As highlighted by Ali (@ali_charts), the market saw the following capital outflows over the past few days:

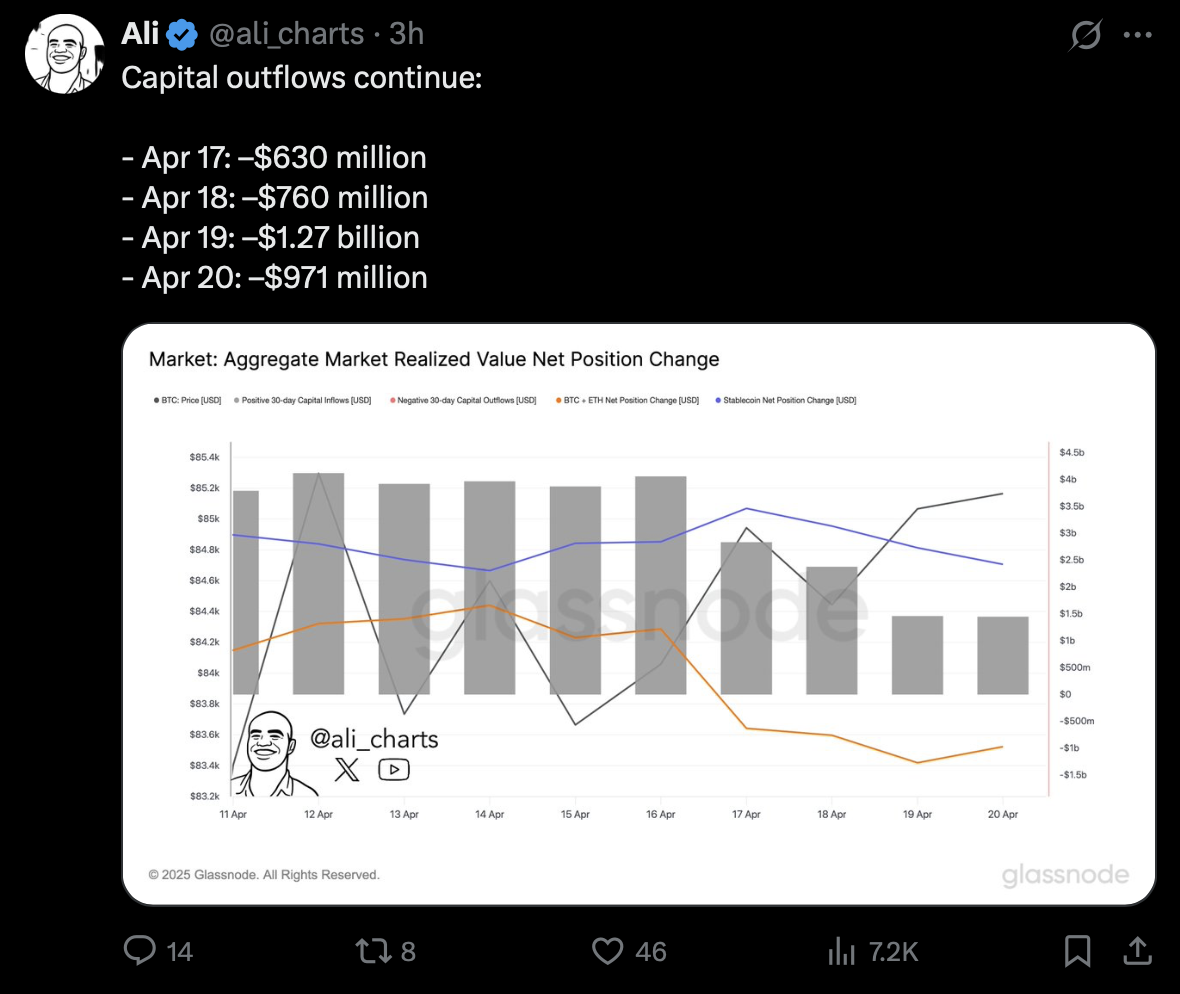

April 17: -$630 million April 18: -$760 million April 19: -$1.27 billion April 20: -$971 millionThis pattern of outflows has raised concerns within the crypto space, as investors appear to be pulling back. The data was supported by a chart from Glassnode that shows the movement of various assets over time, including Bitcoin (BTC), Ethereum (ETH), and stablecoins.

The chart below illustrates the correlation between these outflows and the price of Bitcoin. As seen, Bitcoin’s price has experienced notable fluctuations alongside these capital movements, potentially signaling a shift in market sentiment. Interestingly, the net position change of stablecoins has been on the rise, suggesting a potential shift towards stable assets amid market uncertainty.

The aggregated data points to a continued negative trend in capital flows, which could be indicative of broader market consolidation or a temporary retreat. It remains to be seen whether these outflows will continue or if the market will stabilize in the coming weeks.

Market Insights

The trend of capital outflows may be connected to broader economic factors affecting investor behavior. With more stablecoins moving into the market, there could be a trend toward risk-off behavior, as investors seek safer assets. Bitcoin and Ethereum continue to dominate the space, but their price fluctuations could indicate heightened market volatility.The key takeaway from these developments is that despite the continued pullback, the cryptocurrency market remains dynamic and highly reactive to both external economic pressures and internal shifts in investor behavior.

The post Capital Outflows Continue in the Cryptocurrency Market appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·