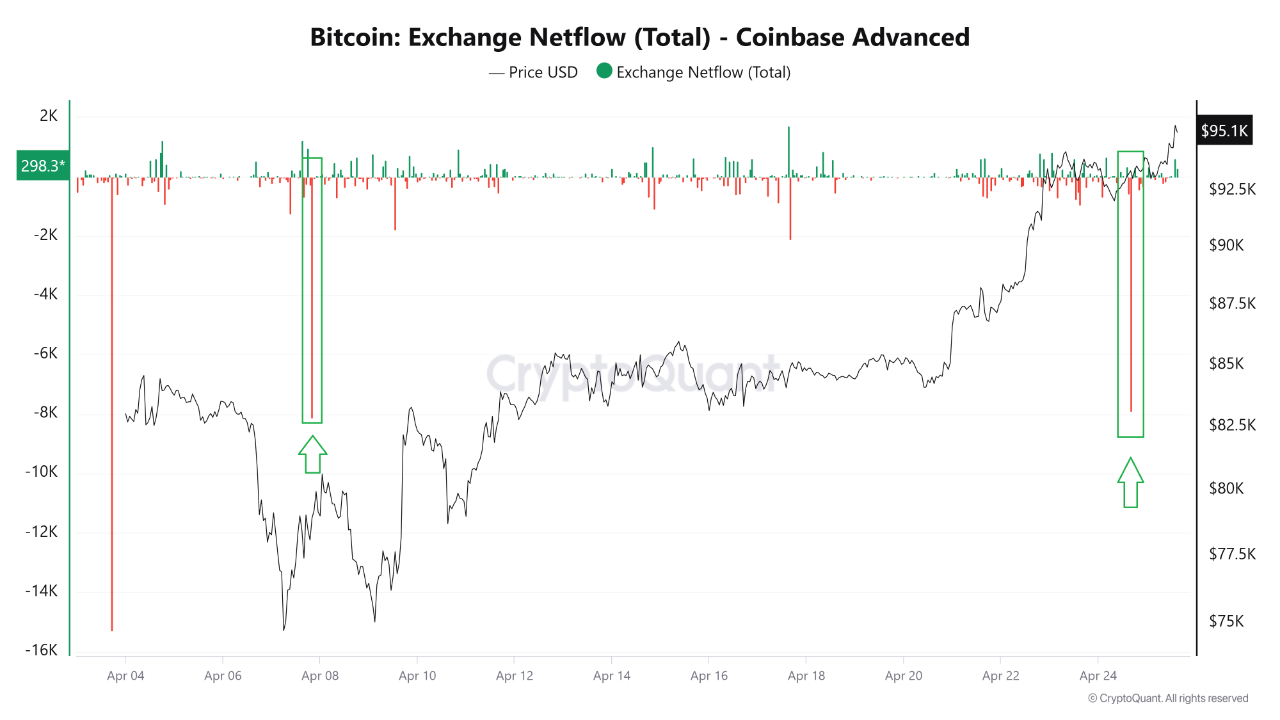

The large-scale outflow has caught the attention of on-chain analysts, who view it as a potential signal of renewed accumulation by deep-pocketed players.

Coinbase has long been recognized as a primary bridge between institutional capital and Bitcoin markets. When substantial amounts of Bitcoin move off exchanges like Coinbase, it often reflects long-term holding strategies rather than intentions to sell. This latest wave of withdrawals, reported by CryptoQuant, may point toward institutional buying, suggesting that major investors are positioning themselves for future upside.

ETF Flows and the Supply Squeeze Narrative

There is also speculation that some of these movements could be related to Bitcoin exchange-traded funds (ETFs). If these outflows are indeed tied to ETF activity, it would imply strong underlying demand from fund managers and financial institutions. Such ETF-related accumulation can have a powerful reinforcing effect, tightening available supply and setting the stage for upward price pressure.

Supporting this thesis, Bitcoin’s market price has recently crossed above the realized price for short-term holders, measured by the 1-day to 1-week UTXO Age Band. Historically, when Bitcoin trades and holds above realized prices, it indicates that the average market participant is in profit, which tends to shift sentiment decisively in a bullish direction. This dynamic can trigger a feedback loop of increased buying interest and momentum-driven rallies.

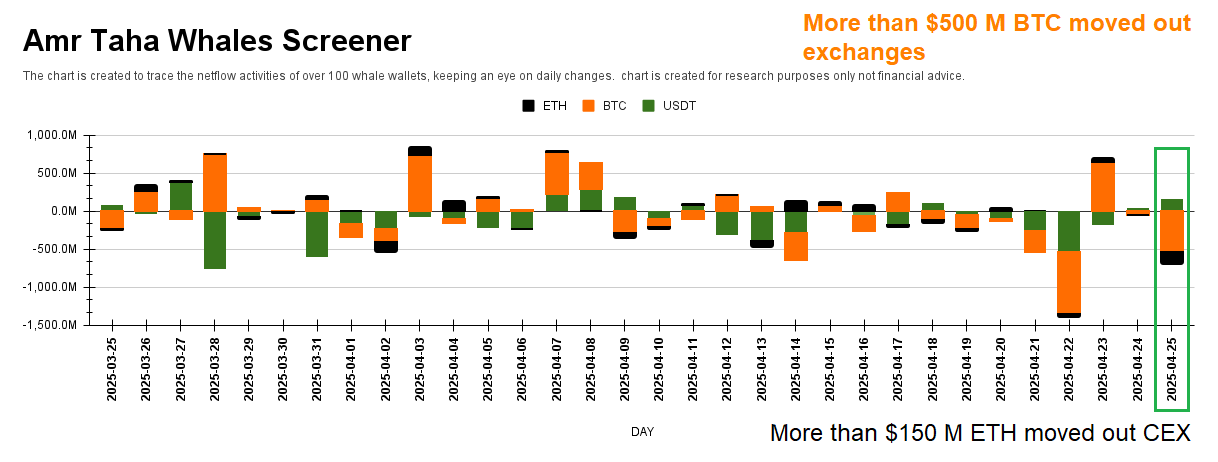

Whale Behavior Strengthens the Bullish Outlook

Further strengthening the bullish outlook, whale activity has shown a clear trend toward accumulation. Recent data reveals that over $500 million worth of Bitcoin has been pulled off exchanges by large holders. Typically, whales withdrawing BTC for cold storage or decentralized finance (DeFi) platforms is interpreted as a reduction in immediate selling pressure — another classic indicator of a positive market setup.

Taken together, the convergence of large exchange outflows, improving spot market structure, and visible whale accumulation paints an increasingly optimistic picture for Bitcoin’s short-term and medium-term prospects. If these flows are sustained, and if ETF demand continues to grow, Bitcoin may soon find itself entering a new phase of bullish momentum.

For now, on-chain data suggests the smart money is moving — and the rest of the market may not be far behind.

The post Bitcoin Withdrawals from Coinbase Spark Bullish Hopes appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·