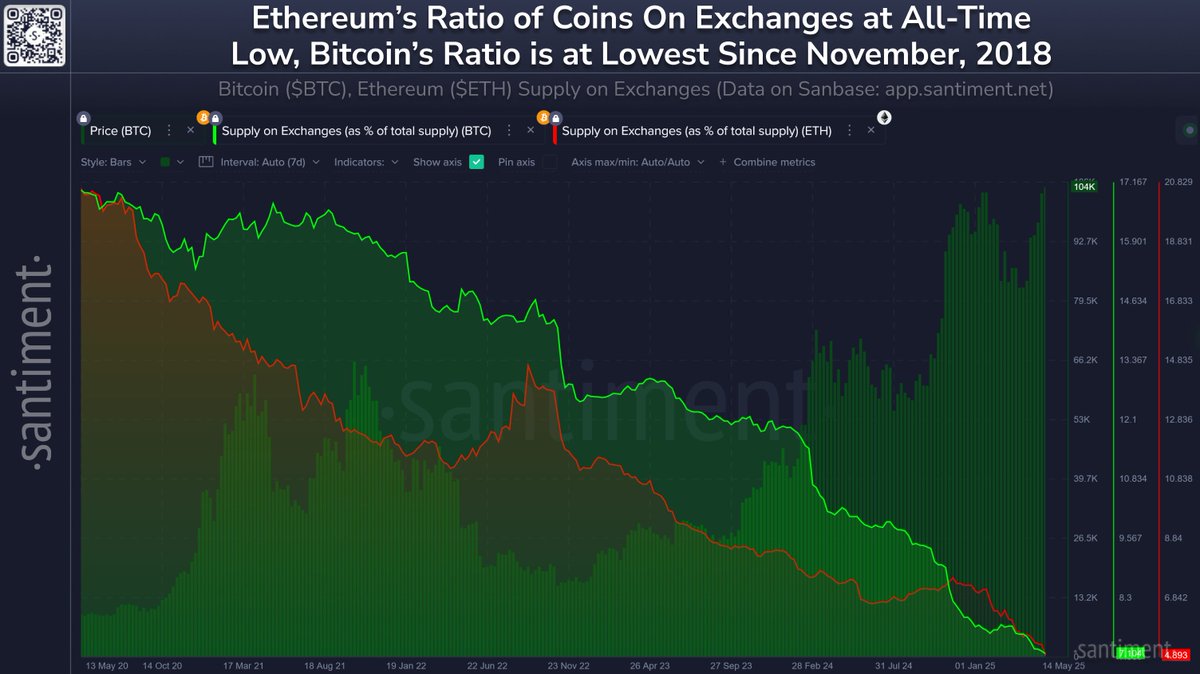

According to on-chain analytics platform Santiment, Ethereum now has under 4.9% of its total supply on exchanges — a record low in its 10+ year history. Meanwhile, Bitcoin‘s exchange supply has also declined to just 7.1%, its lowest since November 2018.

Over the past five years

Bitcoin supply on exchanges has dropped by 1.7 million BTC

Ethereum has seen an even steeper decline, with 15.3 million ETH moving off exchanges

This trend suggests a growing preference among investors to hold their assets in private wallets, possibly reflecting long-term holding strategies (HODLing) or migration to decentralized finance (DeFi) platforms and staking mechanisms.

Price Action Analysis: Ethereum Stuck in a Range

Despite the bullish implications of decreasing exchange supply, Ethereum’s price action over the past two weeks has been notably erratic. Analyst DaanCrypto highlighted on Twitter that ETH, like Bitcoin and the broader crypto market, remains confined to a local range.

On the 4-hour chart, Ethereum is trading within a well-defined consolidation band:

Local Range: ~$2,300 to ~$2,580 High Timeframe Support: $2,100 High Timeframe Resistance: $2,800DaanCrypto noted that there’s no strong conviction to trade aggressively until a clear breakout from this range occurs.

Summary

While the supply dynamics suggest a long-term bullish case, short-term price movement remains range-bound and indecisive. Traders and investors will be watching closely for signs of a breakout, especially with major support and resistance levels clearly established. Whether Ethereum can capitalize on its record-low exchange supply to spark the next leg up remains to be seen.

The post Ethereum and Bitcoin Supply on Exchanges Hits Historic Lows as Price Action Remains Range-Bound appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·