A surge in short positions, a sharp drop in open interest, and spot market resilience may suggest that Bitcoin is entering an accumulation phase—possibly setting the stage for a trend reversal.

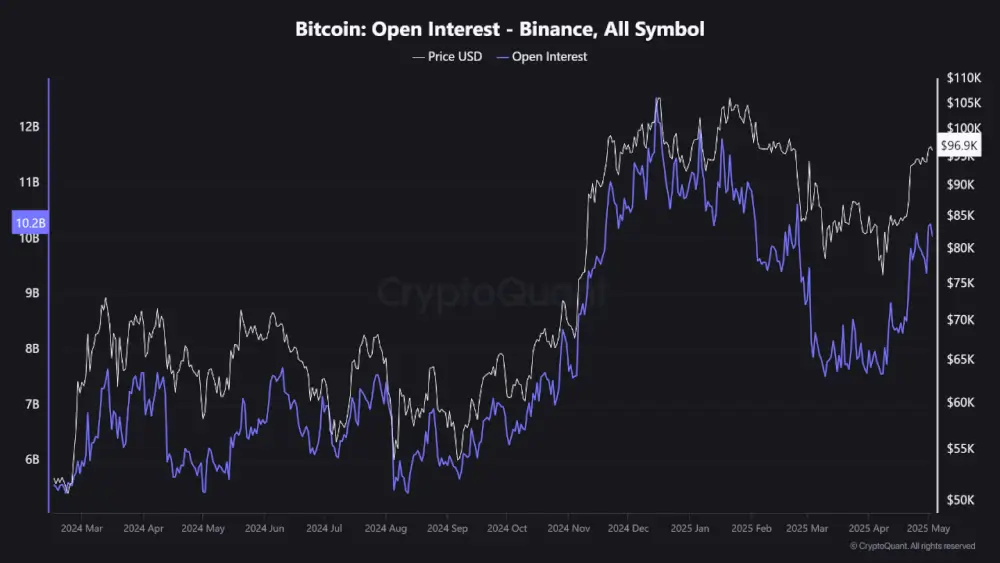

Binance Open Interest Drops 37% After ATH

Binance’s open interest hit an all-time high of $12 billion, reflecting aggressive long positioning. Following a sharp correction in BTC price, open interest dropped to $7.5 billion—a 37% plunge. According to CryptoQuant, this flush likely forced many over-leveraged longs to exit, clearing the path for an increase in short positions.

Funding Rate Swings Point to Bearish Bias

CryptoQuant’s data also notes that Binance funding rates peaked around 0.04%, showing strong long bias at the time. However, as Bitcoin pulled back from the $75K mark, the funding rate fell and recently turned negative. This indicates that short sellers are now paying longs—a sign that bearish sentiment is overtaking the market.

Historically, extremely negative funding rates have preceded short squeezes, where sudden price rallies force short traders to cover their positions—amplifying upward momentum.

Spot Market Signals Underlying Demand

Despite bearish futures data, CryptoQuant points out a critical divergence: the spot price of Bitcoin is trading roughly $60 higher than its perpetual futures counterpart on Binance. This gap implies that while futures markets are dominated by shorts, spot market participants may be accumulating.

This divergence between spot accumulation and futures pessimism can often signal a hidden bullish undercurrent, especially in pre-reversal market setups.

Final Take: Flush, Reset, or Foundation for a Rally?

Based on CryptoQuant’s data:

Open interest is down sharply Funding rates are negative Spot price shows strength over perpsThis combination suggests the market may be in a reset or accumulation phase, not a full breakdown. Traders should watch closely for volatility and potential reversal signals, especially if short pressure builds further.

The post CryptoQuant Data Reveals: Binance Traders Go Short—Is a Bitcoin Reversal on the Horizon? appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·