Estimated reading time: 14 minutes

Learn about our July 2024 budget update and gain valuable insights into managing your finances. Discover the tools and strategies we use to stay on track.

July 2024 Budget Update Canadian Budget Binder

July 2024 Budget Update Canadian Budget BinderWhy I Share Our Monthly Budget

For anyone new to CBB, this briefly explains our monthly budget update.

I look forward to putting this post together as it lets us see where we spend our money.

A budget also acts as a diary for your expenses so you can look back to see success and failure.

Our budget update also lets readers know that we are not perfect and must make changes like everyone else.

We use the tools (Free budget Binder), and I hope you have downloaded your free copy.

Alright, let’s get into this.

Percentages For Our July 2024 Budget

Our year-to-date percentage chart is another way to chart our household budget.

July 2024 Month by Month

July 2024 Month by MonthJuly 2024 Household Budget Percentages

Our July 2024 Household Percentages

Our July 2024 Household PercentagesSavings of 32.70% include investments and savings based on our net income.

Our life ratio is 39.04% and contains everything from groceries, entertainment, miscellaneous items, health/beauty, clothing, etc., all variable expenses.

Since the life category should have been 15% or less, we could not sustain this in July.

More explanation will be below.

Transportation is 1.61%, which covers gas, insurance, and maintenance for our vehicle, which is paid.

Our house and vehicle are paid for, and we have zero consumer debt; however, we still pay property taxes and maintenance fees. In July, this cost was 11.97%.

The projected expenses of % can change based on what we encounter monthly, such as a new item we need to save for.

