Estimated reading time: 12 minutes

Learn about our June 2024 budget update and gain valuable insights into managing your finances. Discover the tools and strategies we use to stay on track.

Our June 2024 Budget Update

Our June 2024 Budget UpdateWhy I Share Our Monthly Budget

For anyone new to CBB, this briefly explains our monthly budget update.

I look forward to putting this post together as it lets us see where we spend our money.

A budget also acts as a diary for your expenses so you can look back to see success and failure.

Our budget update also lets readers know that we are not perfect and must make changes like everyone else.

We use the tools (Free budget Binder), and I hope you have downloaded your free copy.

Alright, let’s get into this.

Percentages For Our June 2024 Budget

Our year-to-date percentage chart is another way to chart our household budget.

Our June 2024 Month by Month

Our June 2024 Month by MonthJune 2024 Household Budget Percentages

Our June 2024 Household Percentages

Our June 2024 Household PercentagesSavings of 37.00% include investments and savings based on our net income.

Our life ratio is 32.21% and contains everything from groceries, entertainment, miscellaneous items, health/beauty, clothing, etc., all variable expenses.

In June, we went over the life category due to spending more than usual on health, beauty, and tools for the garage. I’ll explain more in detail below.

Transportation is 1.77%, which covers gas, insurance, and maintenance for our vehicle, which is paid.

Our house and vehicle are paid for, and we have zero consumer debt; however, we still pay property taxes and maintenance fees. In June, this cost was 15.98%.

The projected expenses of 12.29% can change based on what we encounter monthly, such as a new item we need to save for.

52-Week Savings Challenge

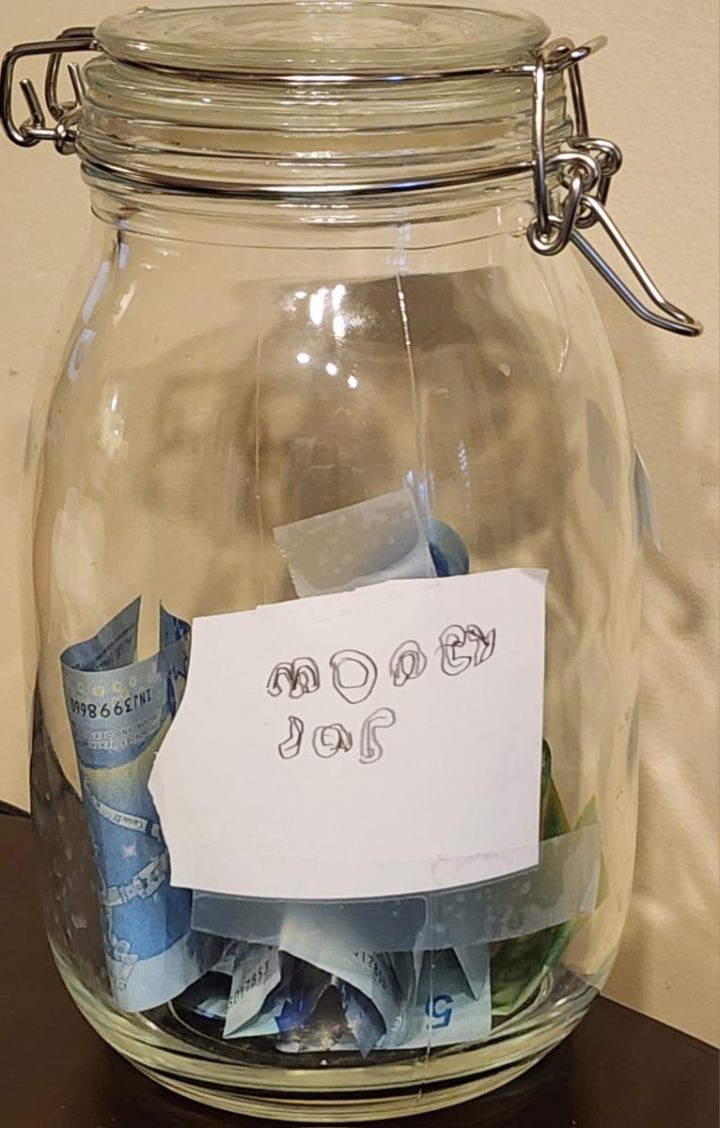

Moola Jar – 52-week Money Savings Jar Jr CBB

Moola Jar – 52-week Money Savings Jar Jr CBBIn December, I started a 52-week Savings Challenge and asked my readers if they wanted to participate.

