The price hasn’t reacted dramatically yet. But the market may be setting the stage for a breakout.

Massive ETF Inflows Led by BlackRock

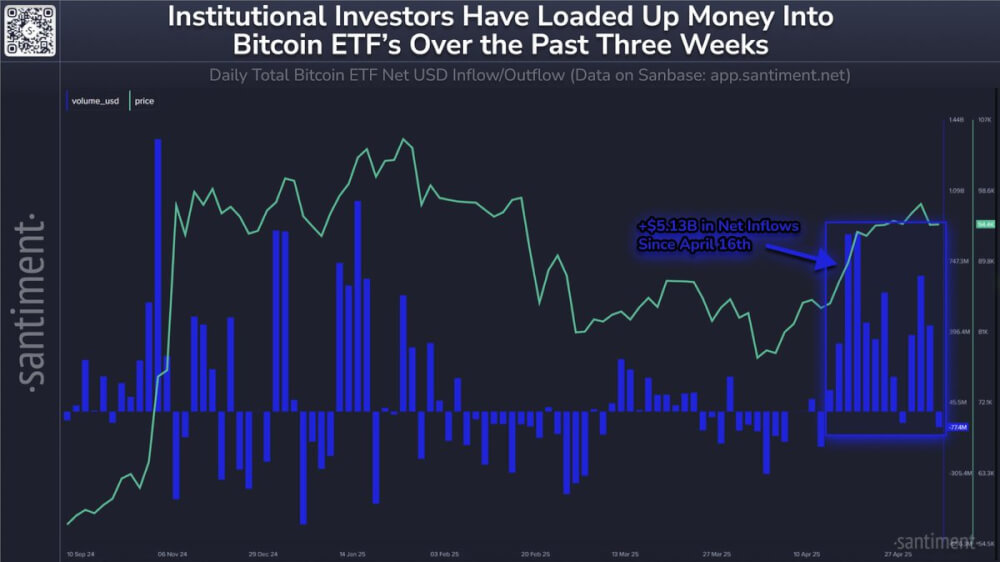

Starting April 16, Bitcoin ETFs have seen over $5.13 billion in net inflows. Leading the charge is BlackRock’s iShares Bitcoin Trust, which added $4.7 billion in just a few weeks.

That’s serious demand — and it’s coming fast.

However, the flow isn’t all one-way. On May 6, Bitcoin ETFs saw a combined outflow of $85.7 million, suggesting some short-term caution.

Fed Pause Could Fuel BTC Momentum

These inflows come just ahead of the next Federal Open Market Committee (FOMC) meeting. According to Polymarket data, there’s a 98% chance the Fed holds rates steady at 4.50%.

If confirmed, it would mark the third straight meeting without a hike — a potentially bullish backdrop for Bitcoin. With inflation cooling and rates on pause, risk assets like BTC may find room to move higher.

The post Bitcoin Whales and ETF Inflows Signal a Potential Rally appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·