Cardano price finds itself at a crossroads, where fundamentals and technicals are pulling in opposite directions. On one side, the project continues to roll out ecosystem upgrades and expand adoption. On the other hand, price action has been volatile, leaving participants debating whether ADA will bottom out or face further declines.

Cardano Price Showing Signs of Volatility

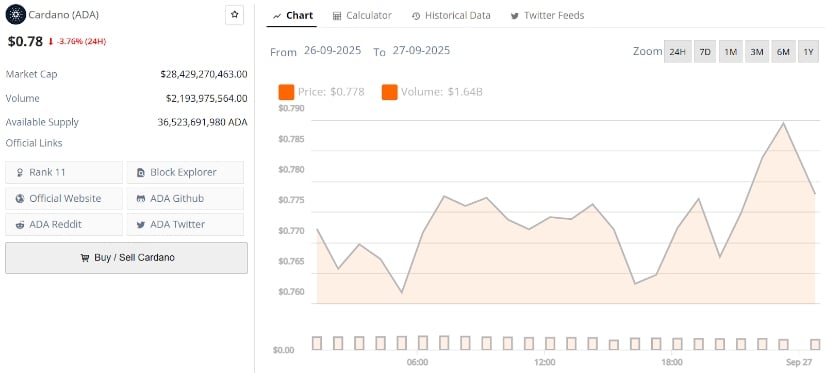

Cardano is currently trading near $0.78, marking a 3.7% decline in the past 24 hours. The market cap stands at $28.4 billion, with trading volume exceeding $2.1 billion, indicating that activity remains strong even during a pullback. The chart reflects sharp intraday swings, with the price dipping toward $0.76 before bouncing slightly, highlighting the instability of the structure in recent sessions.

Cardano price is trading around $0.89, up 0.12% in the last 24 hours. Source: Brave New Coin

From a technical view, ADA is now hovering just above its $0.78 support zone, a level that has repeatedly acted as a short-term floor in recent weeks. If this level holds, traders could see attempts to retest $0.82–$0.85 resistance. But if selling extends and $0.75 breaks, the next likely support sits closer to $0.70. For now, ADA remains caught in a choppy range where both buyers and sellers are testing control.

Fundamentals Showing Positivity Ahead

Cardano Foundation’s latest roadmap update highlights developments such as eight-figure ADA liquidity for stablecoins, new venture hub expansions, and RWA + Web3 integrations. Over 220 million ADA has also been delegated to new DReps, reflecting continued governance adoption.

Cardano roadmap update brings new liquidity, governance growth, and Web3 integrations. Source: TapTools via X

These updates underline the long-term case for Cardano, reinforcing its positioning as more than just a speculative token. Stronger fundamentals don’t always reflect immediately in price, but they build a foundation that bulls argue will support the next major rally.

Historical Cycles Keep ADA on Track

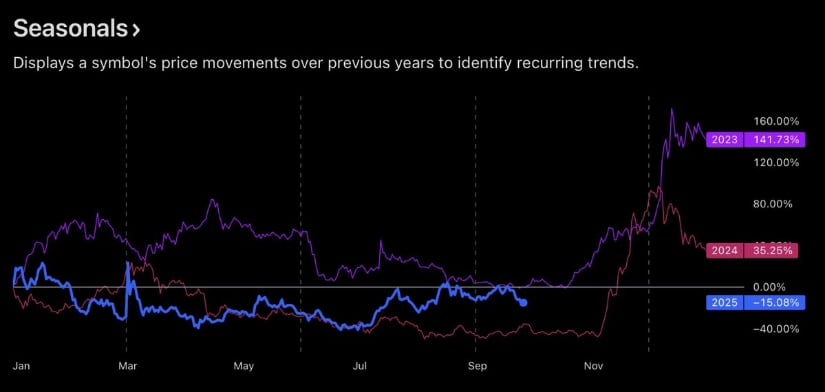

Another TapTools post emphasized that Cardano price remains in line with its historical price patterns. The seasonal chart shows how ADA has often mirrored past cycles, with sharp surges typically following consolidation phases. While 2024 lagged behind 2023’s explosive rally, the current year is still tracing familiar ranges. If this cycle rhyme holds true, ADA may be entering the kind of late-year recovery phase seen in earlier runs.

Cardano’s seasonal chart shows ADA still tracking historical cycles, hinting at a possible late-year recovery phase. Source: TapTools via X

Bullish Divergence Signals Potential Bottom

Analyst Jesse Peralta pointed to a bullish divergence forming as the price approaches the support levels below. The divergence between price action and RSI momentum suggests downside pressure may be easing, potentially setting the stage for a rebound back towards $0.92.

Bullish divergence on ADA charts suggests selling pressure may be easing, hinting at a potential rebound. Source: Jesse Peralta via X

If confirmed, this would strengthen the case for Cardano price finding its bottom before another push higher. Divergences like these have historically preceded recovery waves, but the challenge lies in whether buyers have enough conviction to defend these zones.

Contrary View: Breakdown Risks Remain in Play

Balancing the bullish outlook, Crypto Yapper warned that ADA has broken important daily chart support, exposing risks of a move down towards $0.69. His analysis highlights how the failure to hold structure leaves ADA vulnerable, with the chart showing lower highs and weakening defenses.

ADA’s break of key support could expose downside risks towards $0.69. Source: Crypto Yapper via X

This bearish setup underscores that downside is still a live risk despite divergence signals. For ADA, the short-term outlook appears split: while bulls argue for accumulation and recovery, bears see a path lower unless stronger bids re-enter the market soon.

Final Thoughts: Bullish or Bearish Outlook?

Cardano is sitting in a tricky zone where both bulls and bears have the lead. The fundamentals, from liquidity expansions to governance participation, show that the network continues to build strength behind the scenes. At the same time, historical cycles and bullish divergence patterns give bulls a reason to stay optimistic, hinting that ADA may not be too far from carving out its next recovery phase.

On the flip side, breaking below key supports like $0.75 could trigger another wave of selling, dragging ADA closer to the $0.70 area before buyers step in again. For now, Cardano’s outlook remains split, leaving traders watching closely for whether conviction builds on the bullish side or if bears seize control in the short term.

3 weeks ago

19

3 weeks ago

19

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·