Below is the jar we created to save the money for twelve months.

Our son wanted to participate, so he decided to save his allowance or any other money he earned.

He’s saving $5 weekly from his allowance in the savings jar.

In June, he saved $20 for the month plus an extra $10, which his aunt had given him.

June 2024 52 Week Savings Challenge Update

June 2024 52 Week Savings Challenge UpdateThe yearly total to date, June 2024, is $100 in savings.

He created a Moolah Jar label for his money savings jar, which I thought was funny.

52-Week Savings Challenger Update

Below is the report from a CBB fan participating in the year-long savings challenge.

Hello,

It’s me, TFSASaver, with my monthly update on the budget challenge

I sold $75 of things I no longer need on Facebook Marketplace, used $10 of gift cards, and found .35 cents out for my walks.

So, the total for June is $85.35 in my TFSA savings.

Thanks!

Happy Canada Day

Grocery Food Savings Jar June 2024 Update

June 2024 Grocery Food Savings Jar

June 2024 Grocery Food Savings JarWhy will we track our grocery discounts for the entire year?

Tracking Our Grocery Discounts For One Year + Free Printable

I will tally it at the end of the year to see how much we saved buying reduced food products.

Read the 2023 End of Year Grocery Food Savings Jar Review.

We saved $217.48 for June using coupons, rewards apps, and Flashfood.

So far, in 2024, purchasing discounted food has saved us $891.31.

June 2024 Budget Estimation and Actual Budget

Below are two tables: Our June 2024 Budget and our Actual Budget.

Our June 2024 budget represents two adults and a 9-year-old boy.

Budget Colour Key: It is a projected expense when highlighted in blue.

Since May 2014, we’ve been mortgage-free, redirecting our money into investments and home improvement projects.

Spending less than we earn and budgeting has been the easiest way to pay off our debt and save money.

This type of budget is a zero-based budget where all the money has a home.

Estimated June 2024 Budget

June 2024 Monthly Budgeted Amount

June 2024 Monthly Budgeted AmountWe may not need all the money we budgeted for in each category; however, remember the number is only an estimate from the previous year.

Don’t forget to budget for projected expenses because your entire month can fail due to not planning.

Actual June 2024 Budget

June 2024 Monthly Actual Amount

June 2024 Monthly Actual AmountOur Canadian Banks

Chequing– This is the bank account from which we pay our household bills. We use Simplii Financial, TD Canada Trust, and Tangerine Bank. Join Simplii Financial today! Read more about the best Canadian online virtual banks. Emergency Savings Account– This money is in a high-interest savings account (HISA) High-Interest Savings Account (HISA)– This savings account holds our projected expenses.Breakdown Of Our June 2024 Budget

Below are some of our variable expenses from June that I will discuss.

Clothing

We spent $288.94 on clothing, which is still under budget for the month of June.

In some months, our clothing expenses are higher, and at other times, we hardly spend anything.

Mrs. CBB purchased clothing from Terra Greenhouse in June when we visited to buy plants.

It was an impulse shop from the reduced rack of high-end clothing, which was 50% off.

She wasn’t going to buy it, but she hadn’t splurged on herself in a while, so I said, get it.

She also purchased some jeans from Goodwill as she’s been losing weight.

Grocery Budget June 2024 Budget

Our monthly grocery budget is $900 plus a $25 stockpile budget.

We spent $726.80, or $173.20, under budget for our June groceries.

In the last few months, we have found that we buy the same foods week after week.

Also, we noticed that we aren’t eating as much as we used to.

Lots of our grocery expenses have been from the Flashfood app or 50% off at Zehrs or Shoppers Drug Mart.

I think I mentioned that we buy bagged salads only at 50% off as it’s better for us.

It was becoming too hard to finish a head of lettuce and other veggies to make a salad.

To eliminate waste, we opt for reduced and frozen vegetables.

