According to new data, long-term ETH holders are refusing to sell—instead, they’re actively accumulating more, effectively lowering their average cost basis and signaling strong bullish sentiment.

Key Data Highlights

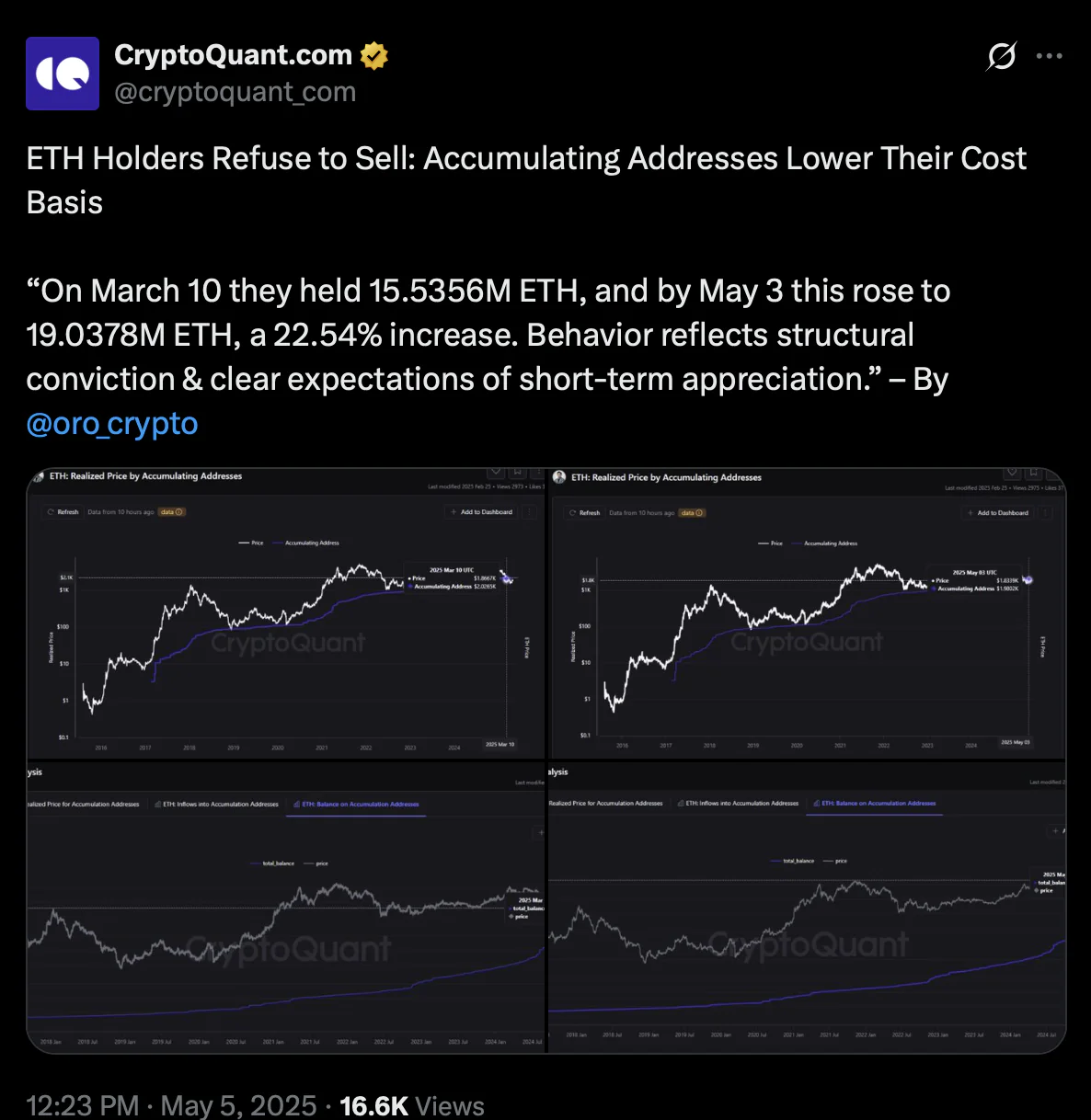

Accumulating Addresses: On March 10, 2025, Ethereum accumulating addresses held 15.5356 million ETH. By May 3, that figure surged to 19.0378 million ETH—a 22.54% increase in just under two months.This behavior reflects what the data describes as “structural conviction & clear expectations of short-term appreciation.”

What the Charts Show

The four CryptoQuant charts included in the tweet provide valuable insights:

Top Left (ETH Realized Price by Accumulating Addresses): The blue line (representing realized price) remains steadily below the market price, showing that these addresses have improved their cost basis while ETH price rises. Top Right: A closer view reaffirms this trend over a shorter timeframe, emphasizing accumulation since early March. Bottom Left & Right: These plots illustrate the growing ETH balance on accumulating addresses, consistently trending upward, indicating net buying behavior rather than selling pressure.Implications for the Market

This behavior from accumulating addresses—wallets with a pattern of steady inflows and no history of selling—suggests growing investor confidence. It’s a classic signal of “smart money” positioning ahead of a move. By lowering their average acquisition cost, these investors are preparing to maximize gains if ETH appreciates in the near term.

With over 19 million ETH now concentrated in these strong hands, the supply on exchanges remains tight, potentially contributing to positive price pressure as demand picks up.

The post Ethereum Accumulation Surges: Holders Lower Cost Basis Ahead of Potential Rally appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·