According to on-chain analytics platform Glassnode, Bitcoin’s recent surge above $111,000 is encountering headwinds from long-term holders who are finally starting to sell.

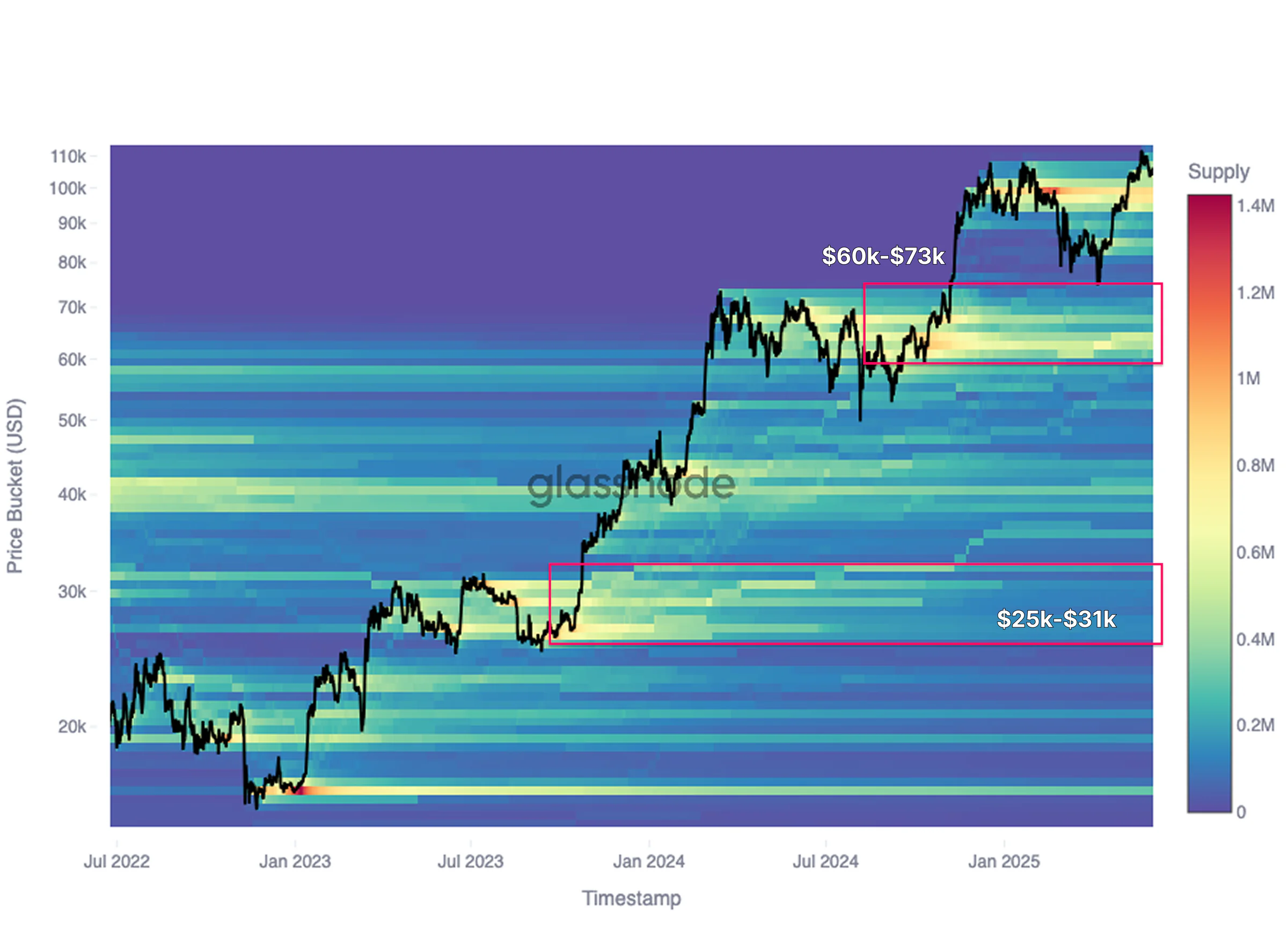

By analyzing the Cumulative Volume Delta (CBD) Heatmap from the cycle low in June 2022, analysts have identified a structural shift: the very price zones that once supported accumulation are now becoming areas of distribution.

As price advanced through previous consolidation levels, these supply-dense zones—once marked by horizontal movement—have flipped from support into resistance.

The heatmap reveals this transition clearly, as it maps net buying versus net selling intensity across time and price.

Key Selling Zones Identified

The most significant sell pressure is coming from two key historical accumulation zones: $25,000–$31,000 and $60,000–$73,000. Holders who bought during these phases and sat through extended periods of market volatility are now offloading their positions as BTC approaches new highs.

This wave of distribution has created a supply overhang, which is likely contributing to the recent stall in upward momentum. While it doesn’t necessarily signal a reversal, it does suggest that continued upside may require fresh demand strong enough to absorb this released supply.

Conclusion: Bullish Momentum Meets Long-Term Profit-Taking

Bitcoin’s macro trend remains constructive, but Glassnode’s data shows that profit-taking by seasoned investors is starting to weigh on the rally. Until this overhead supply is cleared or absorbed, further breakout attempts could face short-term resistance, particularly around previously established psychological and technical zones.

As always, watching on-chain behavior remains crucial for anticipating inflection points in market structure.

The post Bitcoin’s Rally Faces Resistance as Old Holders Cash Out appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·