Jr. CBB’s 52-Week Savings Challenge

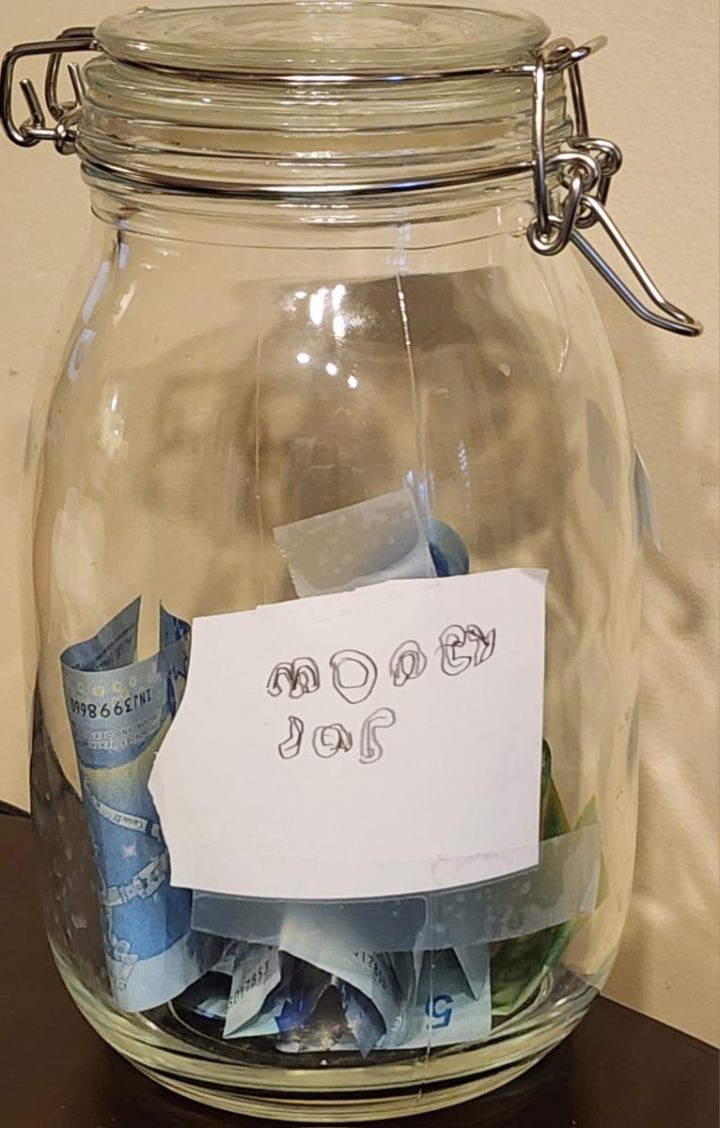

Moola Jar – 52-week Money Savings Jar Jr CBB

Moola Jar – 52-week Money Savings Jar Jr CBBIn December 2023, I started a 52-week Savings Challenge for 2024 and asked my readers if they wanted to participate.

Below is the jar we created to save the money for twelve months.

Our son wanted to participate, so he decided to save his allowance or any other money he earned.

He’s saving $5 weekly from his allowance in the savings jar.

In July, he saved $20 for the month.

52 Weeks Savings Challenge July 2024 Canadian Budget Binder

52 Weeks Savings Challenge July 2024 Canadian Budget BinderAs of July 2024, the yearly total is $150 in savings, which means he’s halfway to meeting his goal of $300.

He created a Moolah Jar label for his money savings jar, which I thought was funny.

52-Week Savings Challenger Update

Below is the report from a CBB fan participating in the year-long savings challenge.

Hi, It is TFSA saver here.

I’m submitting for the month as we are heading on a small vacation, and I won’t be around until the end of July.

Thankfully, I sold a chest of drawers for $20 as I’m downsizing.

I used $15.50 on gift cards and transferred the money to savings.

Also, I used many coupons to save $17.25 on items and transferred the equivalent amount to savings.

The total for July 2024 was $52.75.

I was a little under my monthly goal of $62 per month.

Thanks!

Grocery Food Savings Jar July 2024 Update

Grocery Food Savings Jar July 2024 Canadian Budget Binder

Grocery Food Savings Jar July 2024 Canadian Budget BinderWhy will we track our grocery discounts for the entire year?

Tracking Our Grocery Discounts For One Year + Free Printable

I will tally it at the end of the year to see how much we saved buying reduced food products.

Read the 2023 End of Year Grocery Food Savings Jar Review.

We saved $185.26 for July using coupons, rewards apps, and Flashfood.

So far, in 2024, purchasing discounted food has saved us $1076.57.

July 2024 Budget Estimation and Actual Budget

Below are two tables: Our July 2024 Budget and our Actual Budget.

Our July 2024 budget represents two adults and a 9-year-old boy.

Budget Colour Key: It is a projected expense when highlighted in blue.

Since May 2014, we’ve been mortgage-free, redirecting our money into investments and home improvement projects.

Spending less than we earn and budgeting has been the easiest way to pay off our debt and save money.

This type of budget is a zero-based budget where all the money has a home.

Estimated July 2024 Budget

July 2024 Monthly Budgeted Amount

July 2024 Monthly Budgeted AmountWe may not need all the money we budgeted for in each category; however, remember the number is only an estimate from the previous year.

Don’t forget to budget for projected expenses because your entire month can fail due to not planning.

Actual July 2024 Budget

July 2024 Monthly Actual Amount

July 2024 Monthly Actual AmountOur Canadian Banks

Chequing– This is the bank account from which we pay our household bills. We use Simplii Financial, TD Canada Trust, and Tangerine Bank. Join Simplii Financial today! Read more about the best Canadian online virtual banks. Emergency Savings Account– This money is in a high-interest savings account (HISA) High-Interest Savings Account (HISA)– This savings account holds our projected expenses.Breakdown Of Our July 2024 Budget Categories

Below are some of our variable expenses from July that I will discuss.

Clothing For Family

A massive chunk of the clothing budget went to me buying items for my mum’s funeral.

I took your advice and didn’t buy a suit for the funeral, which I was happy about.

It was so hot in the UK that I wouldn’t have been as focused as I should have been.

