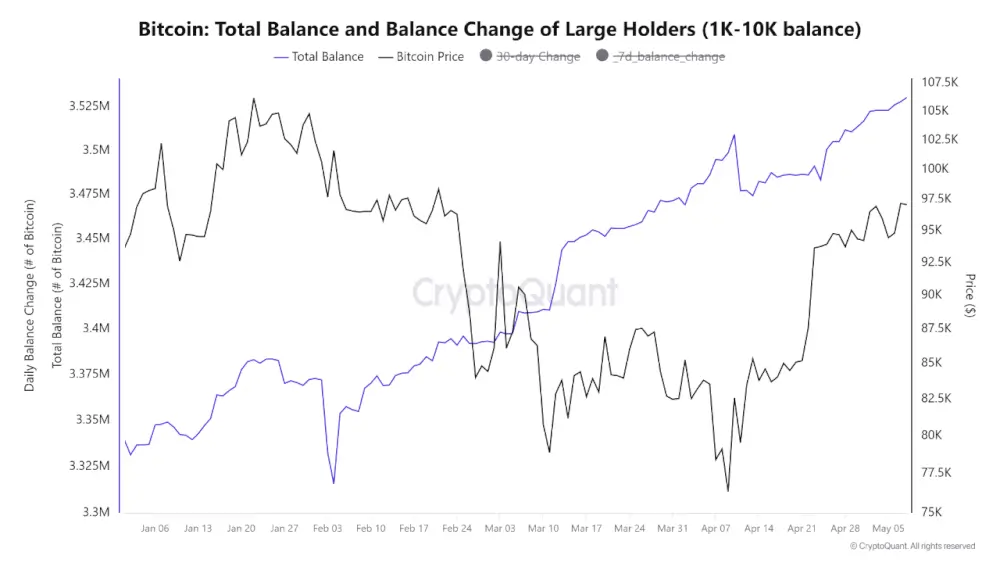

This trend continues into 2025, signaling sustained institutional interest despite a complex macroeconomic environment.

Unlike past bull runs led by retail speculation, this cycle appears to be dominated by passive accumulation from institutions. Large corporations are strategically acquiring BTC using internal cash flow and even debt issuance, creating what analysts call a steady, acyclical buying pressure.

This institutional demand is particularly notable because it persists even in an environment still tinged with risk aversion. Instead of fear-driven exits, the market is seeing calm, calculated entries from new corporate players. This shift could reshape Bitcoin’s price behavior, reducing volatility and decoupling its performance from traditional retail-driven boom-bust cycles.

Importantly, this accumulation isn’t just a blip—it reflects a systematic shift in who is buying Bitcoin and why. As noted by CryptoQuant, the rise in price is not being driven by retail frenzy but by measured, long-term positioning by large-scale investors.

The post Bitcoin Whale Accumulation Surges as Institutions Keep Buying appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·