TLDR

Mega Matrix positions itself as the first public proxy for Ethena ecosystem, betting on ENA token growth potential Arthur Hayes purchased nearly $1M worth of ENA tokens ahead of Sunday’s USDH stablecoin ticker vote on Hyperliquid Ethena’s synthetic stablecoin USDe has grown to become the world’s third-largest stablecoin with over $13 billion market cap Ethena competes for USDH ticker control through Hyperliquid validator decision, offering BlackRock backing and 95% revenue share Fee-switch mechanism approved for ENA token but no activation date announced yetPublic holding company Mega Matrix has made Ethena the centerpiece of its digital asset strategy. The company positions itself as the first publicly traded treasury dedicated to the Ethena ecosystem.

Why @MegaMatrixMPU is starting with $ENA

• USDe reached a $12 billion circulating supply in 18 months – fastest growth of any stablecoin ever

• White label USDe demand

• Major CEX listings

• $500 million in revenue

• Fee switch imminent

Not a hard trade.

Ticker is MPU pic.twitter.com/Wfk5GS5yOX

— Colin Butler (@RealCryptoColin) September 9, 2025

Colin Butler, Mega Matrix’s executive vice president, believes Ethena has strong growth potential. He told reporters the company expects Ethena to generate $150 million in revenue within 6-12 months.

Butler sees this as a 6x upside compared to Circle’s current performance. Circle went public in June with shares up 87% since listing.

