This milestone indicates that the average purchase price of BTC acquired over the past year is now below the current market price — a bullish sign that holder confidence is strengthening as fewer investors are underwater.

What Is the YoY True MVRV and Why Does It Matter?

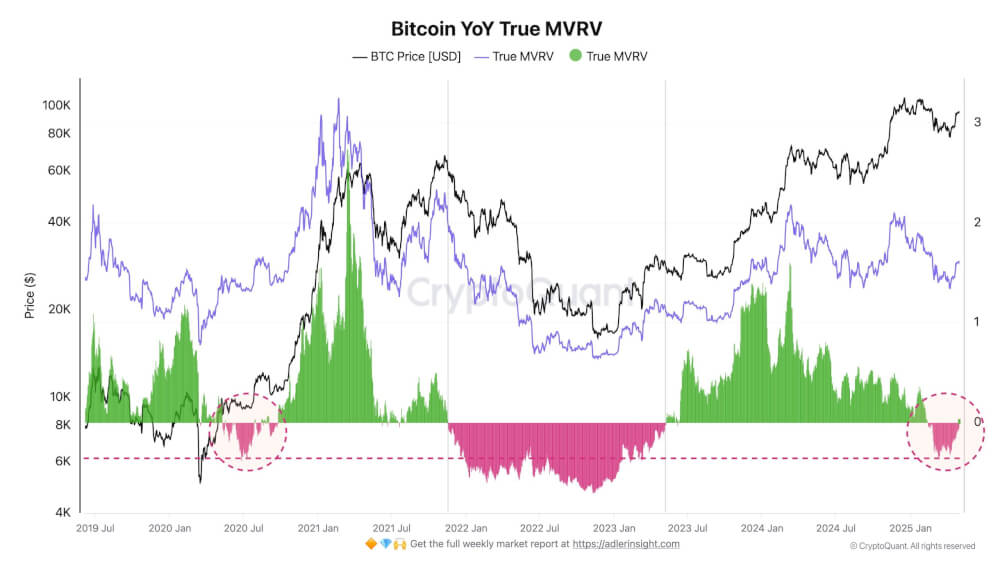

The YoY True MVRV is a key on-chain metric used to gauge investor profitability by comparing the current market price to the average cost basis of coins acquired in the past year. When the MVRV is negative, many holders are in loss, increasing the likelihood of panic selling.

However, when it turns positive — as it just did — it suggests that most investors are now in profit and less likely to sell. This shift often marks the early stages of a recovery and can precede strong upward momentum in price.

According to Adler, this positive crossover often aligns with the beginning of a new bull cycle, as was seen in early 2020 and mid-2023. In those cases, the return to profit territory led to prolonged rallies and increased market participation.

A Bullish Recovery Phase May Be Underway

As the chart in Adler’s post illustrates, previous flips from negative to positive MVRV territory have been accompanied by significant Bitcoin price appreciation. The green bars on the chart — now reappearing — represent this shift into profitability. With the speculative pressure easing and panic sellers retreating, more sustainable price growth becomes likely.

“This ‘switch’ coincides with the recovery phase and the beginning of more sustainable price growth,” Adler noted, emphasizing that the market may now be transitioning from a period of uncertainty to one of optimism.

“In short, the most interesting part is just beginning,” he concluded — reinforcing the belief that Bitcoin’s next major move may already be taking shape.

The post Bitcoin’s YoY True MVRV Turns Positive — Signaling the Start of a New Bullish Phase appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·