From dollar-pegged assets to tokenized gold and U.S. Treasurys, Ethereum has quietly become the primary chain for real-world asset (RWA) adoption.

Institutional Momentum Builds

One of the clearest signs of this shift came at the start of September, when Fidelity launched its on-chain U.S. Treasurys product, the Fidelity Digital Interest Token (FDIT). Within days, the fund amassed more than $200 million, highlighting how traditional finance is increasingly choosing Ethereum as its tokenization platform.

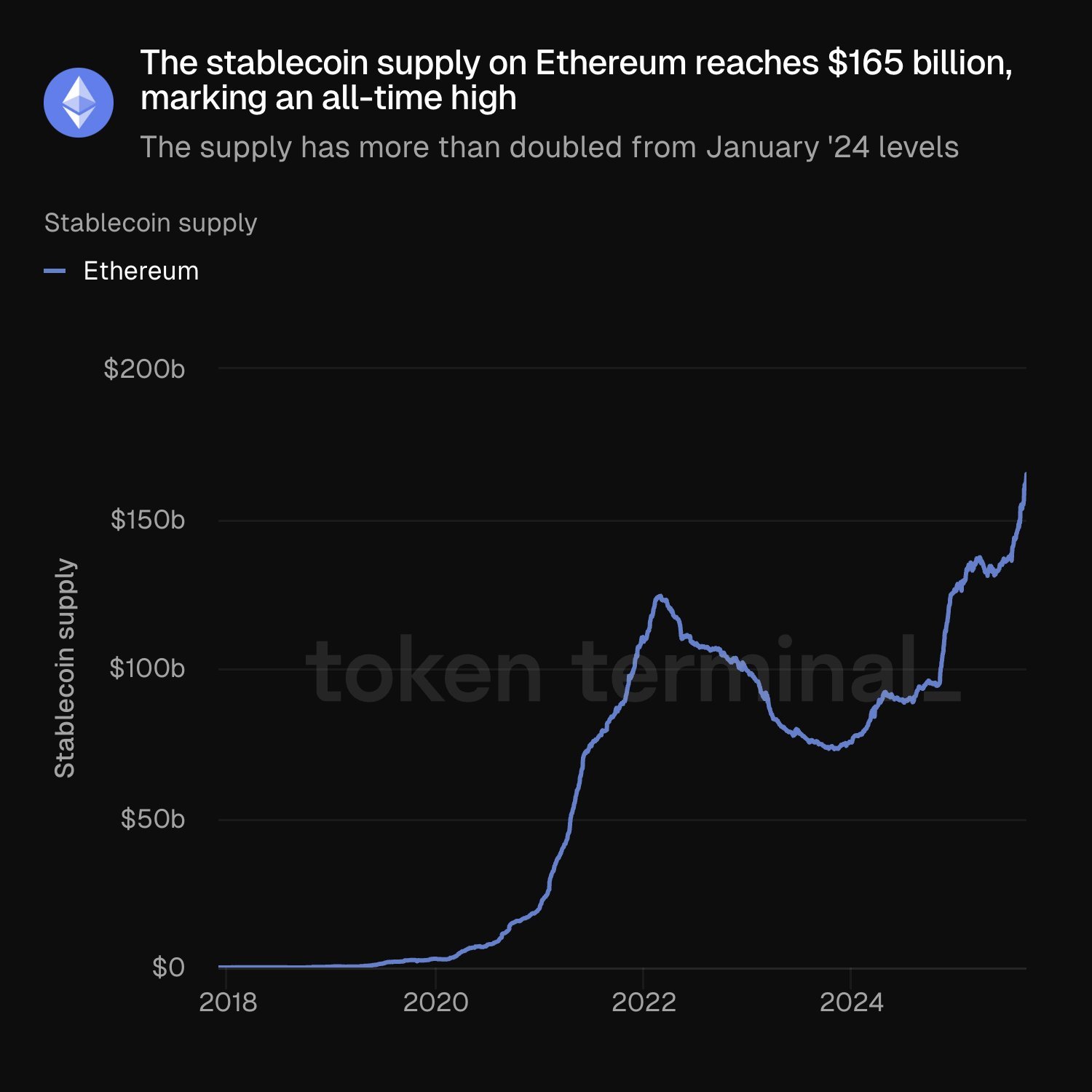

Stablecoins Drive the Core Economy

While funds make headlines, stablecoins remain the network’s beating heart. Analysts estimate that over $160 billion worth of stablecoins now circulate on Ethereum — more than double the amount at the start of 2024. That supply gives the chain a commanding lead, controlling well over half of the global stablecoin market and leaving rivals like Tron and Solana far behind.

Commodities and Treasurys Move Onchain

It isn’t just digital dollars finding a home. Tokenized gold on Ethereum has surged past $2.4 billion this year, while the network also dominates tokenized U.S. Treasurys with a share above 70%. Including assets deployed on Polygon, Ethereum controls nearly the entire tokenized commodities market, according to industry trackers.

Impact on ETH and Market Confidence

This tidal wave of tokenization has had a direct effect on Ether’s price. Since April, ETH has climbed more than 200%, briefly testing the $5,000 level in late August. At the same time, corporate treasuries have scooped up close to 4% of Ethereum’s circulating supply in just five months — a sign of deepening institutional confidence.

Ethereum educator Anthony Sassano argues that the draw comes from the network’s neutrality: “The only way mass adoption happens is through permissionless systems that belong to no one,” he explained, pointing to Ethereum’s design as the key reason why RWAs are flocking there.

From stablecoins to gold to government bonds, Ethereum has positioned itself not just as a smart-contract platform but as the financial backbone of the digital age.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Ethereum Becomes the Leading Platform for Tokenized Assets appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·