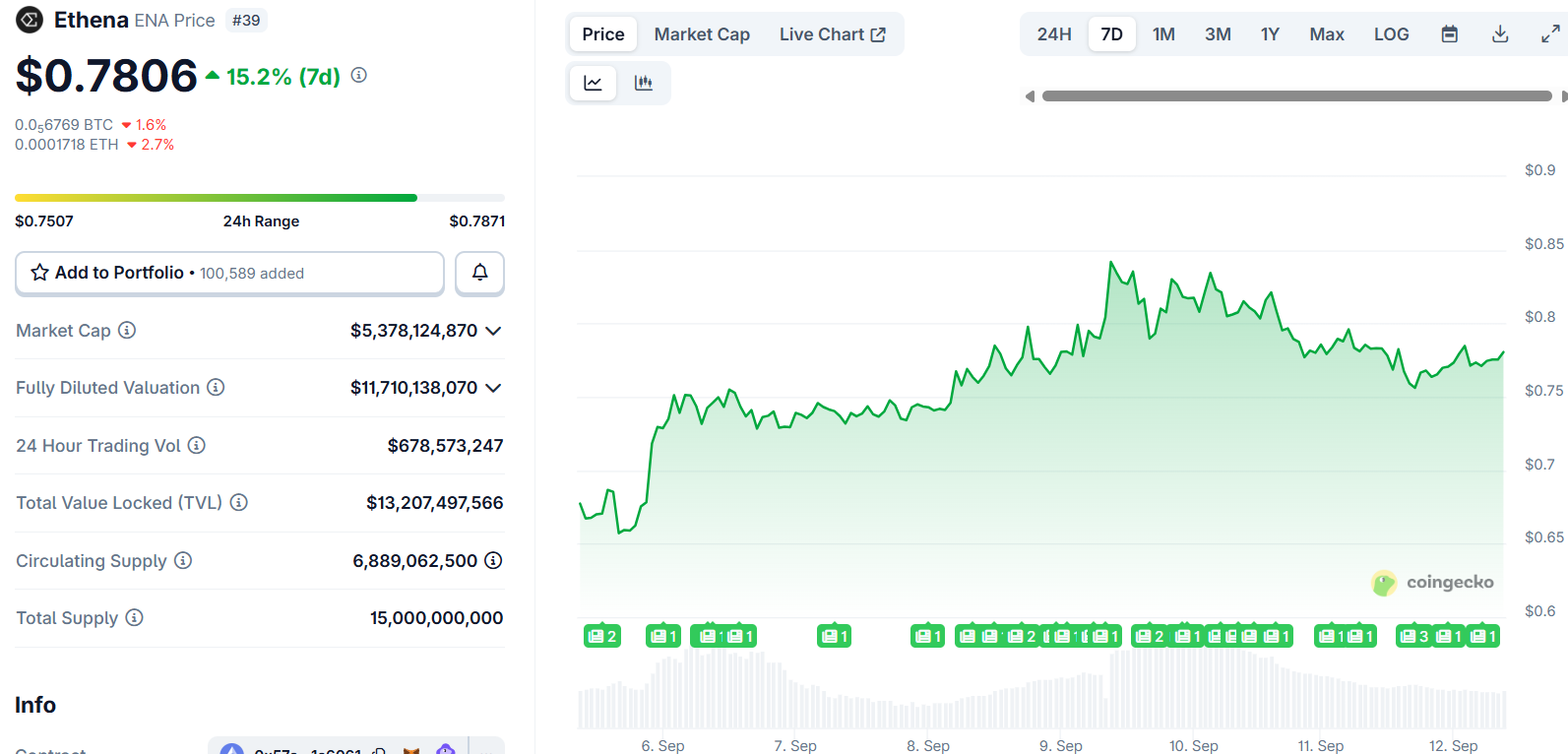

Ethena (ENA) Price

Ethena (ENA) Price

Mega Matrix concentrates its reserves in ENA, Ethena’s governance token. The company operates through a $2 billion shelf registration to build its ENA holdings over time.

Before entering digital assets, Mega Matrix worked in entertainment and game publishing. The company began exploring blockchain in 2021 and formally repositioned as a digital asset treasury in 2025.

Arthur Hayes Makes Large ENA Purchase

Maelstrom co-founder Arthur Hayes purchased nearly $995,000 worth of ENA tokens over 48 hours. Arkham Intelligence data shows he bought 578,956 ENA tokens worth $473,000 on Wednesday.

Arthur Hayes(@CryptoHayes) spent 1.02M $USDC to buy 1.34M $ENA again in the past 8 hours and currently holds 4.45M $ENA(3.48M).https://t.co/eSqihcbm6e pic.twitter.com/qahbRH28Sh

— Lookonchain (@lookonchain) September 9, 2025

Earlier purchases totaling 672,800 ENA tokens valued at $521,000 occurred Monday and Tuesday. The timing aligns with Hyperliquid’s Sunday vote on the USDH stablecoin ticker.

Ethena competes for control of the USDH ticker through Hyperliquid’s validator decision process. The company offers BlackRock backing through its USDtb stablecoin.

Ethena pledges 95% of revenue to Hyperliquid while covering migration costs. This would shift trading pairs from USDC to USDH if successful.

Native Markets leads prediction market odds at 90% despite being newly formed. Their proposal features GENIUS-compliant USDH managed through Bridge, Stripe’s stablecoin issuer.

Paxos revised its Wednesday proposal after PayPal’s backing. The company expanded beyond regulatory emphasis to pledge larger reserve yield shares.

USDe Stablecoin Growth Drives Interest

Ethena’s synthetic stablecoin USDe generates yield through staking and hedging strategies. Unlike USDC and USDT, USDe offers holders a return on their investment.

USDe’s market capitalization has surged past $13 billion. This makes it the world’s third-largest stablecoin by market value.

Butler argues USDe serves as more attractive collateral than traditional stablecoins. He believes this positions Ethena better to capture market share.

The growth comes as stablecoin regulation advances through the US GENIUS Act. This comprehensive bill establishes federal oversight of stablecoin issuers.

Ethena’s fee-switch mechanism was approved in November 2024 but remains inactive. Once activated, it would redirect protocol revenues to ENA token holders.

Wintermute Governance introduced the proposal requesting parameters for revenue distribution. Factors include USDe supply, average protocol revenues, and exchange adoption.

Ethena Labs set success metrics tied to circulating supply and cumulative revenues. Market watchers note Ethena’s growth has already exceeded some original thresholds.

HypurrCollective founder Kirby Ong suggests Hayes’ positioning appears personal rather than backing Ethena specifically. Validator alignments and prediction market sentiment will determine Sunday’s vote outcome.

The post Ethena (ENA) Price: Arthur Hayes Drops $1 Million While Mega Matrix Bets Big on ENA appeared first on CoinCentral.

3 months ago

33

3 months ago

33

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·