TLDR

Broadcom (AVGO) now represents over 2.5% of the S&P 500 index weighting, up from a much smaller component just a year ago Passive investing flows are driving capital into AVGO automatically as index funds allocate more money to the stock The company’s earnings per share have grown 18% annually over three years with EBIT margins expanding from 31% to 40% Insiders hold $20 billion worth of shares, showing strong alignment with shareholders CEO compensation is modest at $2.6 million, well below the $13 million median for similar-sized companiesBroadcom is making moves in the index world that most investors aren’t talking about. The chip giant has quietly climbed to represent over 2.5% of the S&P 500’s total weighting.

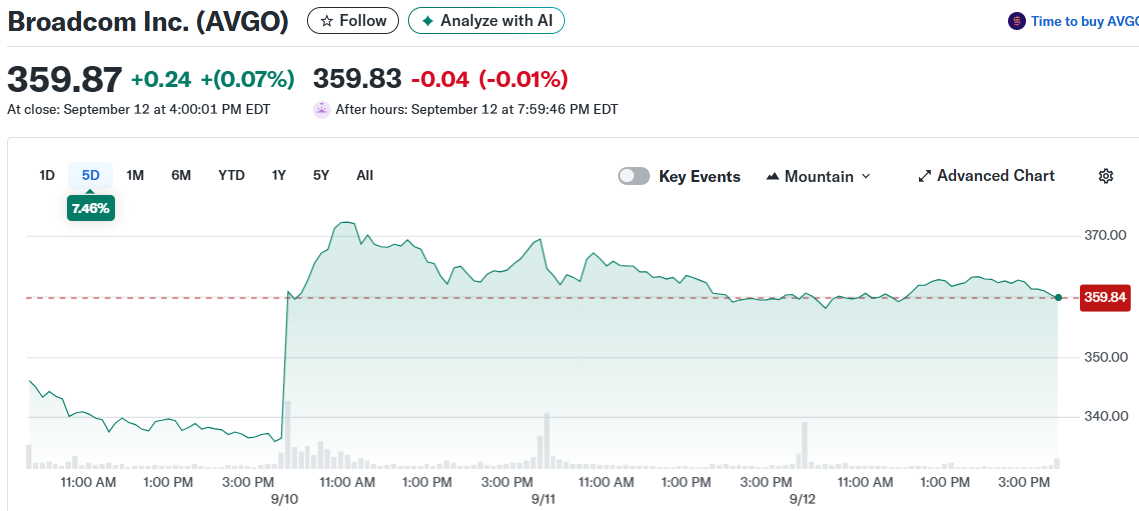

Broadcom Inc. (AVGO)

Broadcom Inc. (AVGO)

That’s a big jump from where it sat just 12 months ago. The company now sits as a larger piece of the passive investing pie that flows into index funds every month.

This growth isn’t happening by accident. Nearly 20% of the S&P 500’s total weighting comes from just three stocks: NVIDIA, Microsoft, and Apple.

But Broadcom is carving out its own space in this concentrated landscape. The stock benefits from a simple math problem that works in its favor.

Every dollar that goes into large-cap growth funds or S&P 500 index funds doesn’t spread evenly across all 500 companies. Instead, the money flows heavily into the biggest names by market cap.

Passive Money Flows Create Automatic Buying

This creates an interesting situation for Broadcom shareholders. As the company’s index weighting grows, it automatically attracts more capital from passive funds.

The money flows regardless of quarterly earnings reports or business fundamentals. Index funds must buy shares to match their target weightings.

John Rowland from Barchart put it simply: monthly money flows into Broadcom happen regardless of the company’s actual results. The passive investing structure makes it almost automatic.

This trend shows how modern equity markets work. A small group of mega-cap stocks capture most of the investment flows.

Broadcom has joined this exclusive club through its rising market value. The company now competes with the traditional “Magnificent 7” tech giants for investor dollars.

Strong Financial Performance Backs the Rise

The stock’s index climb isn’t just about passive flows. Broadcom’s actual business performance supports its higher market value.

The company’s earnings per share have grown 18% annually over the past three years. That’s solid growth for a company of Broadcom’s size.

The profit margins tell an even better story. EBIT margins expanded from 31% to 40% over recent periods.

Revenue growth paired with expanding margins shows the business is getting more efficient. This combination typically drives stock prices higher over time.

These fundamentals give substance to the passive flow story. Strong earnings growth justifies the higher index weighting that drives automatic buying.

Broadcom’s insider ownership adds another layer of confidence. Company insiders hold $20 billion worth of shares.

That’s serious money for executives to have tied up in their own company. It shows they believe in the business they’re running.

CEO compensation also reflects shareholder-friendly management. The chief executive earned $2.6 million in total compensation.

That’s well below the $13 million median for companies with similar market caps. Modest CEO pay often signals boards that prioritize shareholder returns.

The combination of strong financials and reasonable executive compensation creates a compelling package. It helps explain why passive funds are willing to allocate more money to the stock.

Broadcom’s rise shows how concentration works in modern markets. A few giant companies capture most of the investment flows from index funds.

The company has successfully joined this elite group through consistent execution and growing market value. As of the latest data, Broadcom maintains its position as a top S&P 500 component with over 2.5% index weighting.

The post Broadcom (AVGO) Stock: Insiders Hold $20 Billion in Company Shares. Time To Buy? appeared first on CoinCentral.

3 months ago

36

3 months ago

36

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·