TLDR

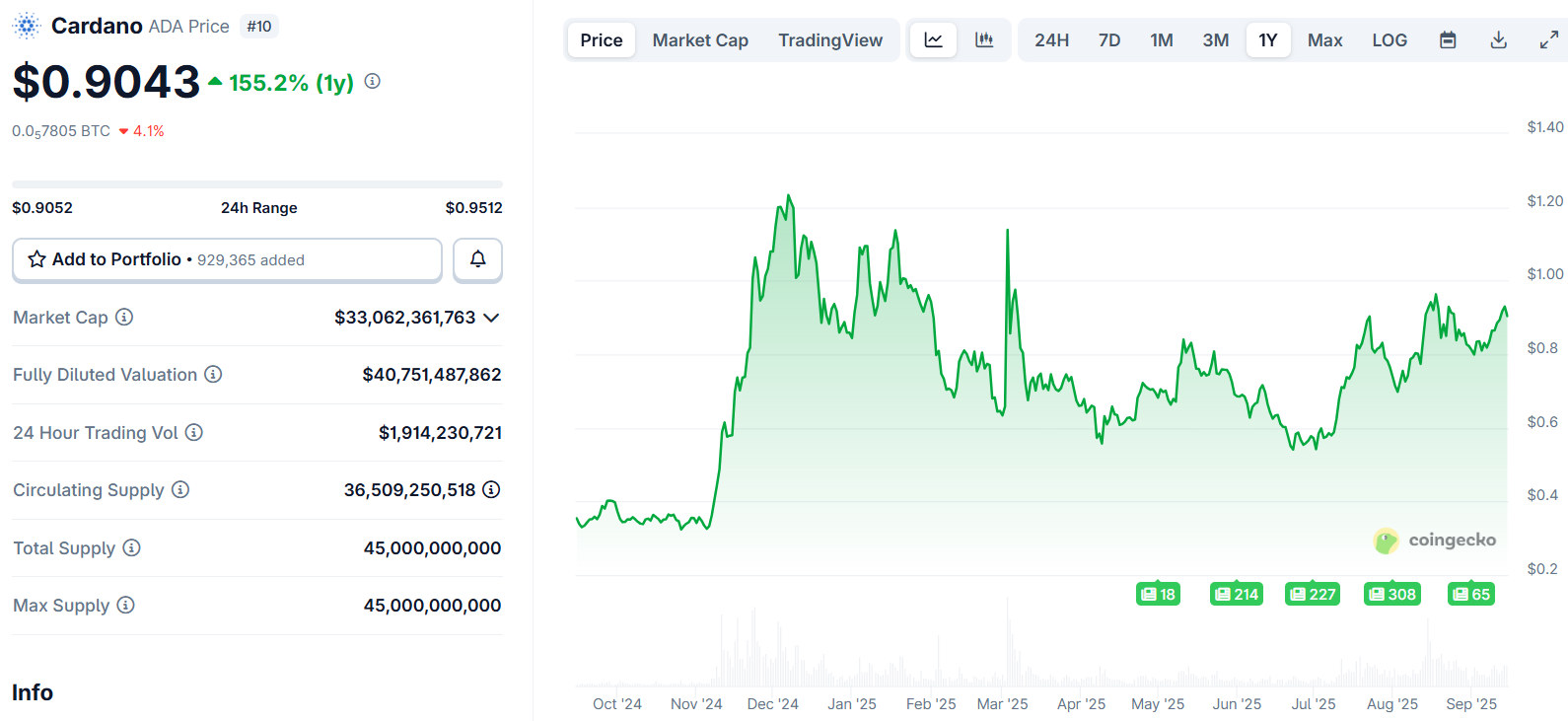

ADA reached an intraday high of $0.954, approaching the key $1 psychological level after seven consecutive days of gains Cardano whales acquired over 20 million ADA tokens in 24 hours, showing strong institutional buying pressure The cryptocurrency is testing resistance in a symmetrical triangle pattern with potential targets at $1.30 if breakout occurs Market cap climbed to $33.84 billion, pushing Cardano to ninth place in crypto rankings On-chain activity increased with total transactions reaching 113.68 million and 320 GitHub commits this weekCardano is experiencing its longest winning streak of 2025, with ADA prices climbing for seven straight sessions since September 7. The rally has pushed the cryptocurrency within striking distance of the closely watched $1 price level.

