Crypto analyst Crypto Rover shared a chart showing Bitcoin bouncing on a well-defined horizontal support, suggesting that bulls are stepping in at a structurally significant level.

After a brief period of weakness, the price is currently hovering around $102,500, a level that aligns with both historical consolidation and Fibonacci zones.

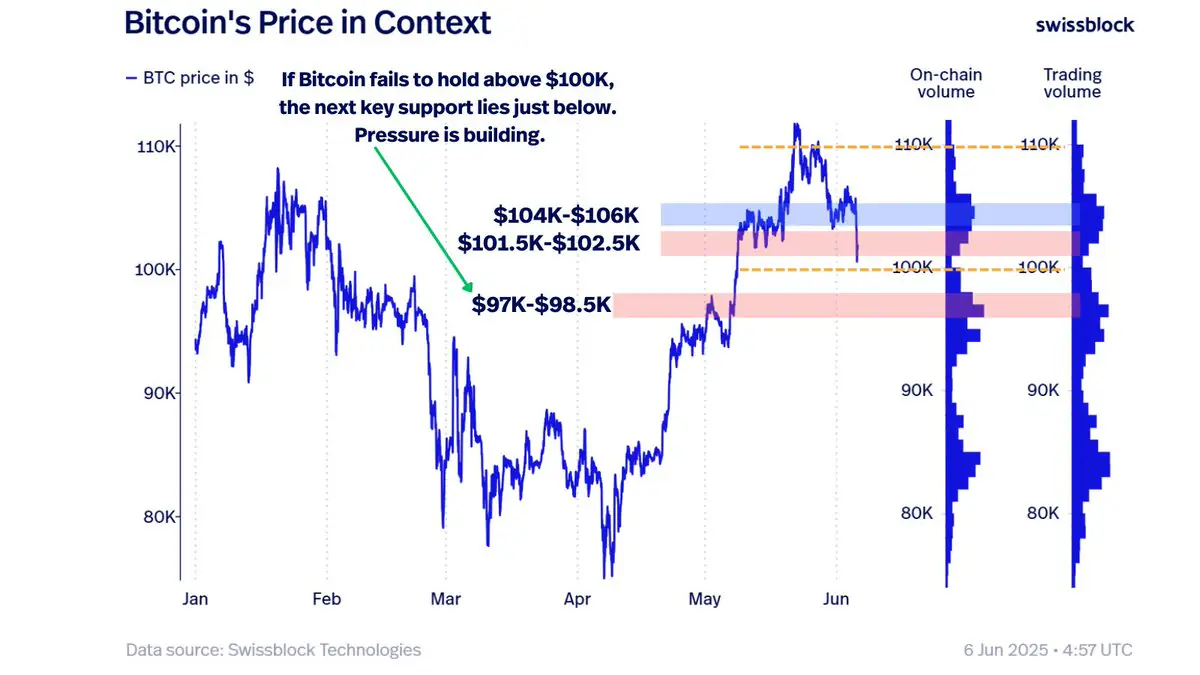

Meanwhile, Swissblock reported a failed breakout above $106K, followed by a “sharp rejection” and wide intraday volatility. Still, analysts note that there’s “no panic,” and BTC has returned to a key support area, with the next potential floor resting between $97K and $98.5K if $100K fails to hold.

Structure Weakens, But Accumulation Could Follow

Swissblock noted that while price structure has weakened slightly, bulls still have a path to regroup. They emphasized that weekend price flattening is not uncommon, and low-volume phases often precede fresh accumulation cycles.

On-chain volume clusters also suggest that strong buyer interest remains concentrated near the $100K level, reinforcing its psychological and technical importance in the short term.

Outlook

For now, Bitcoin’s ability to defend the $101.5K–$102.5K zone will be crucial. A rebound from this area could signal renewed bullish momentum, while a breakdown might expose the $97K–$98.5K level next. Traders are watching closely for signs of stabilization or further volatility heading into the weekend.

The post Bitcoin’s Make-or-Break Moment: What Traders Are Watching Now appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·