The upgrade, announced shortly after a period of heavy transaction congestion, includes a 5X increase in throughput and a series of fail-safes to improve system resilience. The exchange noted these changes aim to handle rising Solana activity with fewer delays.

Back in January, the company faced mounting pressure after delays in deposits and withdrawals left users waiting hours to complete basic SOL transactions.

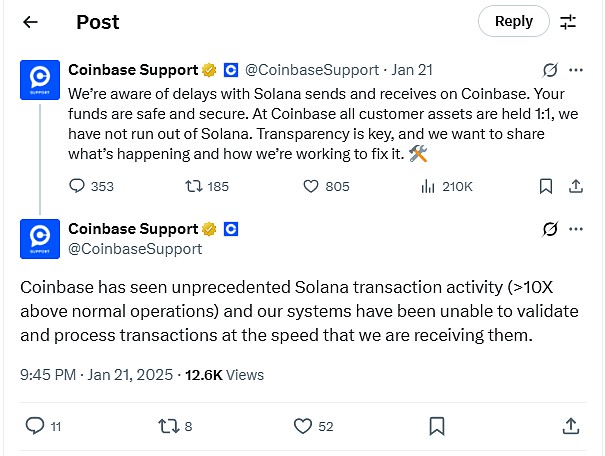

“Coinbase has seen unprecedented Solana transaction activity … and our systems have been unable to validate and process transactions at the speed that we are receiving them,” the firm stated in a public X post on January 21.

During this crunch period, transaction volume on Solana was 10X the norm. This massive increase in network demand exposed Coinbase’s system limitations and pushed the exchange to move fast on infrastructure investment.

Solana Gains Spark Institutional and Retail Moves

Meme coin trading played a big role in the sudden spike in network activity. In early January, Solana’s on-chain volume hit an all-time high of $3.79 billion with around 4.5 million active addresses, as meme coin mania swept the chain.

The buzz reached a new level in January when Donald and Melania Trump launched their own tokens on Solana- $TRUMP and $MELANIA – driving even more attention.

