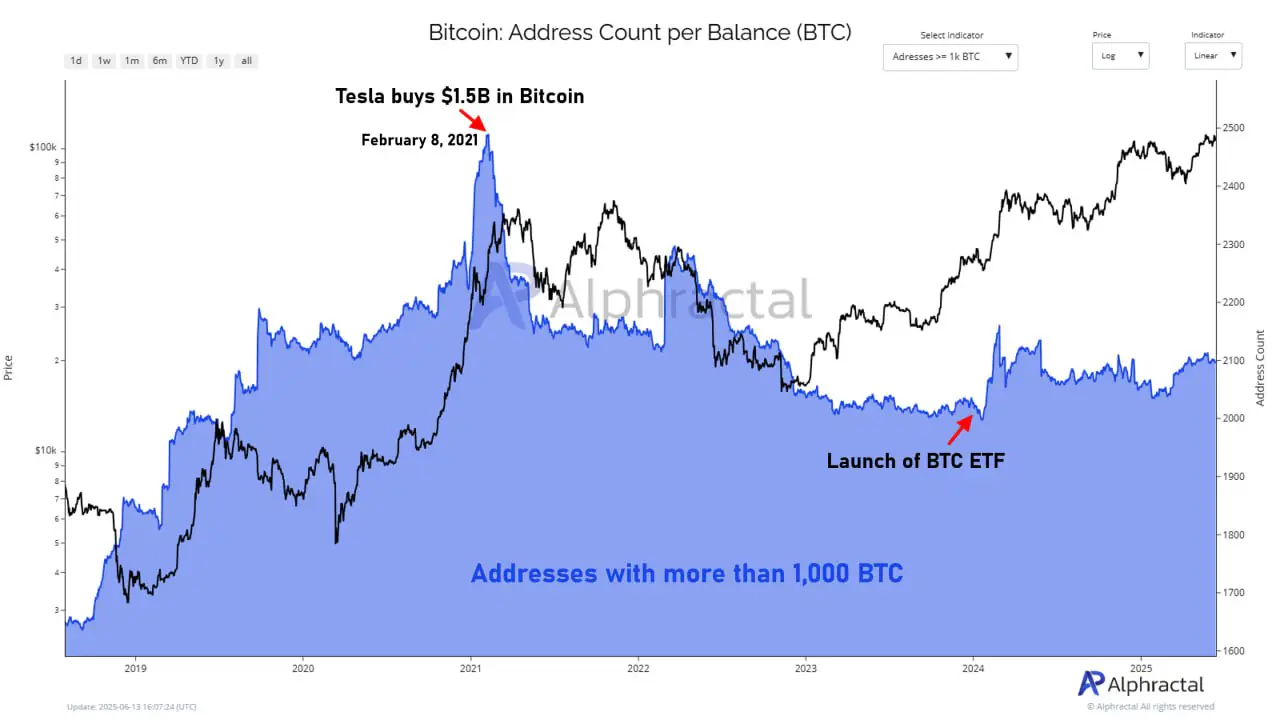

On February 8, 2021, Tesla shocked the financial world by announcing a $1.5 billion purchase of Bitcoin. But instead of fueling long-term whale accumulation, the event appears to have marked a turning point. Since that announcement, the number of wallets holding more than 1,000 BTC — typically associated with large institutions or crypto-native whales — has been in steady decline.

According to the report, the only notable break in this downward trend came during the approval of spot Bitcoin ETFs in early 2024. At that time, whale wallet counts briefly spiked, reflecting renewed interest from large investors.

However, the momentum was short-lived. Since the initial ETF-driven surge, the number of 1,000+ BTC wallets has moved sideways, showing no meaningful growth despite Bitcoin’s continued mainstream adoption and price rallies.

This raises an important question: was Tesla’s Bitcoin entry a coincidence in timing, or did it mark the beginning of a broader shift in how large holders engage with the market?

The stagnation in whale accumulation may reflect a more diversified investor base, increased use of custodial and institutional trading services, or a growing trend of large holders splitting their coins across multiple addresses for privacy or operational reasons.

Still, Alphractal’s data highlights a compelling narrative: while the Bitcoin price continues to hit new highs, the makeup of its largest holders is quietly evolving — and that could have long-term implications for market dynamics.

The post Bitcoin Whales Have Been Shrinking Since Tesla’s $1.5B BTC Buy — Coincidence or Clue? appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·