Besides, I would have been the only man with a suit because nobody else wore one.

I purchased two pairs of trousers from Marks Work Warehouse, two T-shirts, a black long-sleeve dress shirt, and a hoodie.

Thankfully, I have nice dress shoes that fit perfectly with the outfit.

Mrs. CBB purchased shoes, sports, and regular bras on Prime Day.

On Temu, she purchased two new t-shirts and a pair of Capri pants since she’s lost weight.

She’s been purging her closet, selling what she can, and donating to the local women’s shelter.

For Jr. CBB, we purchased eight pairs of New Balance boxers to bring back to school.

Grocery Budget July 2024 Budget

Our monthly grocery budget is $900 plus a $25 stockpile budget.

We spent $1145.08, or $145.08, over budget for our July groceries.

I never get too excited when we spend less on groceries for one month because we always seem to make up for it.

Since I was heading to the UK at the end of July, we stocked up on the necessities so Mrs. CBB wouldn’t have to worry while I was gone.

She also stocked up on essentials during the Amazon Prime days, such as Sukrin Gold Brown Sugar substitute, Torani, Matteo, and Jordan’s sugar-free caramel syrup, Post Raisin Bran, pure maple syrup x2, Triscuit crackers, Oreo maple cream cookies x2, and Peak Freans Maple cookies.

You can find all the groceries we purchased in the CBB Amazon Storefront.

Health And Beauty

Our health and beauty budget was higher than usual, spending $768.86 in July 2024.

Mrs. CBB changed her skin routine a bit as it’s getting dry as she ages, and she has some adult acne.

All three of us use the body and face creams and the shampoo.

Below are some items she purchased that fell under Health and Beauty for our family.

Almost all of what she purchased for skin care is a once-a-year expense.

She also purchased vitamins and items to clean around the home.

I’ll link everything in my Amazon Storefront so you can take a look.

Check it out here- CBB Amazon Storefront.

Milk Toner Vani Cream (Walmart) CeraVe Healing Ointment Extra Strength La Roche-Posay Tinted Mineral Face Sunscreen Grace and Stella under eye masks with Retinol Nat.&Co. Derma Care Pro Professional Grade Face Towels Organic 100% Pure Frankincense Essential Oil Gua Sha Facial Tool for self-care – once only purchase Kanzy Rosehip oil for face natural cold-pressed Lus Bran Love Your Curls All-In-One Styler TheraBreath Fresh Oral Rinse Palmers Coconut Oil (Walmart) Shea Better Vanilla Cashmere (nope, not butter) 24 H Moisture Body Lotion CeraVe Hydrating Foaming Oil Face Cleaner Renpure Tea Tree and Rosemary Shampoo (Walmart) St. Francis Herb Farm Castor Oil Element Hypochlorous Acid RestoraFiber Daily Prebiotic Fibre Gummies Sports Research Vitamin C 1000mg Biotin Gummies 5000mcg per gummy Charmin Toilet Paper Ultra Soft 24 Mega Rolls Jumbo Palmolive Dish Soap x 4 Lysol Bathroom Cleaner Pine-Sol Multi-Surface King Size Bed Sheets Workout face towelsHome Maintenance

Since most of the month I was dealing with the death of my mum and preparing for my flight to the UK, I didn’t purchase too much.

I bought parts to repair a lawn mower and two weed eaters, one of which I gave to my sister-in-law.

Our patio door handle decided to stop working, so I replaced it with a new handle.

Items I needed to purchase for home maintenance;

Work Light Bright LED Energizer Batteries HIPA Fuel Line Hose Fuel Tank Assembly Gearwrench Fan Clutch Service Set Garage door side lock Brass Pipe Fittings High Flow Air Blow Gun Carburetor Adjustment Tools Organic Liquid FertilizerFlashFood App

Please use the CBB code (see photo below) when you sign up for Flashfood!

A little bit of free bonus cash for you and my little family.