Plus, we have tomatoes, zucchini, garlic, spring onions, and green peppers growing in the garden.

We also still have plenty of meat and fish in our freezer to eat before we buy more.

Health And Beauty

June was a big month for health and beauty expenses because we went to get laser hair removal touch-ups.

While there, Mrs. CBB purchased a face exfoliation scrub for $115.

It was also the month when everything in the bathroom needed replenishment.

Everything from vitamins to shampoo, conditioner, face serums, toilet paper, paper towels, hand soap, moisturizer, and deodorant was replaced.

We paired it with Shoppers Optimum 20x points days and received money back as reward points.

At Costco, she also picked up a big container of Organika Collagen for around $40.

Lastly, we all purchased a Food Intolerance Test to determine if we had food sensitivities.

I’ll explain more in a blog post, but the results were exciting.

Home Maintenance

I’ve been spending a bit of money buying tools for my garage to repair small engines, such as lawnmowers, snow blowers, and weed wackers.

I hope to do this as a hobby/business when I retire, so I’m learning along the way.

I’ve met two retired men in our neighborhood who do this and enjoy the extra spending money.

You could call this my retirement business plan B and blogging on CBB.

What do you plan to do when you retire? Do you have a plan B?

FlashFood App

Please use my code when you sign up for Flashfood! Money for you and money for me.

Spend-15-get-a-3-or-5-dollar-credit-with-Flashfood-Canada

Spend-15-get-a-3-or-5-dollar-credit-with-Flashfood-CanadaEvery person who signs up gets a $3 or $5 credit, a freebie Flashfood offers for new app customers.

Also, Flashfood has added a small service fee to every order, which I feel is acceptable.

Use my referral code, MOCD28ZN4, for the $3 or $5 credit.

Your first purchase must be over $15.

In June, we picked up lots of high-protein yogurt with no added extra sugar for $1.50 for each package of four.

Along with the yogurt, we found this unique Bergeron Classique Cheese from No Frills, which was so cheap, $0.25, that we couldn’t pass it up. It was well worth it.

Source Vanilla Yogurt on FlashFood App

Source Vanilla Yogurt on FlashFood App Classique Ripened Firm Cheese from the Flashfood App.

Classique Ripened Firm Cheese from the Flashfood App.PC Optimum Rewards Points June 2024

Over 45 days, we’ve earned 202,850 PC Optimum Points, or approximately $202, towards free products.

Since 2018, we have earned 8,659,385 PC Optimum Points or $8,660.

PC Optimum Points June 2024

PC Optimum Points June 2024We started 2024 with under 7 million PC Optimum Points, or $7000, and are working towards $8000.

The process of saving them started after our son was born in 2014.

Between diapers and formula, we amassed points faster than we could spend them.

Yes, we have redeemed many times, but only during their Mega Bonus Event at Christmas.

Below are blog posts for anyone wanting to learn how we earn PC Optimum Points.

How To Earn PC Optimum Points Fast How We Earned 4 Million PC Optimum Points President’s Choice Financial World Elite MasterCardTD Rewards Credit Card June 2024

Our TD Visa has a cash-back balance of $467.39.

TD Visa Cash Back June 2024

TD Visa Cash Back June 2024Dream Air Miles June 2024

Dream Air Miles June 2024 CBB

Dream Air Miles June 2024 CBBMost points are from our house and car insurance, which offers Air Miles.

There was a point where we had to choose Cash Miles or Dream Miles.

Since my family lives in the UK, we felt the Dream Miles would have worked best for us.

June 2024 CBB Net Worth Update

June 2024 Net Worth Update CBB

June 2024 Net Worth Update CBBOverall CBB June 2024 Budget + Net Worth Update

We have $7707.39 worth of cash in rewards points from TD Visa and Shoppers Drug Mart.

In June, we realized a $30,165.64 net worth increase from our retirement investments, followed by cash and emergency savings.

Not too bad of a month.

I hope to see you again to read my July 2024 budget update in August.

Please drop me a question or comment below.

If you’re new, don’t forget to subscribe.

Thanks for reading,

Mr. CBB

You can find all the CBB monthly budget updates from 2012-present in our library.

The post CBB June 2024 Budget Update appeared first on Canadian Budget Binder.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·