The analysis centers on the Bitcoin Composite Market Indicator (BCMI), a proprietary metric that blends multiple key on-chain indicators.

It includes the Market Value to Realized Value (MVRV) weighted at 30%, Net Unrealized Profit/Loss (NUPL) at 25%, Spent Output Profit Ratio (SOPR) at 25%, and the Fear & Greed Index, which contributes 20%.

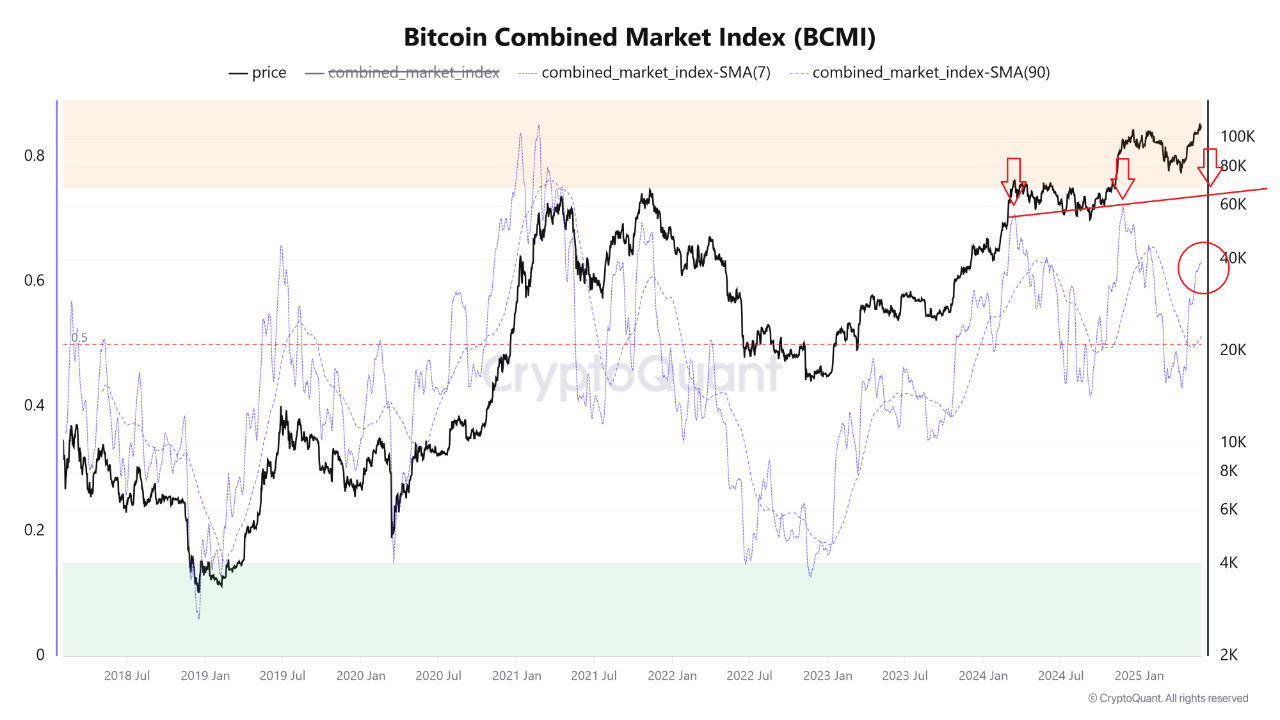

Signal thresholds within the BCMI are clearly defined. When the indicator falls below 0.15, it signals a period of extreme fear, often corresponding to macro bottoms in the market. Conversely, a BCMI reading above 0.75 indicates market euphoria and acts as a warning of potential cycle tops.

Currently, the 7-day simple moving average (SMA) of the BCMI is rising sharply and hovers around 0.6, which is interpreted as an early upside signal. Meanwhile, the 90-day SMA remains relatively flat near 0.45, suggesting that the market has not yet entered an overheated or euphoric phase.

With on-chain sentiment improving and profit-taking slowing down, the report concludes that early signals of recovery are flashing—even as broader market participants remain on the sidelines. According to Woominkyu, this sets the stage for what could be the initial phase of a broader accumulation trend.

The post Early Accumulation Phase? New Data Signals Uptick in Bitcoin Market Sentiment appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·