Spend-15-get-a-3-or-5-dollar-credit-with-Flashfood-Canada

Spend-15-get-a-3-or-5-dollar-credit-with-Flashfood-CanadaEvery person who signs up gets a $5 credit, a freebie Flashfood offers for new app customers.

Also, Flashfood has added a small service fee to every order, which I feel is acceptable.

Use my referral code, MOCD28ZN4, for a $5 credit.

Your first purchase must be over $15.

Canadian Tire Rewards Points

July 2024 Canadian Tire Rewards Points

July 2024 Canadian Tire Rewards PointsWhenever Mrs. CBB sees my Canadian Tire points balance, she asks me what I bought.

All homeowners know it’s easy to earn reward points when buying housing materials and vehicle parts.

It all adds up, so we squeeze every bit of the extras out of these programs, including when ordering online.

Do it if you order anything online and haven’t subscribed to Rakuten Canada.

Not only do you get $30 cash free from Rakuten when you use the CBB link, but you also get cash back from thousands of online stores.

I would never tell you to sign up for something we didn’t believe in.

You can read my full review of Rakuten Canada if you are still unconvinced.

We regularly receive cheques in the mail from Rakuten, which further earns us money.

PC Optimum Rewards Points July 2024

Over 45 days, we’ve earned 191,646 PC Optimum Points, or $191, towards free products.

Since 2018, we have earned 8,768,000 PC Optimum Points or $8,768.

PC Optimum Points July 2024 CBB

PC Optimum Points July 2024 CBBWe started 2024 with under 7 million PC Optimum Points, currently have $7450, and are working towards $8000.

What would you do with the points? Share your ideas in the comment section below.

The process of saving them started after our son was born in 2014.

Between diapers and formula, we amassed points faster than we could spend them.

Yes, we have redeemed many times, but only during their Mega Bonus Event at Christmas.

Below are blog posts for anyone wanting to learn how we earn PC Optimum Points.

How To Earn PC Optimum Points Fast How We Earned 4 Million PC Optimum Points President’s Choice Financial World Elite Mastercard PC Insiders World Elite MastercardTD Rewards Credit Card July 2024

Our TD Visa has a cash-back balance of $478.11

TD Cash Back Visa Rewards July 2024

TD Cash Back Visa Rewards July 2024Dream Air Miles July 2024

Dream Air Miles July 2024 CBB

Dream Air Miles July 2024 CBBMost points are from our house and car insurance, which offers Air Miles.

There was a point where we had to choose Cash Miles or Dream Miles.

Since my family lives in the UK, we felt the Dream Miles would have worked best for us.

July 2024 CBB Net Worth Update

July 2024 Net Worth Update Canadian Budget Binder

July 2024 Net Worth Update Canadian Budget BinderOverall CBB July 2024 Budget + Net Worth Update

I’ve had a few people email me about our mortgage and why we don’t have one in the chart.

After purchasing our home in 2009, we paid it in full by 2014, which was not easy, but we did it.

Today, we have $8076.07 in rewards points from TD Visa, Canadian Tire, and Shoppers Drug Mart.

In July 2024, our net worth decreased by ($21,956.92) followed by cash and emergency savings at +0.64%.

We weren’t the only investors seeing a reduction in July, as many saw their portfolios nosedive.

“The stock market is experiencing a long overdue rotation,” said Glen Smith, chief investment officer at GDS Wealth Management.

“Investors are taking money out of big tech stocks which have performed so well and moving that money into other areas of the market.”

Some investors might get scared and retreat, but we kept our portfolio the same.

These long-term investments will eventually help the market work its way back up, and things will calm down.

I hope to see you again to read my August 2024 budget update in September.

Please drop me a question or comment below.

If you’re new, don’t forget to subscribe.

Thanks for reading,

Mr. CBB

You can find all the CBB monthly budget updates from 2012-present in our library.

The post CBB July 2024 Budget Update appeared first on Canadian Budget Binder.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·