TLDR

The tokenized gold market reached a record $2.57 billion in market capitalization Tether’s XAUT token saw $437 million in new supply minted in August alone Paxos’ PAXG token attracted $141.5 million in inflows since June Gold price trades near $3,470, approaching its April record high of around $3,500 Both tokens are backed by physical gold bars stored in secure vaultsThe market for blockchain-based gold tokens has reached a new milestone. Total market capitalization across all tokenized gold offerings hit $2.57 billion according to CoinGecko data.

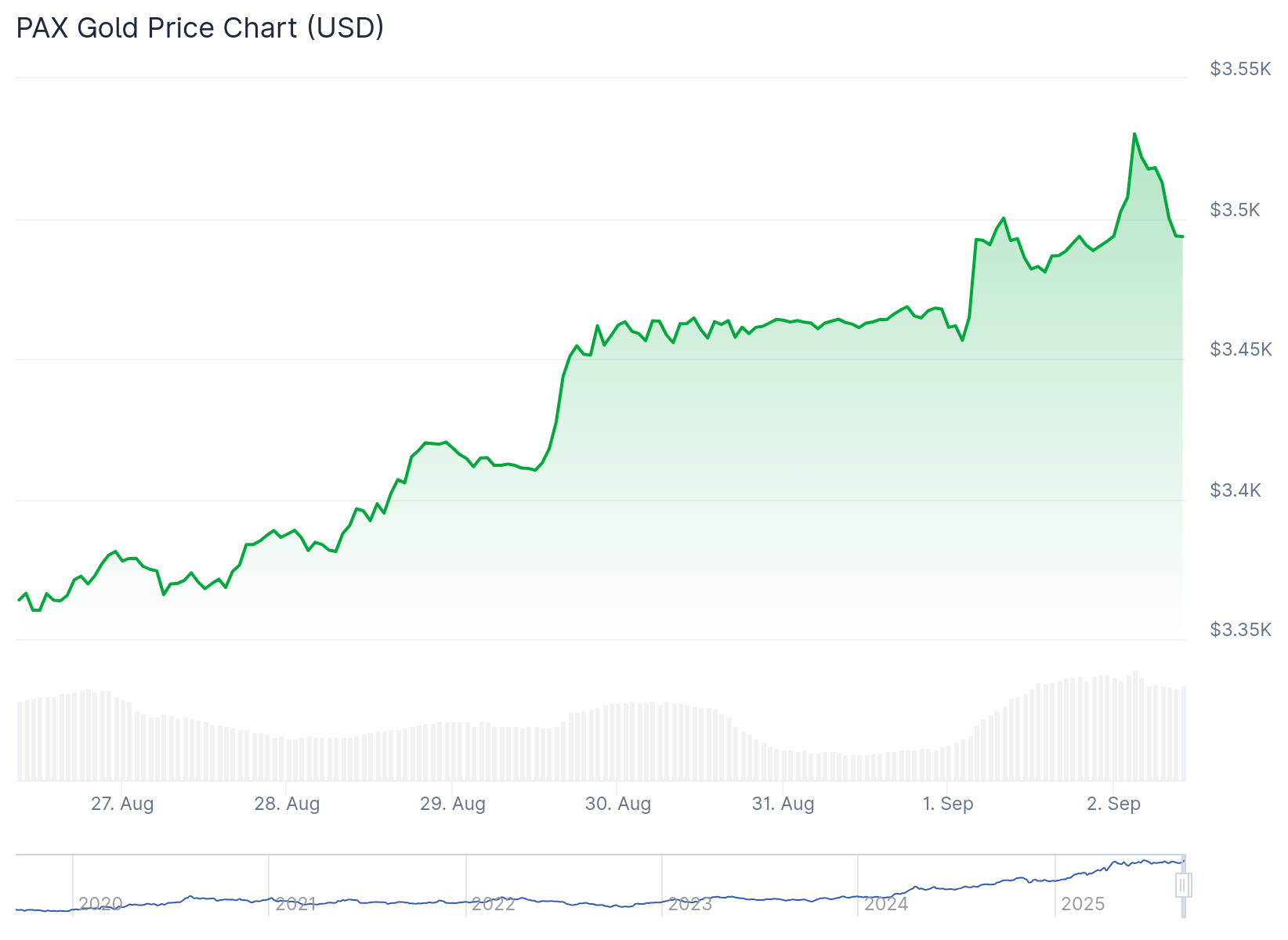

This growth comes as the price of physical gold trades near its April peak. The precious metal currently sits at approximately $3,470 per ounce.

Two major players dominate the tokenized gold space. Tether’s XAUT and Paxos’ PAXG tokens account for most of the market activity.

Pax Gold (PAXG) Price

Pax Gold (PAXG) Price

XAUT experienced massive growth in August. The token saw $437 million in new supply created during the month.

Tether’s Treasury department minted 129,000 new XAUT tokens in early August. This minting occurred on the Ethereum blockchain network.

The new tokens brought XAUT’s total market value to $1.3 billion. This represents a record high for the Tether-issued gold token.

Growing Demand for Digital Gold

PAXG also saw strong investor interest over recent months. The Paxos-issued token attracted $141.5 million in net inflows since June.

These inflows pushed PAXG’s market capitalization to $983 million. This marks another record high for the token according to DefiLlama data.

Source: DefiLlama

Source: DefiLlama

Both tokens operate on the same basic principle. Each token represents ownership of physical gold bars stored in secure vaults.

Token holders can redeem their digital assets for actual gold. This backing provides stability and ties the token values directly to gold prices.

Physical Gold Drives Digital Demand

Gold has been performing well in traditional markets. The metal reached its previous peak on April 22 during market uncertainty.

Current prices sit just below that April high. Market analysts point to safe haven demand as a key driver.

The U.S. Treasury yield curve has been steepening recently. This economic indicator often correlates with increased gold investment.

Tokenized gold offers investors digital exposure to the precious metal. These products combine traditional gold investment with blockchain technology benefits.

The tokens can be traded 24/7 on cryptocurrency exchanges. This provides more flexibility than traditional gold investment methods.

Storage costs are eliminated for token holders. The issuing companies handle physical gold storage and security.

Both XAUT and PAXG have seen their token supplies expand significantly. The August minting activity for XAUT represents the largest monthly increase on record.

The post Digital Gold Rush: Crypto Gold Tokens Break $2.5 Billion Barrier appeared first on CoinCentral.

8 hours ago

1

8 hours ago

1

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·