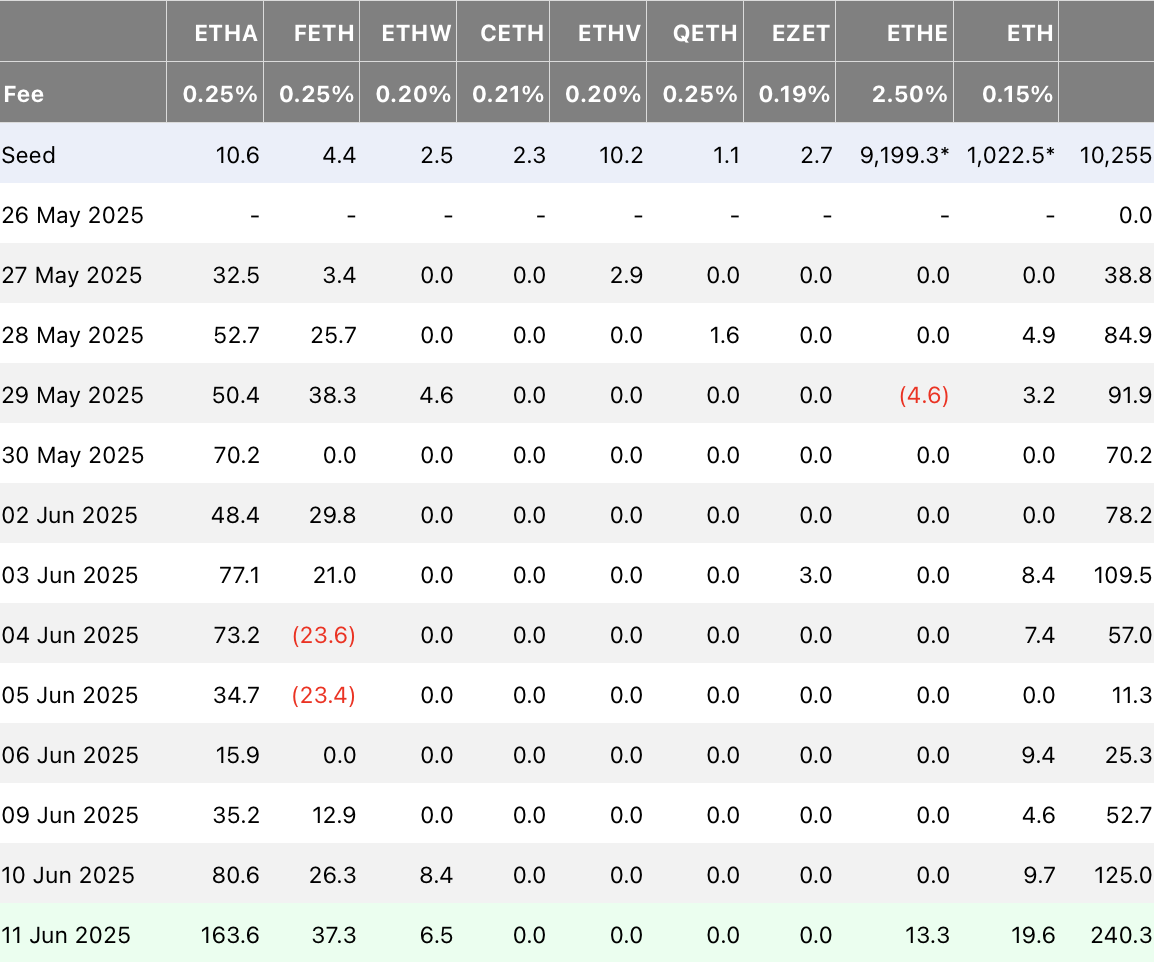

According to data from Farside, BlackRock’s iShares Ethereum Trust (ETHA) once again led the inflow tally with $160 million, followed by Fidelity’s FETH with $37 million.

Grayscale’s two Ethereum products, including its Mini Trust and the flagship ETHE fund, brought in a combined $32 million. Bitwise’s ETHW fund also contributed, adding $6 million to the total.

This latest inflow streak pushes cumulative capital additions over the past few weeks to roughly $1.2 billion. June 11 now ranks as the strongest day for Ethereum ETF inflows since February 2, when the sector posted a record $300 million in a single session.

The consistent demand signals growing institutional confidence in Ethereum as a long-term investment vehicle, particularly as spot ETF access continues to expand. With ETH continuing to build momentum in the ETF arena, market observers are watching closely for further capital rotation from Bitcoin into Ethereum as part of broader crypto asset diversification strategies.

The post Ethereum ETFs Outpace Bitcoin with $240M in Daily Inflows appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·