According to a new analysis from 10x Research, the token’s recovery—now hovering near a key technical breakout—comes as market sentiment shifts and investors eye the potential of Ethereum ETF inflows.

A year ago, the firm took a bearish stance on ETH ETFs, citing weak on-chain fundamentals and an uninspiring Wall Street pitch to institutions. That view proved prescient as Ether plummeted in the absence of strong narratives or usage metrics.

Now, however, the tone is more nuanced.

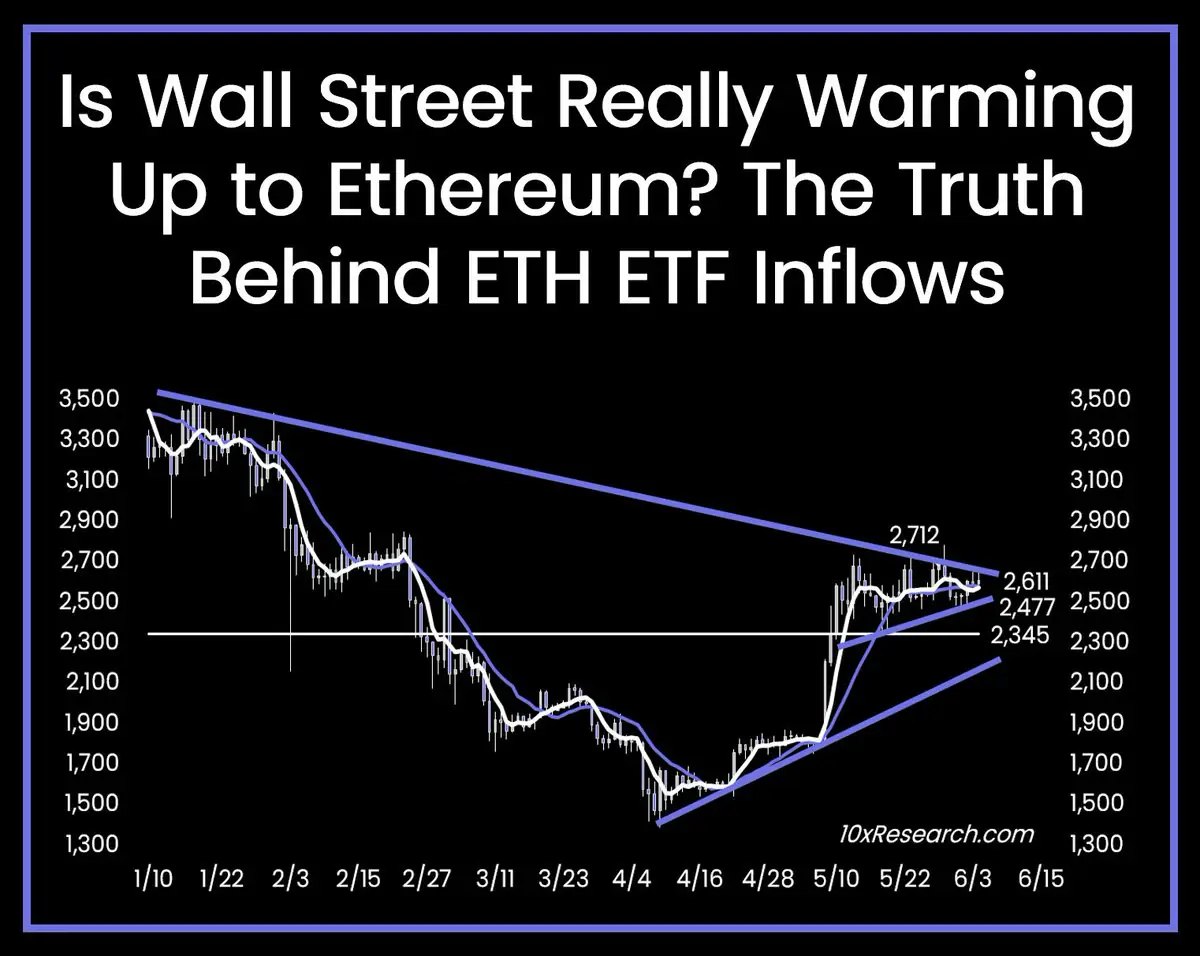

Triangle Formation Points to $3,000 Breakout—But Needs a Trigger

ETH is currently nearing the apex of a large symmetrical triangle, suggesting that a decisive move is imminent. A breakout could swing price action toward either $2,000 or $3,000, depending on momentum and macro conditions.

“The resilience of ETH has been stronger than expected,” 10x Research noted, highlighting the market’s recovery following eased fears around Trump’s tariff policy.

Still, the next leg depends heavily on whether real demand—especially from institutions—is behind the recent uptick.

Is Wall Street Finally Buying In?

One major question: has the narrative around Ethereum ETFs improved enough to attract long-only institutional investors?

Unlike Bitcoin, Ethereum’s ETF push lacked clear messaging. But that may be changing as Sharplink Gaming made headlines by allocating $425 million into ETH, hinting that some corporate treasuries are warming up to the asset.

If others follow suit, ETH could experience inflows on par with the early days of the Bitcoin ETF boom.

On-Chain Revival and Legislative Catalysts

The report also highlights several potential bullish drivers:

The Petra upgrade, which may help Ethereum claw back value lost to Layer 2 networks. The GENIUS Act, a stablecoin regulation bill advancing in the U.S. Senate, potentially providing legal clarity for Ethereum-based applications. A broader risk-on shift in markets, benefiting assets with high beta like ETH.Conclusion: A Pivotal Moment for Ethereum

ETH sits at a technical and narrative crossroads. A confirmed breakout, paired with rising ETF inflows or policy tailwinds, could drive the next major rally. But absent sustained institutional conviction or network usage growth, the price action could fade as quickly as it returned.

The next few weeks will be crucial in determining whether Ethereum is on the cusp of real adoption—or just another relief rally.

The post Ethereum ETF Inflows Spark Debate: Real Demand or Speculative Bounce? appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·