But according to Sina, a co-founder at 21st Capital and the mind behind a new Bitcoin Cycle Model, those fears may be misplaced.

The Bitcoin Cycle Model: Explained

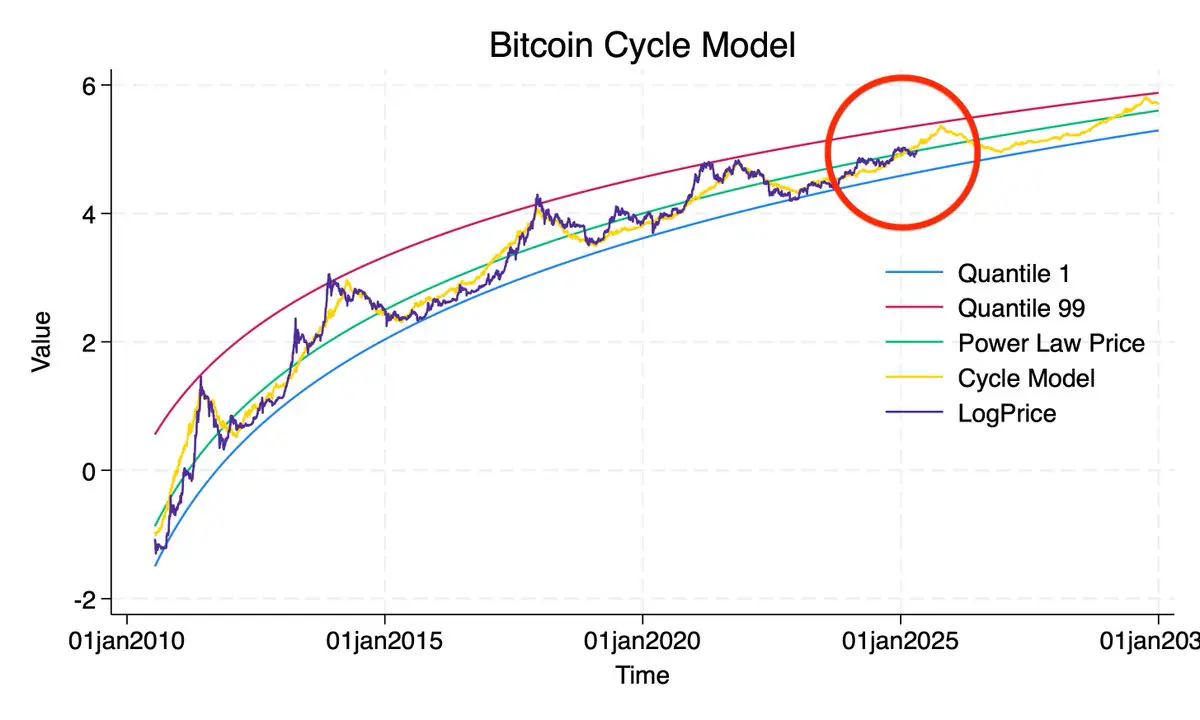

In a tweet pinned on May 3, Sina introduced his proprietary Bitcoin Cycle Model — a tool that blends traditional Quantile Modeling (QM) with added cycle timing elements.

This model overlays Bitcoin’s historical performance with prior cycle averages to assess whether the current market behavior is lagging behind.

The chart he shared shows multiple indicators:

Quantile Bands (1 and 99) – Representing extreme historical valuation levels Power Law Price Curve – A theoretical projection of long-term price behavior Cycle Model Curve (Orange) – Average trajectory of prior cycles Actual Log Price – Bitcoin’s real price movementThe visual makes one thing clear: Bitcoin is still following the expected growth trajectory, just at a pace consistent with “diminishing returns” — a feature of each successive cycle.

Diminished Volatility Doesn’t Mean Deviation

Sina points out that although this cycle may feel “boring” to many, that’s more a function of slowing volatility rather than a failure to perform. ETF launches, post-halving price action, and macro narratives (including potential political shifts like a Trump re-election) may have “pulled forward” some of the anticipated price growth.

READ MORE:

Coinbase to Delist Five Tokens on May 16

“We are still on track,” Sina affirms, reassuring the community that the pattern remains intact even if the pace is less explosive than in 2017 or 2021.

Why This Matters

With institutional capital now playing a much bigger role and ETFs soaking up liquidity, short-term price stagnation could be the new normal — and that doesn’t mean the bull market is off-course.

The takeaway? Bitcoin may not be lagging. It could be maturing.

The post Bitcoin’s Current Cycle Lagging or Maturing ? appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·