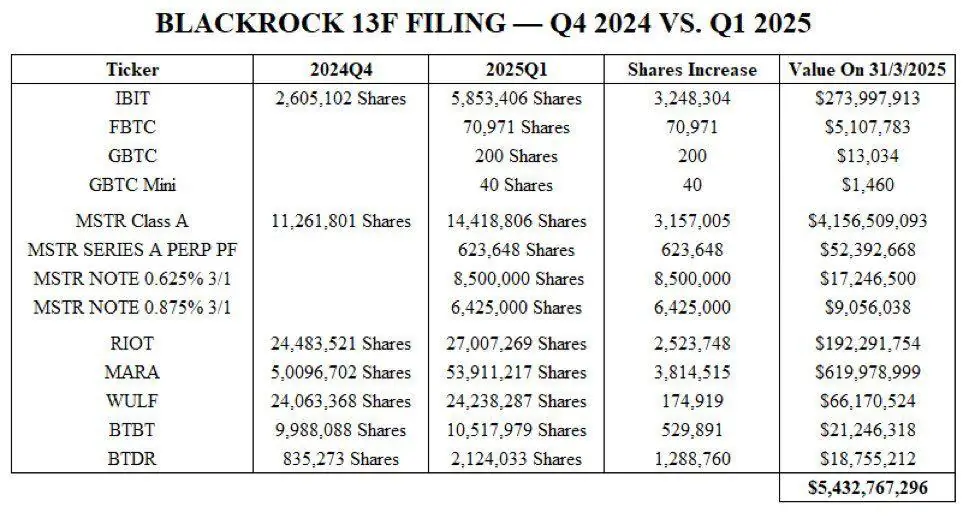

The filing, which details BlackRock’s holdings as of the end of the first quarter of 2025 compared to the fourth quarter of 2024, shows substantial increases in several key areas.

Specifically, the data indicates a significant rise in BlackRock’s iShares Bitcoin Trust (IBIT) holdings, from 2,605,102 shares in Q4 2024 to 5,853,406 shares in Q1 2025. This represents an increase of 3,248,304 shares, with a reported value of $273,997,913 as of March 31, 2025.

The filing also shows new positions or increased holdings in other Bitcoin-related entities. Notably, BlackRock held 70,971 shares of FBTC (likely Fidelity’s Bitcoin ETF) valued at $5,107,783. Additionally, small positions were reported in GBTC (Grayscale Bitcoin Trust) and GBTC Mini.

Furthermore, BlackRock significantly increased its holdings in MicroStrategy (MSTR), a company known for its substantial Bitcoin treasury, from 11,261,801 shares to 14,418,806 shares.

The value of these MSTR Class A shares was over $4.15 billion. The filing also reveals holdings in Bitcoin mining companies such as RIOT Platforms (RIOT), Marathon Digital Holdings (MARA), and others.

The total value of BlackRock’s reported Bitcoin-related holdings as of March 31, 2025, amounts to $5,432,767,296, highlighting the asset management giant’s growing exposure to the cryptocurrency market. This substantial investment underscores the increasing institutional adoption of Bitcoin and related assets.

The post BlackRock’s Bitcoin Exposure Tops $5.4B in Q1 2025 Filing appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·