|

|

I can’t count how many times I’ve heard someone, when talking about disability insurance, say, “I’m healthy, I don’t need it” or “My group policy is enough,” or, even, “My parents will take care of me.” Others assume disability is something that only happens to “other people”—until it isn’t.

For high-income professionals, your ability to earn an income is your most valuable financial asset. Losing it, even for a short time, can derail everything you’ve worked so hard to build. In this article, we’ll break down the most common misconceptions about disability insurance and why falling for them could cost you big.

Misconception #1: “I’m Young and Healthy . . . I Don’t Need Disability Insurance”

Reality: Even if you're in your 20s or 30s and feel invincible, statistics tell a different story.

I get it, young people feel healthy and invincible. But ironically, professionals in their younger years are in a window where it’s the best time to buy disability insurance. Why? Because it’s easier to qualify. Once the “car accident” or unexpected diagnosis happens, it’s too late.

Getting coverage while you're young and healthy means lower premiums, better policy options, and fewer chances of having exclusions for pre-existing conditions—or being declined altogether. And waiting doesn’t save you money; it just increases your risk.

Here’s the reality: the odds of facing a disability are much higher than most people think. According to the Social Security Administration, 1 in 4 20-year-olds will experience a disability lasting at least 90 days before retirement age. That’s a far greater risk than losing your home to fire or getting into a major car accident—yet most people insure those things without a second thought.

More information here:

People Aren’t Buying Disability Insurance, But They Should

Top 12 Reasons to Buy Disability Insurance as a Resident

Misconception #2: “My Employer Group Coverage Is Enough”

Reality: Employer-provided coverage can be helpful, but it’s often not the full picture.

I’ve heard it many times: “I’ve got it through work, so I’m covered.” My first response is usually, “That’s great—how does it work?” Most people either don’t know or assume it’ll be enough to replace their full income. But here’s the thing: group disability policies typically cover only 50%-60% of your base salary, and that’s before taxes. Bonuses, side income, and other forms of compensation are often excluded.

And the drawbacks don’t stop there.

The benefit may be taxable if your employer pays the premiums—which can significantly reduce your actual take-home benefit. Coverage usually ends when you leave your job. It’s not portable, meaning you’d lose it if you change employers or go out on your own. The definition of disability is often more restrictive in group policies, meaning you may have to be totally unable to work in any occupation, not just your specialty. Benefits can be reduced or offset by other sources of income, such as Social Security Disability or workers’ compensation.That’s why it’s smart to think of group coverage as a supplement, not a standalone solution. If you can qualify, a personal policy helps fill in those gaps, and it follows you throughout your career, regardless of where you work.

Misconception #3: “Disabilities Are Rare and Only Happen from Accidents”

Reality: When people hear the word disability, they often picture a wheelchair, a broken arm, or some kind of dramatic accident. But that image doesn’t reflect reality.

Nearly 90% of long-term disabilities are actually caused by illness, not injury. Think cancer, heart disease, depression, autoimmune conditions, or chronic back and joint issues.

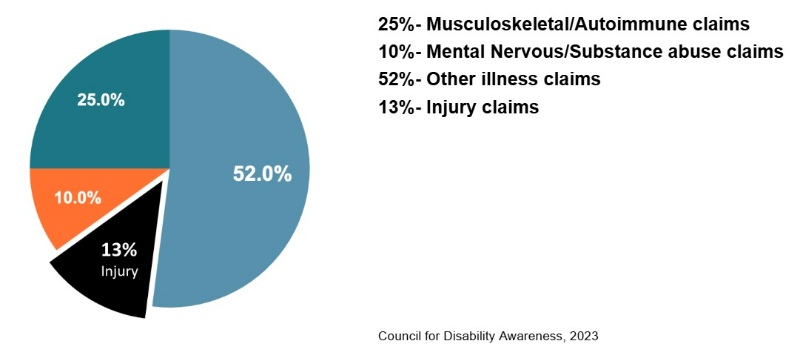

For physicians and other high-income professionals, this is even more important to understand. Musculoskeletal and autoimmune conditions make up the largest share of physician disability claims, followed closely by mental health disorders. These aren’t always visible, but they can severely impact your ability to work in your specialty—or to work at all.

And disability doesn’t always mean you’re completely unable to work. It might mean you can’t earn all of your income or can only perform certain duties. Whether it’s a partial or total disability, the financial impact can be serious—and often long-lasting.

