As U.S. stock markets saw over $3 trillion in value wiped out during a sharp sell-off, crypto took a surprising turn. Instead of joining the bleed, digital assets absorbed more than $5 billion in fresh inflows. ADA Cardano price quietly held its ground with a modest gain, offering a glimpse of resilience when it mattered most. That kind of stability during broader chaos is exactly what catches seasoned eyes, and ADA may be stepping into a new phase of relevance.

Markets Bleed, But Cardano Shows Quiet Strength!

As the U.S. stock market saw $3.25 trillion erased in a brutal sell-off, the crypto market absorbed $5.4 billion in fresh inflows, signaling a potential shift in investor sentiment. In the latest post by Watcher.Guru, this divergence was highlighted as traditional markets bled while digital assets showed surprising strength. Cardano’s price quietly posted a +1.74% move, showing resilience amid broader market chaos.

Crypto inflows rise as U.S. stocks tumble, with Cardano showing quiet resilience. Source: Watcher.Guru via X

For Cardano, this could mark a crucial turning point. Despite facing recent sell pressure, ADA’s ability to hold steady while major stocks tumbled highlights its growing strength. If this trend continues, ADA could see further upside as more investors rotate into crypto. With key support levels intact and a renewed push in on-chain activity.

Cardano Leads Institutional Inflows

As broader financial markets experience turbulence, institutional investors are quietly making a bold move into Cardano. According to TapTools, Cardano has recorded the highest institutional inflows of any crypto asset over the past month, bringing in $63.3 million. In contrast, Bitcoin and Ethereum, historically the top choices for institutional capital, saw net outflows of $826 million and $370 million, respectively.

Cardano tops institutional inflows with $63.3M. Source: TapTools via X

The significance of this inflow shift cannot be ignored. Cardano’s rising appeal signals growing confidence in its ecosystem. With continued network upgrades and expanding adoption, ADA’s ability to attract capital in a challenging market could set the stage for a stronger price performance. If this trend holds, Cardano price predictions may need an upward revision sooner than expected.

Whales Accumulate ADA

Following Cardano’s dominance in institutional inflows, on-chain data now reveals a surge in whale activity, with between 190 million and 230 million ADA purchased in recent weeks. Dudewhyme shares that this sizable accumulation may be a signal that large investors are quietly positioning themselves for a longer-term play.. When whales move, they often do so with deeper insights, making this trend worth watching closely.

Whales quietly buy over 200 million ADA as Cardano gains quiet momentum. Source: Dudewhyme via X

Interestingly, this accumulation comes at a time when broader market uncertainty has pushed many investors toward safer bets like Bitcoin and Ethereum. Yet, whales appear to be favoring ADA, potentially seeing it as undervalued compared to other assets.

ADA’s Bullish Setup

Crypto analyst LLuciano_BTC highlights a compelling technical setup for ADA, with price action forming a bullish flag just above the key $0.62-$0.65 support zone. Historically, this pattern signals a continuation of the previous uptrend, and a breakout past $0.90 could open the door for a move toward $1.32. With ADA holding its ground despite broader market fluctuations, technicals suggest an inflection point may be near.

Cardano forms bullish flag near key support, with breakout potential towards higher levels. Source: LLuciano_BTC via X

Beyond the charts, on-chain data continues to reflect strong accumulation, with large wallets adding between 190M-230M ADA in recent weeks. Coupled with upcoming governance advancements and a steady recovery in market sentiment, ADA’s technical positioning aligns well with its broader ecosystem strength. If these factors continue playing out, the stage could be set for a decisive breakout.

Cardano Price Prediction: Wave 5 Rally to Target $1.00?

Cardano has been moving through a classic Elliott Wave structure, and right now, wave 4 consolidation has traders watching closely. According to chartist BigMike7335, ADA is hovering near $0.64, a key level where past corrections have found support. If this zone holds, a wave 5 breakout could push the price toward $0.92 and potentially $1.28, aligning with Fibonacci extensions.

Cardano eyes wave 5 breakout with targets at $0.92 and $1.28, while long-term projections stretch to $3.50. Source: BigMike7335 via X

Looking further ahead, the chart outlines a possible move toward $2.86 and even $3.50, aligning with Fibonacci extensions and previous cycle tops. While technically possible, ADA would need sustained momentum, strong on-chain growth, and broader market support to reach these levels.

Final Thoughts: Key Levels to Watch

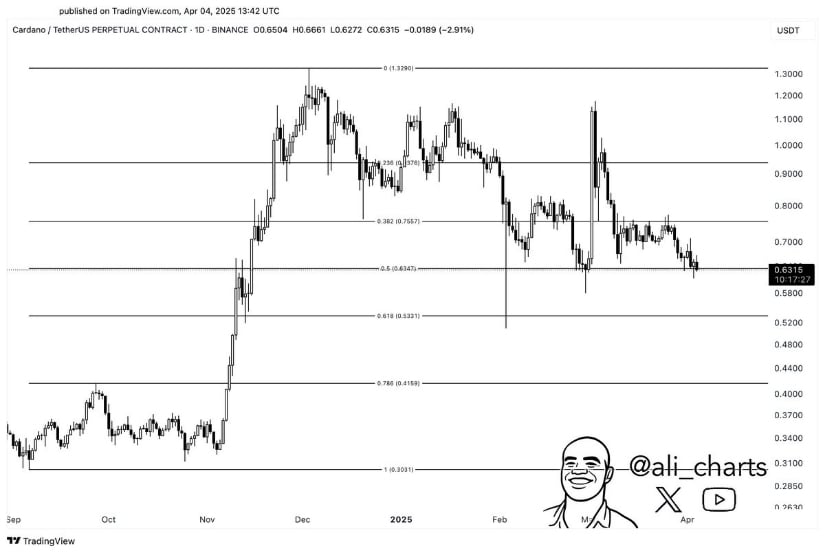

Cardano is at a critical juncture, with renowned chartist Ali Martinez highlighting $0.63 as the key support level to hold. A daily close below this mark could accelerate losses toward $0.53 and even $0.42, aligning with the lower Fibonacci retracement zones. Given recent price action, ADA traders should keep a close eye on how the asset reacts at these levels.

Cardano tests critical $0.63 support with downside risks toward $0.42 if breached. Source: ali_charts via X

Cardano finds itself at a pivotal moment, with institutional inflows, whale accumulation, and strong on-chain fundamentals painting a bullish longer-term picture. However, short-term risks remain, especially if the $0.63 support fails to hold. But if buyers defend this level, ADA could stabilize and set the stage for a recovery.

22 hours ago

1

22 hours ago

1

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·