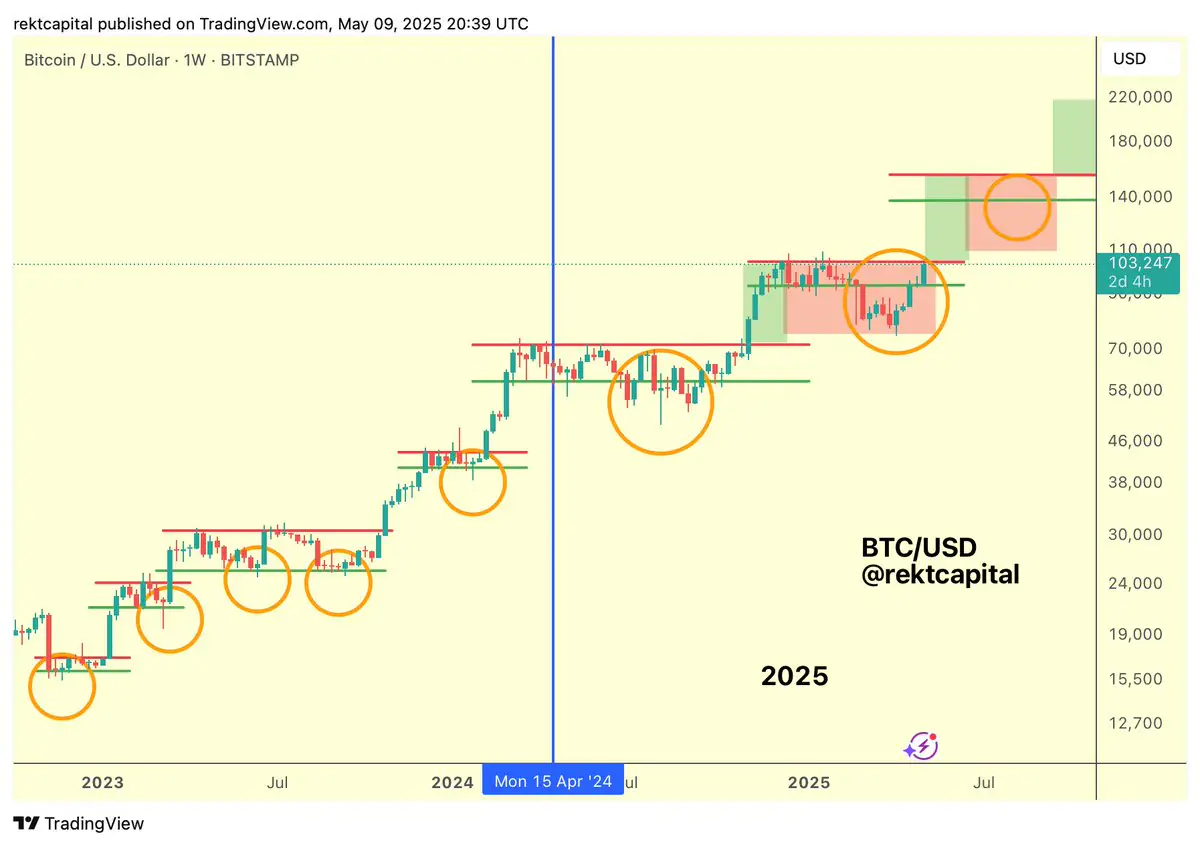

According to his analysis, the ongoing structure shows Bitcoin consistently deviating downward from accumulation ranges before reclaiming them — a recurring theme that could still play out in 2025.

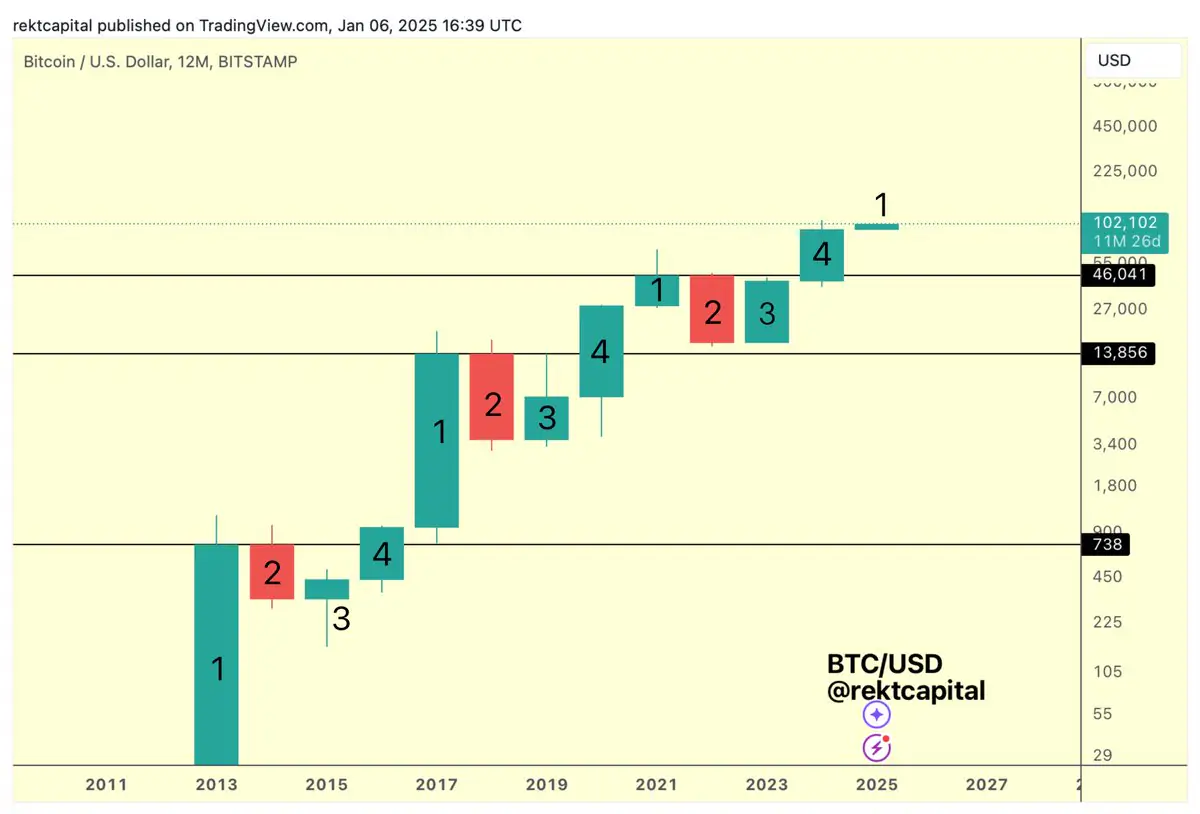

Rekt Capital also reiterates his long-standing theory about Bitcoin’s four-year cycle. As 2025 unfolds, he forecasts this year to mark the bull market peak, followed by a bearish trend in 2026, and a bottoming year in 2027 — a setup that has historically preceded the next major bull cycle.  His charts reinforce this predictive rhythm, showing the market maturing with each cycle while respecting historical precedents.

His charts reinforce this predictive rhythm, showing the market maturing with each cycle while respecting historical precedents.

The message is clear: while volatility may persist, the longer-term structure still supports a peak this year — but traders should be cautious of short-term downside deviations within that broader bullish context.

The post Bitcoin’s Path Forward: Re-Accumulation and Four-Year Cycle in Focus appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·