So while it’s easy to assume disability is rare or only happens to “other people,” the truth is that it’s common and often caused by the kinds of health issues that sneak up on you.

Misconception #4: “Social Security Will Take Care of Me”

Reality: Relying solely on Social Security Disability Insurance (SSDI) as your safety net is a gamble that may not pay off.

Strict eligibility criteria: SSDI has stringent requirements. To get Social Security Disability benefits, the definition of disability is really strict. One must be unable to do any kind of work, period. And the condition has to last at least a year or be expected to result in death. SSDI also won’t pay anything for short-term or partial disabilities. On top of that, if you're earning more than about $1,550 a month in 2025 (or $2,590 if you're blind), they’ll likely say you’re not disabled. Bottom line? SSDI is limited, and it's not a real income replacement plan—especially if you're used to earning a high income or working in a specialized field. Low initial approval rates: About 38% of initial SSDI applications are approved. This means that about 62% of applicants are denied upon their first application. Lengthy waiting periods: Even if approved, there's a mandatory five-month waiting period before benefits begin, and the average processing time for initial decisions can be over seven months. Modest benefit amounts: The average monthly SSDI benefit is around $1,707. That may not be sufficient to maintain your current lifestyle, especially for high-income professionals.SSDI is basic and minimal protection, and you shouldn’t rely on it. For anyone with significant income and financial obligations, individual disability insurance should be at the top of their purchasing list.

More information here:

The Physician’s Guide to the Best Disability Insurance Companies

|

|

Misconception #5: “I’ll Just Rely on My Savings If Something Happens”

Reality: A three- to six-month emergency fund is great for short-term financial challenges, like car repairs or a surprise medical bill. But if you're out of work for a year or longer, that cushion disappears fast. Most disabilities last longer than people think, and once savings are drained, the financial pressure can become overwhelming.

The truth is, disability insurance isn’t there to protect your savings; it’s there to protect your future income. If you're a high-income professional, your ability to earn over the next 20 or 30 years could be worth millions. Why risk it by relying on a savings account that was never meant to carry that kind of weight?

Misconception #6: “My Family Will Take Care of Me”

Reality: It’s natural to feel like your family would step in during a crisis, and in many cases, they would. But relying on your parents as your disability plan comes with real risks—for you and them.

I once had someone tell me this exact thing: “If something happens, my parents will take care of me.” So, I asked a simple question: “Do your parents know they’re the plan?” Especially if an illness or injury takes you out of work for an extended period—six months, a year, or even longer—do they know they’d be responsible for keeping your financial life afloat?

That’s when the realization hit. There was no question their parents would step up out of love, but could they actually afford to replace this physician’s income, cover living expenses, and handle medical costs long-term? Probably not.

Disability insurance is what gives you a real plan, one that doesn’t put your loved ones in a financial bind. Your parents should be your support system, not your backup paycheck.

More information here:

Why Do Some Doctors Get Declined for Disability Insurance?

The Bottom Line

The biggest misconception of all is thinking, “It won’t happen to me.” But disability doesn’t discriminate. It can affect anyone, regardless of how young, healthy, or successful you are. And if it does, the financial consequences can be devastating.

We’ve walked through the most common misconceptions: thinking you're too young to need it, assuming your employer's policy has you covered, brushing it off as something that only happens from accidents, trusting Social Security to catch you, leaning on savings that weren’t built for long-term loss, or believing your family will fill in the gap. These are all costly assumptions.

The truth is simple: your income is your greatest financial asset! It fuels your lifestyle, your savings goals, your retirement plan, and your ability to support the people you love. Protecting your most valuable asset—your ability to earn a living—is one of your most important financial tasks. Don't wait. Get disability insurance now. Your future self will thank you.

What has been your experience with disability insurance? Did you wait too long to get it? Did you buy some early in your career that helped you when you needed it most?

The White Coat Investor may receive compensation from White Coat Insurance Services, LLC; licensed in all states including MA and DC; CA license #6009217; NY license #1758759 (exp. 6/2027); Registered address: 10610 S. Jordan Gateway, #200 South Jordan, UT 84095. This does not affect the cost or coverage of insurance.

The post Disability Insurance Misconceptions: Common Assumptions Physicians Can’t Afford to Make appeared first on The White Coat Investor - Investing & Personal Finance for Doctors.

|

|

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·