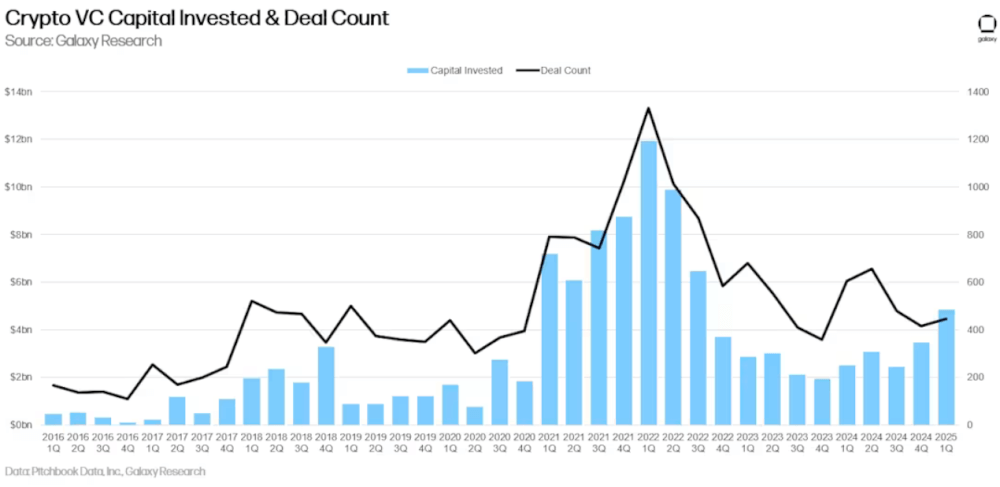

Despite the strong topline figure, the spike was largely driven by a single outlier: MGX’s $2 billion investment in Binance, which accounted for over 40% of total capital deployed. Excluding that one transaction, venture investment actually fell to $2.8 billion, representing a 20% decline compared to Q4 2024.

VC Activity Still Lagging Behind Bitcoin

Historically, venture capital investment in the crypto space has closely mirrored Bitcoin’s price trends. However, since early 2023, this correlation has weakened. Although Bitcoin has soared, venture funding has remained sluggish, due in part to a cautious allocator environment and the market’s dominant focus on Bitcoin-centric narratives, leaving many altcoin and Web3 themes from 2021 out of the spotlight.

While Q1 2025 offered a glimpse of renewed alignment between price action and venture activity, the data suggests true recovery in crypto VC may still depend on broader narrative shifts and more sustained investor confidence beyond mega-deals like Binance’s.

The post Crypto VC Investment Surges in Q1 2025—But One Deal Skews the Data appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·