This transition suggests that many investors are moving from short-term speculation toward longer-term conviction. Coins aging out of short-term classifications and into the long-term holder (LTH) category often indicate reduced selling pressure, reinforcing the broader bullish thesis.

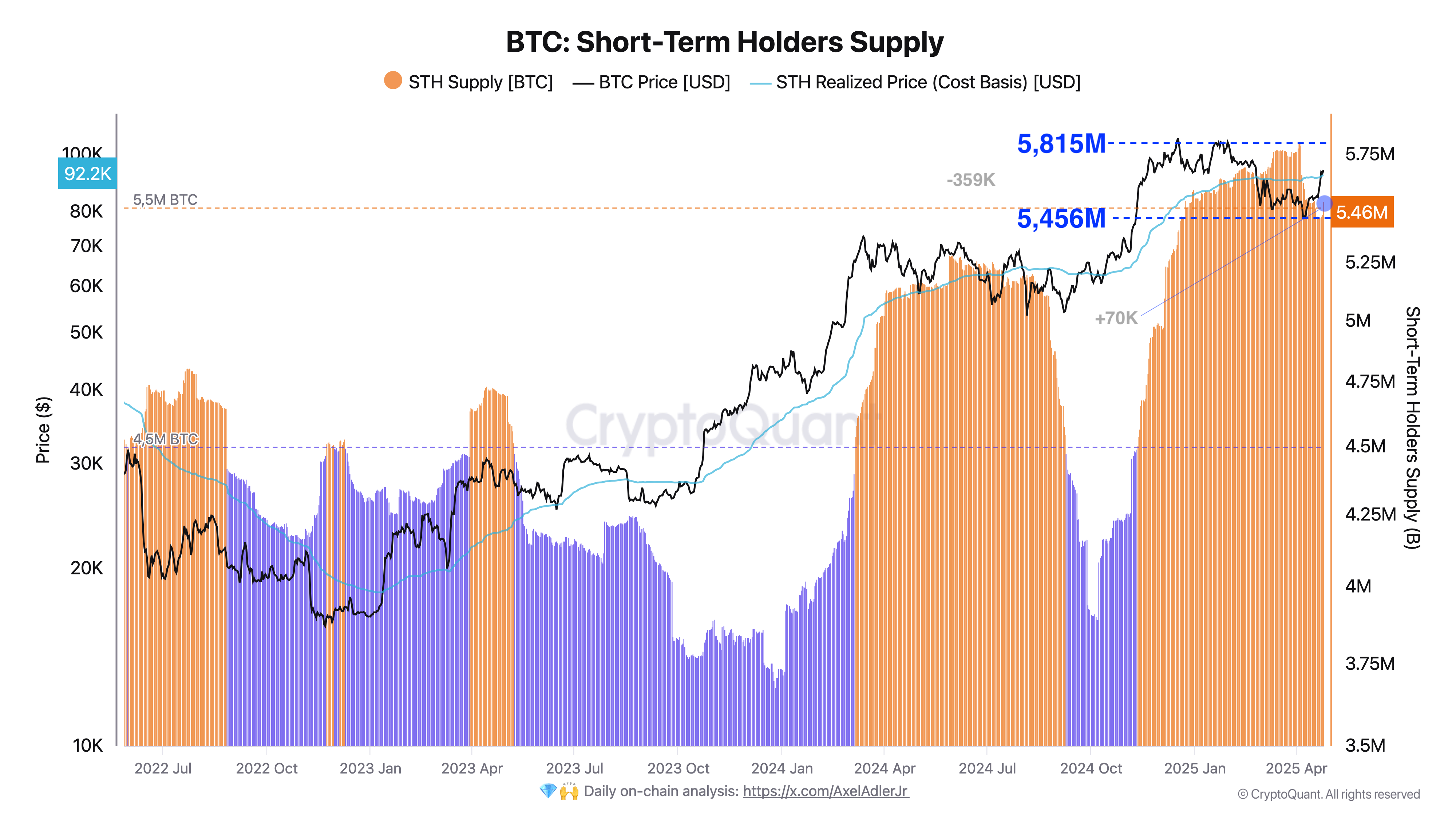

According to information, shared by CryptoQuant more recently, as Bitcoin’s price has rallied, the STH supply has ticked back up, adding around 70,000 BTC over the last two days. This uptick represents new redistribution: long-term holders are selling into fresh demand from new entrants. Importantly, the market has managed to absorb this new supply effectively without losing upward momentum.

Bitcoin’s price remains above the short-term holder cost basis, currently at around $92,200. Maintaining price levels above this metric is typically seen as a sign of market strength, suggesting that recent buyers are still in profit and less likely to capitulate.

READ MORE:

Bitcoin Price Prediction From 21Shares

Taken together, the dynamics of shrinking short-term holder supply followed by healthy absorption of new coins point toward a Bitcoin market that is maturing, resilient, and potentially setting up for continued strength. As long as Bitcoin holds above key realized price levels, this underlying foundation could support further upside.

The post Bitcoin Shows Strong Absorption of New Supply as Short-Term Holders Transition appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·