This development underscores a renewed wave of investor interest in cryptocurrency exposure through traditional financial vehicles.

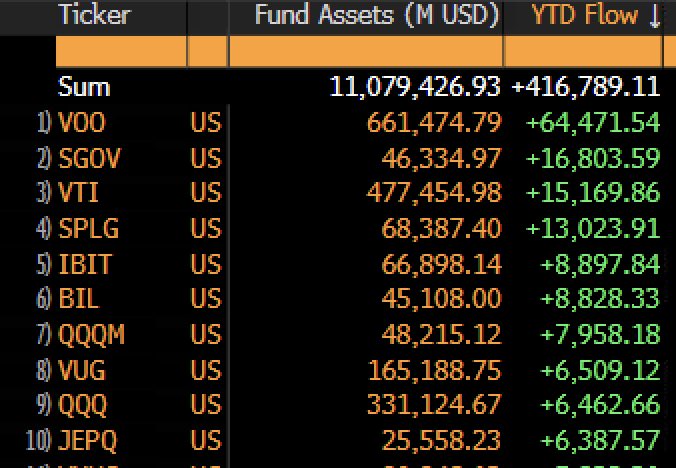

The data shows that IBIT now ranks 5th, with $8.89 billion in YTD inflows, trailing behind heavyweights like VOO, SGOV, VTI, and SPLG. This marks a significant achievement for a Bitcoin-focused ETF, reflecting growing institutional confidence in the asset class.

The top positions are held by:

VOO (Vanguard S&P 500 ETF): +$64.47B SGOV (iShares 0-3 Month Treasury Bond ETF): +$16.80B VTI (Vanguard Total Stock Market ETF): +$15.17B SPLG (SPDR Portfolio S&P 500 ETF): +$13.02B IBIT (iShares Bitcoin Trust): +$8.89BAs highlighted in the tweet: “Bulls are back ” — a sentiment that’s increasingly echoed across the market.

The surge in flows into BlackRock’s BTC ETF demonstrates the merging of traditional finance with digital assets, and suggests that institutional adoption of Bitcoin is gaining serious momentum in 2025.

The post BlackRock’s Bitcoin ETF Climbs Into Top 5 for YTD Flows appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·