Cardano (ADA) Price

Cardano (ADA) Price

ADA reached an intraday peak of $0.954 early Saturday, representing a 7% gain in the past 24 hours. Weekly performance shows even stronger momentum, with prices up 15% over the seven-day period.

The current price action represents a recovery from the September 1 low of $0.789. This climb has elevated Cardano’s position in the cryptocurrency market rankings to ninth place.

Market capitalization now stands at $33.84 billion, reflecting the recent price appreciation. The sustained buying pressure has caught the attention of technical analysts tracking the asset’s chart patterns.

Whale Activity Drives Momentum

Large investors have returned to Cardano in recent sessions. Crypto analyst Ali reported that whales acquired over 20 million ADA tokens within a 24-hour window, indicating institutional-level demand.

Whales are back! They bought over 20 million Cardano $ADA in the last 24 hours. pic.twitter.com/uwdkOer10c

— Ali (@ali_charts) September 12, 2025

This accumulation pattern coincides with broader market optimism. Traders are positioning ahead of a potential Federal Reserve rate cut in September.

The U.S. consumer price index data released Thursday showed annual inflation at 2.9% in August. Core inflation, which excludes food and energy prices, reached 3.1% annually.

These economic indicators have influenced cryptocurrency markets. Risk assets typically benefit from expectations of looser monetary policy.

Technical Breakout Setup

Chart analysis reveals ADA trading within a symmetrical triangle formation. The pattern has developed over several months, with prices compressing between key support and resistance levels.

The lower boundary sits around $0.60 to $0.65, where buying interest has consistently emerged. This zone has absorbed selling pressure during multiple retests throughout the year.

Above current levels, resistance appears concentrated between $1.00 and $1.10. Multiple rallies have stalled near this area, but repeated tests suggest weakening selling pressure.

A clean break above $1.10 could trigger a move toward $1.30. Technical analysts view this as the next major upside target if the current consolidation resolves higher.

$ADA is close to a Breakout 🔥

I gave you a nice entry at $0.6 😌#Altcoins are about to move. https://t.co/2uZuH7w4f1 pic.twitter.com/cBkmo5BCd1

— Crypto Seth (@seth_fin) September 14, 2025

The narrowing price range within the triangle typically precedes directional moves. When cryptocurrencies compress within these patterns, breakouts often produce strong momentum in either direction.

Network Development Continues

Cardano achieved a governance milestone this week with its first fully community-elected constitutional committee taking office. The development strengthens the network’s decentralization efforts.

The Yoroi Extension v.5.13.0 was released, introducing new features for Midnight claims and improved Japanese language support. These updates reflect ongoing ecosystem development.

On-chain metrics show increased network activity. Total transactions reached 113.68 million for the week, indicating growing usage.

Developer engagement remains consistent with 320 GitHub commits recorded. Input Output is preparing the pre-release of Mithril’s 2537 distribution as part of ongoing technical improvements.

Market Context

The broader altcoin sector is experiencing renewed interest as Bitcoin dominance shows signs of declining. This rotation often creates opportunities for alternative cryptocurrencies to outperform.

Multiple altcoins are approaching similar technical breakout setups. When several cryptocurrencies break higher simultaneously, it often creates positive feedback loops that amplify individual moves.

ADA’s current trading level of $0.946 represents the upper end of recent ranges. The cryptocurrency needs to clear the $1.00 psychological barrier to confirm the bullish technical setup.

Volume patterns will be crucial for any breakout attempt. Strong participation typically accompanies sustainable moves above resistance levels.

Cardano is currently testing the $1.00 to $1.10 resistance zone after reaching an intraday high of $0.954 during its seven-day winning streak.

The post Cardano (ADA) Price: Whale Buying Frenzy Fuels Push Toward $1 Target appeared first on CoinCentral.

2 months ago

40

2 months ago

40

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·