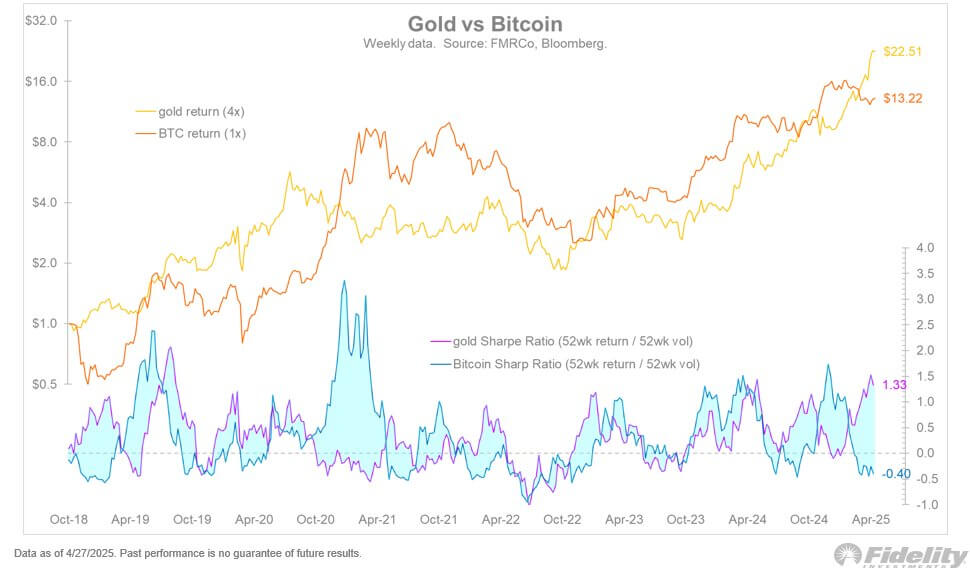

In a recent tweet, Timmer pointed out that Bitcoin and gold have been moving in opposing cycles, particularly when measured by their Sharpe Ratios, a popular metric for assessing risk-adjusted returns. Despite recent weakness in Bitcoin’s ratio (currently at -0.40), gold’s performance now seems to be plateauing, with its Sharpe Ratio rising to 1.33.

“From the looks of it, it may well be Bitcoin’s turn to take the lead,” Timmer noted. “Perhaps we are due for a baton-pass from gold to Bitcoin.”

The Sharpe Ratio Trend: BTC Poised to Rebound?

The chart shared in Timmer’s post highlights the alternating strength of gold and Bitcoin over time. Each asset has had periods of outperformance, and the Sharpe Ratio has provided valuable clues. Currently:

Gold is outperforming, but may be peaking. Bitcoin is lagging, but the negative Sharpe could indicate it’s near a bottom.This could mean a rotation back into BTC is due, particularly if risk appetite returns and capital shifts away from defensive assets like gold.

A Macro Perspective on Digital and Traditional Safe Havens

As head of macro strategy at Fidelity, Timmer often looks at digital assets through a broader lens. His analysis suggests that Bitcoin is becoming a credible alternative store of value—complementary, but also increasingly competitive with gold. While both serve as hedges, their cycles and correlations differ significantly.

With the recent divergence in their Sharpe Ratios, Timmer’s analysis may be pointing to a critical inflection point. If history rhymes, Bitcoin’s next move could surprise to the upside.

The post Bitcoin vs. Gold: Is It Time for a Leadership Shift? appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·