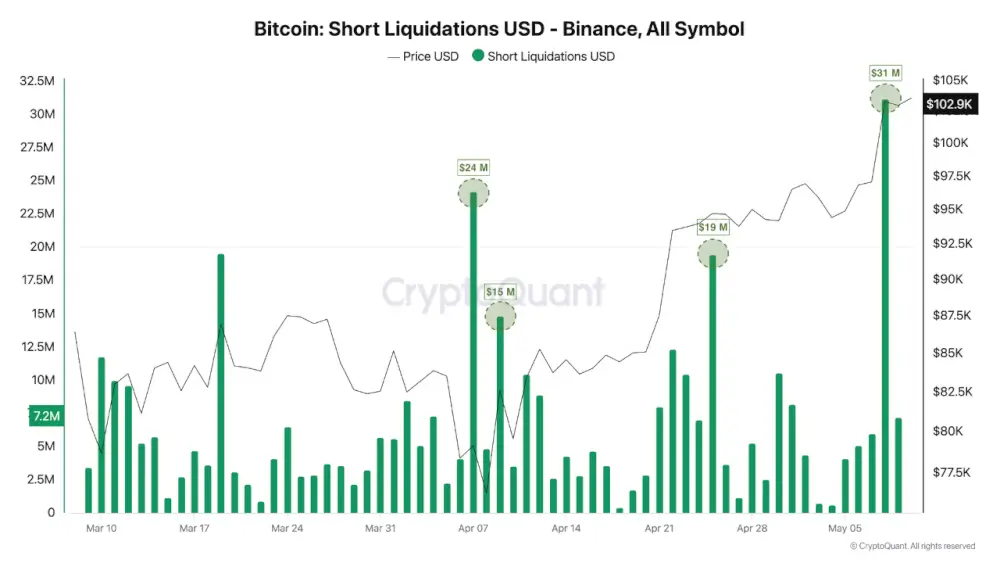

On May 8, over $31 million in short positions were wiped out in a single day, as BTC rallied past the $103,000 level, now trading around $103.4K.

Darkfost Highlights Derivatives-Driven Selling and Rebound

In a detailed post, Darkfost explains that Bitcoin’s plunge from $109,000 to $78,000 earlier this year led to an influx of short positions — particularly on Binance. This bearish buildup added significant selling pressure from the derivatives market, further amplifying downside volatility.

But since early April, as BTC began reversing, those short positions have started to unwind. That shift has turned into buying pressure, fueling Bitcoin’s steady climb.

But since early April, as BTC began reversing, those short positions have started to unwind. That shift has turned into buying pressure, fueling Bitcoin’s steady climb.

“The most significant liquidation event since the start of April occurred on May 8, with over $31 million in short positions wiped out in a single day,” Darkfost noted.

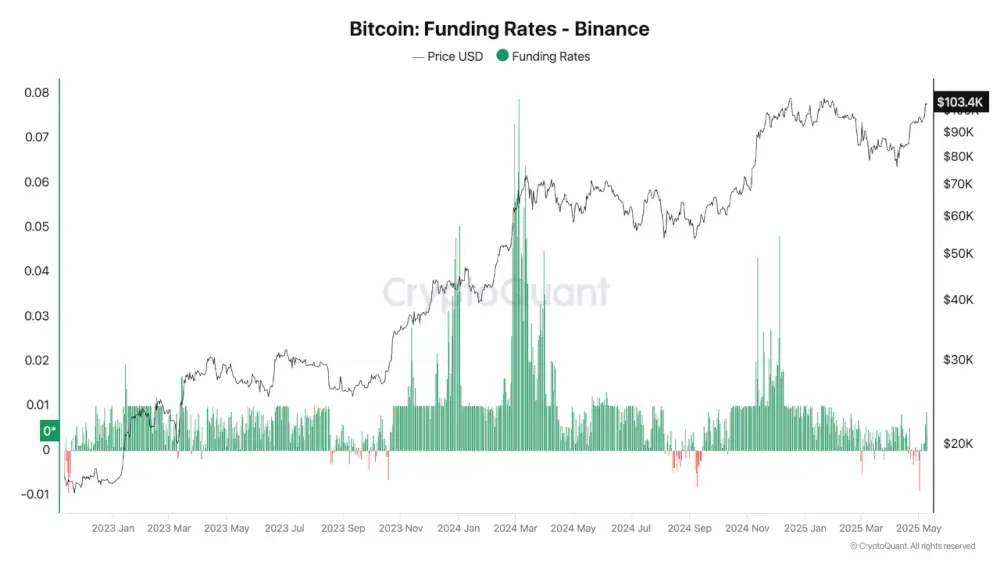

Funding Rates Still Low — Bulls Not Overextended

Interestingly, despite the strong rally, funding rates on Binance remain low, around 0.004, indicating:

Shorts are still present in the system.

Traders are cautious about going long, suggesting the rally may have further room to run before becoming overheated.

This observation is supported by CryptoQuant funding rate data, showing no excessive spikes — a key signal that the derivatives market isn’t yet in an overleveraged state.

Momentum Accelerating, Shorts Fueling the Rally

The second chart reveals multiple major short liquidation spikes in recent weeks, including:

$24M on April 6

$19M on April 21

$31M on May 8

Each spike corresponds with bullish surges, indicating short squeezes are contributing meaningfully to Bitcoin’s continued strength.

The post CryptoQuant Analyst: Bitcoin Liquidates $31M in Shorts as Price Surges Past $103K appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·