Key Takeaways:

BlackRock registered the iShares Bitcoin Premium ETF, a covered-call strategy designed to generate yield from Bitcoin. The move builds on the success of BlackRock’s $87B iShares Bitcoin Trust (IBIT), signaling deeper institutional focus on BTC and ETH. Analysts say this could reshape competition in the crypto ETF market, leaving altcoin ETFs in limbo.BlackRock is doubling down on Bitcoin. After launching one of the most successful spot Bitcoin ETFs earlier this year, the asset manager is preparing a new product that seeks to combine yield-generation with direct Bitcoin exposure.

Read More: BlackRock’s Bold $85M Ethereum Buy Hints at Crypto Confidence Surge Post-ETF Turnaround

BlackRock Prepares iShares Bitcoin Premium ETF

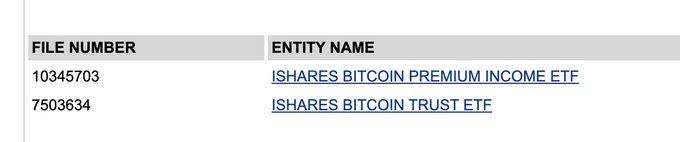

Bloomberg’s senior ETF analyst Eric Balchunas revealed that BlackRock has registered the name iShares Bitcoin Premium ETF, with a filing expected soon. The product is structured as a covered-call strategy, aiming to provide investors with additional yield on Bitcoin holdings rather than relying solely on price appreciation.

This filing marks a shift toward yield-oriented crypto products. While existing ETFs have primarily focused on spot or futures exposure, the new structure targets institutional and retail investors who want to generate income from BTC without selling their positions.

Balchunas described the ETF as a “’33 Act spot product” and called it the sequel to BlackRock’s highly successful $87B iShares Bitcoin Trust (IBIT). That trust has become one of the fastest-growing ETFs in history, attracting billions in inflows since its launch.

Why Another Bitcoin ETF Matters

The decision to file for a second Bitcoin product reflects BlackRock’s clear strategy: concentrate on Bitcoin and Ethereum while stepping back from the broader field of altcoins.

“Given all the other coins about to be ETF-ized, it’s notable that BlackRock is going after another Bitcoin product,” Balchunas posted. “It signifies they are going to build around BTC and ETH and lay off the rest, at least for now.”

This strategy reshuffles the race for altcoin ETFs. With no “Secretariat” competitor like BlackRock aggressively pursuing them, assets like Solana or XRP may see slower institutional adoption, even as other asset managers file.

Covered Calls Meet Crypto

The covered-call schemes are typical of the equity markets and are used to create constant income by selling options over the stocks. Introducing this model to Bitcoin would attract a new type of investor: income-oriented products are more familiar to them.

BlackRock introducing Bitcoin covered-call ETFs means that the dynamics in the industry shift immediately, even though smaller firms tried to do the same. Analysts observe that the existing competitors in the market or those awaiting approval are under immense pressure because BlackRock is in a better position with its size and distribution networks.

Crypto ETF Revenues Already Surging

BlackRock’s crypto business has grown rapidly. Data from Onchain Foundation shows the company’s Bitcoin and Ethereum ETFs now generate more than $260 million annually, with $218 million from BTC products and $42 million from ETH.

On-chain intelligence firm Arkham reports BlackRock is the largest institutional custodian of both Bitcoin and Ethereum, holding more than 756,000 BTC ($85.3B) and 3.8M ETH ($16B). Including smaller assets, BlackRock’s crypto custody exceeds $101B.

Such figures highlight that crypto ETFs are no longer experimental. They are now a substantial profit center and their long term growth potential is competing with the traditional product lines.

Read More: BlackRock’s $547M Ethereum Bet Signals Bold Pivot, 5x Heavier ETH Focus Than Bitcoin

SEC Approvals Speeding Up

BlackRock has also better timing of its filing in a more accommodating regulatory environment. In September, the U.S. SEC gave the green light to new regulations that enable exchanges such as Nasdaq and NYSE Arca to issue crypto ETFs in a fast-track process, which takes as short as 75 days to be approved, whereas the standard review took 240 days.

Such a shift may trigger a flood of altcoin ETF filings. However, BlackRock’s move suggests that while others scramble to capture Solana or XRP exposure, the asset manager prefers to deepen its moat in Bitcoin and Ethereum.

Institutional Adoption Rising

Capital inflows continue to confirm institutional demand. BlackRock’s Ethereum fund saw $512M in new inflows just last week, according to Farside Investors. Its Q2 earnings showed $14.1B in digital asset inflows, making crypto one of its fastest-growing categories despite representing only about 1% of total AUM.

In parallel, BlackRock is exploring tokenization, with its BUIDL tokenized money market fund surpassing $2B in assets this year. CEO Larry Fink has stated repeatedly that he sees tokenization as the future, predicting every financial asset could eventually exist on blockchain rails.

The post BlackRock’s $87B Bitcoin Trust Spurs New ETF Move as Crypto Yield Strategies Accelerate appeared first on CryptoNinjas.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·