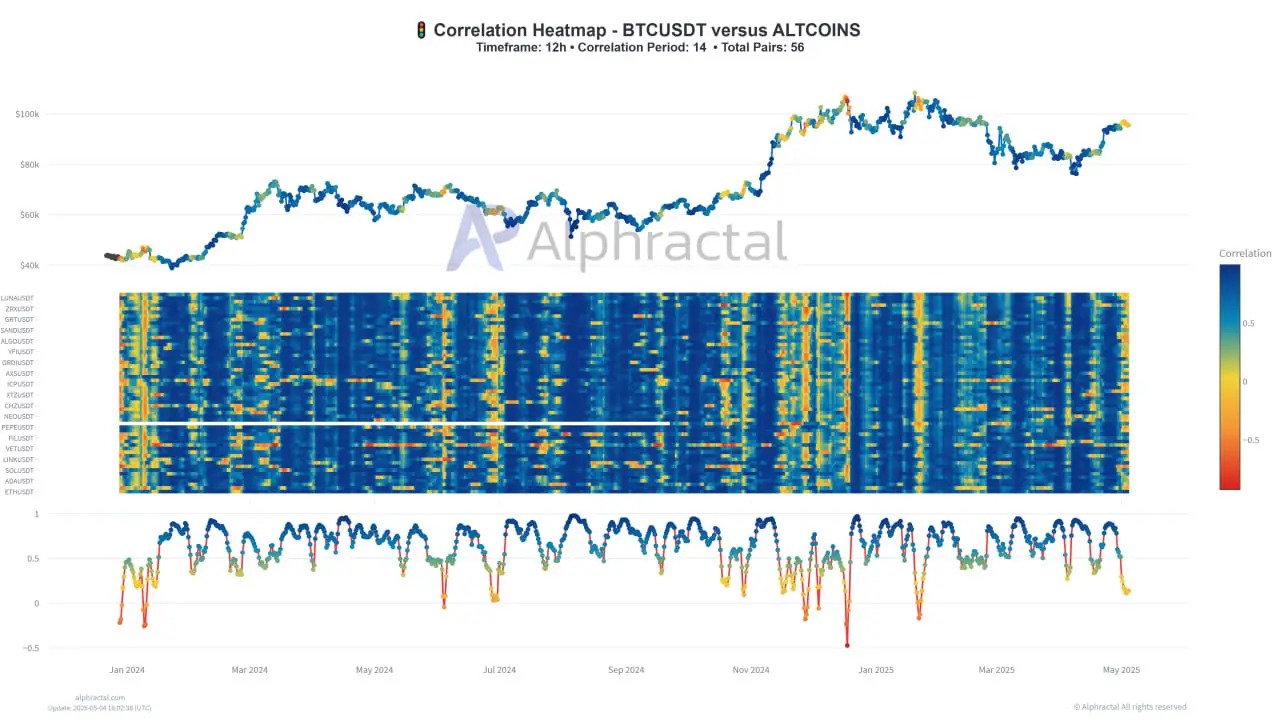

This decoupling, where Bitcoin and altcoins no longer move in tandem, is often described as the “calm before the storm” in the cryptocurrency market.

Historically, this type of divergence has preceded major price movements. Statistical data reportedly indicates a higher probability of a market downturn, particularly when Bitcoin reaches a resistance level and fails to break out, while simultaneously, altcoins attempt to attract liquidity.

This scenario creates a potentially unstable environment where the lack of coordinated movement can lead to sharp and unpredictable price swings.

The analysis concludes with a warning to traders to remain vigilant, noting that the Correlation Heatmap available at Alphractal.com is currently showing “warning signs.”

READ MORE:

Coinbase to Delist Five Tokens on May 16

This suggests that the correlation breakdown is already being observed and could be an indicator of increased risk and potential for significant price fluctuations across the cryptocurrency market in the near future. Investors and traders are advised to monitor market correlations closely as a potential leading indicator of volatility.

The post Correlation Breakdown Between Bitcoin and Altcoins Signals Potential Market Volatility appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·