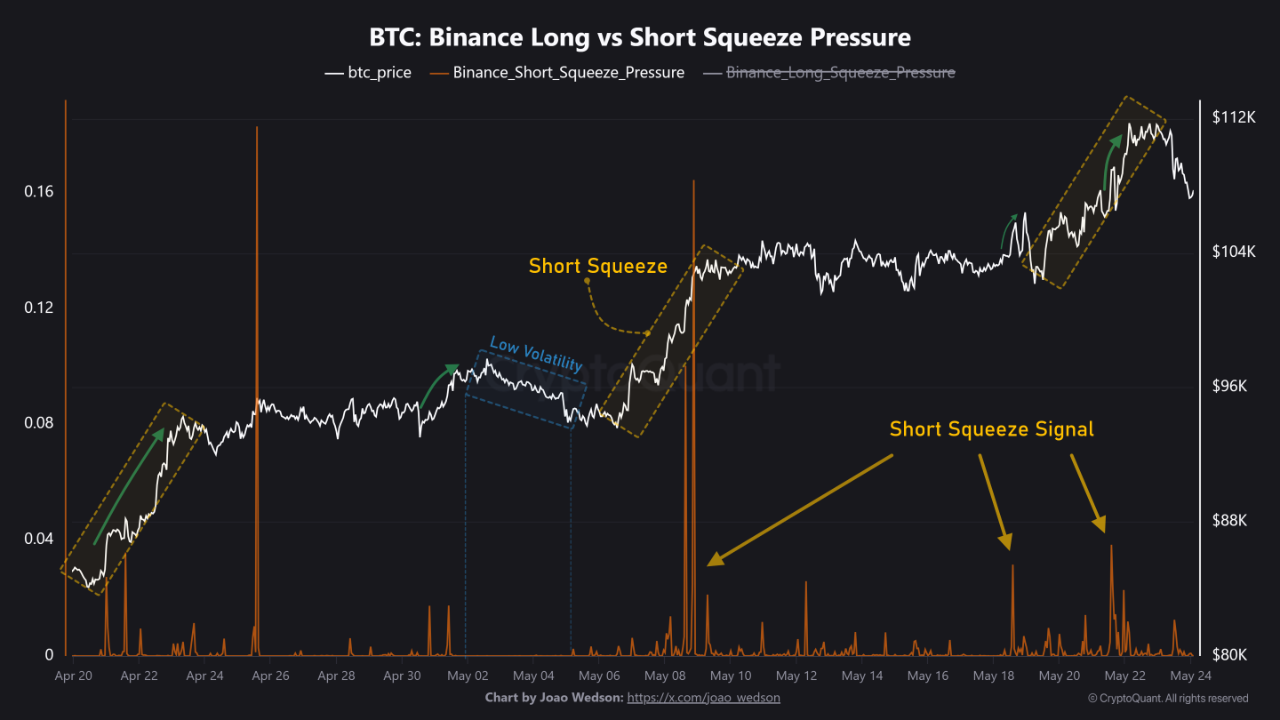

Between April and May, this indicator generated multiple short squeeze signals—moments of intense pressure on short sellers that led to sharp liquidations and triggered notable surges in Bitcoin’s price.

The chart provided shows how spikes in the Short Squeeze Pressure metric (in orange) have consistently preceded or coincided with strong upward moves in BTC’s price (white line).

For example, around May 7–8, a prominent squeeze signal was followed by a rapid price breakout, confirming the metric’s predictive power.

However, the current scenario appears more neutral. As of now, there are no strong squeeze signals, suggesting a temporary easing of pressure from short sellers. This more balanced outlook indicates a possible cooling-off period, where price action may be less volatile—at least for the moment.

Wedson notes that the metric is crucial for tracking when traders holding short positions may be forced to close, often catalyzing rapid price shifts. It’s a key tool for identifying potential turning points in market momentum.

While the short squeeze pressure has eased for now, history suggests it could return swiftly—and bring significant volatility with it. Traders should remain alert.

The post Bitcoin Short Squeeze Pressure Cools After Fueling Major Price Moves appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·