After rebounding from last week’s low around $0.1680, Dogecoin is now showing signs of consolidation, with bulls and bears in a temporary standoff. A decisive breakout from this range could pave the way for a 14% surge, reigniting hopes for a rally toward the $0.20 psychological threshold.

DOGE Price Consolidates Under $0.1750 Resistance

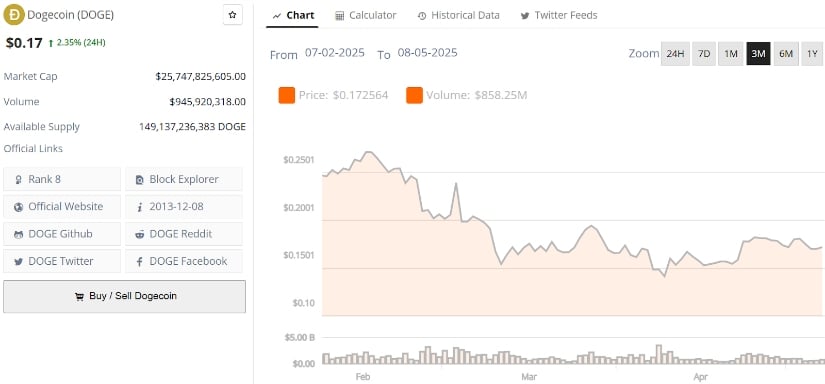

Dogecoin is currently trading around $0.1730, reflecting a modest recovery from its recent dip. According to Coinglass and TradingView data, DOGE remains locked in a tight trading range, with key exponential moving averages (20, 50, 100, and 200-period) all converging between $0.1716 and $0.1738 on the 4-hour chart. This confluence is forming a compression zone under the $0.1750 resistance band.

DOGE has broken a 4-year consolidation, now resting on breakout support with an oversold weekly RSI—summer could be explosive. Source: Djvybe on TradingView

“The structure signals indecision,” analysts noted, “but a breakout above this zone with strong volume could flip short-term sentiment bullish.”

Technical indicators like the MACD and RSI support this thesis. The MACD hovers just above the zero line, showing a narrow bullish bias, while the RSI remains near 58, indicating mild upward momentum without reaching overbought levels. A breakout above $0.1750 could target $0.18 and $0.1850, while failure to breach it may bring DOGE back to $0.1675 or lower.

Falling Wedge Pattern Suggests Breakout Potential

A prominent falling wedge pattern has formed on the Dogecoin chart since late April, connecting a series of lower highs and gradually narrowing the price range. This pattern is typically considered bullish and often precedes upward breakouts.

Dogecoin (DOGE) price has formed a falling wedge pattern on the daily and weekly charts. Source: VariousPear5953 on TradingView

The Dogecoin price analysis highlights that bulls recently defended the wedge’s lower boundary, leading to a small rally from $0.1680. Moreover, DOGE has seen a price rejection at levels below the 200-day simple moving average, further hinting at a potential upward reversal.

If Dogecoin breaks the upper trendline of the falling wedge, analysts expect a 14% rally that could take the DOGE price as high as $0.20. However, any rejection at resistance could cause a revisit to the $0.1560 Fibonacci support level.

Derivatives Market Signals Bullish Tilt

In the derivatives space, sentiment has begun to shift in favor of the bulls. Coinglass data shows that long positions on DOGE have climbed to 51.83% in recent hours, pushing the long-to-short ratio to 1.076. The funding rate, which briefly dipped into negative territory, has now returned to neutral and is poised to turn positive.

This dynamic suggests that Dogecoin investors are increasingly confident about a bullish move. If DOGE manages to break above $0.1750, a short squeeze could occur, liquidating nearly $14.18 million in short positions and amplifying upward pressure on the token.

Such liquidations would not only support Dogecoin’s prediction of hitting $0.20 but also signal a major sentiment shift in the Dogecoin network.

Minor Token Unlock Unlikely to Derail Bullish Momentum

Despite bullish signals, Dogecoin faces a slight headwind from a scheduled token unlock. Nearly 97.89 million DOGE tokens—worth about $16.57 million—will be released over the coming week, equivalent to 0.07% of the total circulating supply.

Dogecoin (DOGE) was trading at around $0.1730, up 2.35% in the last 24 hours at press time. Source: Brave New Coin

Though such a supply increase might seem significant, analysts suggest it is unlikely to cause major price disruption. The unlock is part of a linear release schedule and not expected to overwhelm market demand.

“The release is minor in context,” one trader noted. “It shouldn’t challenge the current Dogecoin rise unless paired with external bearish catalysts.”

Political Sentiment and Meme Coin Resurgence

Another unique factor influencing DOGE’s market behavior is the broader political and social backdrop. Historically, Dogecoin and other meme coins have surged during periods of political unrest or market uncertainty.

Dogecoin is forming an inverse head and shoulders pattern on the hourly chart, signaling a potential bullish reversal. Source: Trader Tradingrade via X

The renewed Dogecoin buzz follows rising global tensions and increased political debate around crypto regulation. According to market watchers, meme coins tend to thrive during such times as retail investors seek alternative assets with high upside potential.

Dogecoin prediction models suggest that if macroeconomic and political conditions continue to stir volatility, meme coins like DOGE could become short-term favorites once again. This was echoed by recent social media trends and Google search spikes for Dogecoin news and forecasts.

Looking Ahead: Make or Break at $0.1750

The near-term Dogecoin challenge is straightforward: reclaim and hold above the $0.1750 resistance. A close above that level, supported by volume, could quickly drive prices toward $0.18 and potentially $0.1850. Intraday momentum could also receive a boost if the 15-minute chart confirms a breakout above $0.1743.

On the downside, failure to hold $0.17 would likely pull DOGE back toward $0.1675 and test support at $0.1640.

While the current setup reflects compression and indecision, the convergence of bullish technical signals, growing derivatives optimism, and strong trading volume puts Dogecoin in a favorable position heading into May 8.

“Dogecoin has always been unpredictable,” one analyst concluded. “But when volume rises and the crowd gets involved, DOGE tends to surprise on the upside.”

2 months ago

12

2 months ago

12

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·