Coinbase Solana Infrastructure

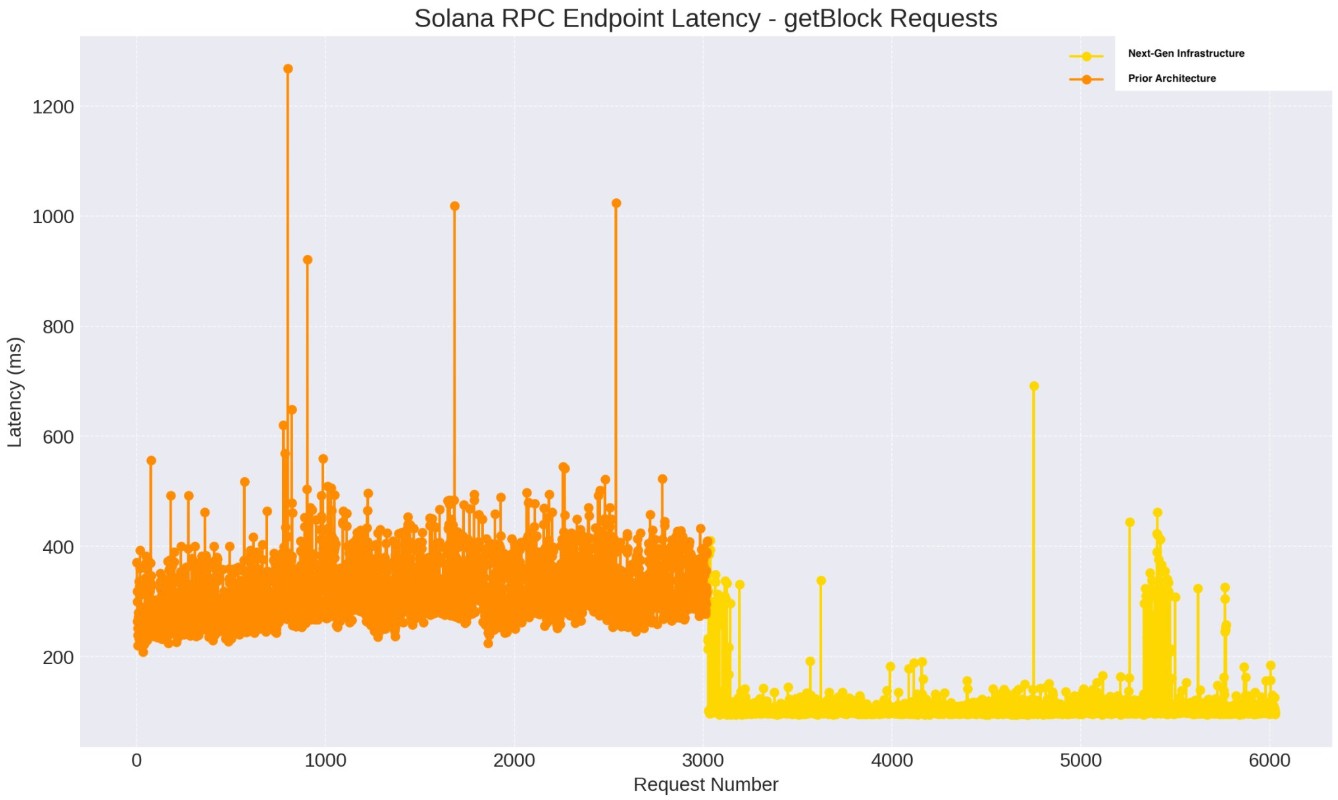

Coinbase’s response wasn’t limited to speed fixes. Along with faster transaction handling, the upgrade also included remote procedure call (RPC) improvements, better liquidity systems, and asynchronous processing. These changes are meant to ensure more stable transactions even during volume spikes.

Latency comparison: old vs. new Solana RPC infrastructure | Source: Coinbase

As the Solana ecosystem matures, Coinbase’s adjustments reflect an ongoing commitment to meet demand. In a statement, the company emphasized its intent to “keep investing in infrastructure” to support future growth.

Solana ETFs and Custody Signal Institutional Confidence

Coinbase’s expansion also includes direct support for Solana-based tokens like io.net (IO), Degen, Tensor (TNSR), and Gigachad (GIGA). This signals preparation for broader trading activity as Solana continues climbing in market popularity.

The buzz isn’t just among traders. Institutional players are also joining in. In Canada, several firms — including 3iQ, Evolve, CI, and Purpose — recently launched spot Solana ETFs. These financial products come with staking functionality, giving investors a yield on staked SOL.

Coinbase’s role in custody services has expanded in parallel. The exchange has been named custodian for the upcoming Solana ETF by Franklin Templeton, a major asset manager. This move boosts confidence among large-scale investors looking for security in their crypto holdings.

Staking Upgrades and the Road Ahead

For individual users, Coinbase’s infrastructure improvements mean a smoother staking experience (check Coinbase staking rates). The faster and more reliable system makes it easier to lock in SOL and earn rewards, directly addressing past pain points. This syncs well with the staking-enabled ETFs now launching outside the U.S.

Even though Solana ETFs haven’t yet been greenlit in the U.S., firms like VanEck, Bitwise, and 21Shares have already filed for approval. These efforts come on the heels of U.S. regulators approving spot Bitcoin and Ethereum ETFs earlier in 2024.

Source: James Seyffart. Bloomberg

From a broader view, Coinbase’s upgrades appear to not just be patching over issues —but instead paving the way for long-term integration of Solana into both consumer and institutional crypto portfolios – and from the perspective of its customers, not a moment too soon.

Why don’t you stay ahead of the curve instead of reacting to it – it’s called PRO-ACTIVITY and business 101 for any competent organization – the degree of repeat issues at Coinbase WILL erode your customer base significantly if you don’t get it together ~ retired CEO

1 month ago

12

1 month ago

12

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·