Retail traders have pivoted away from Bitcoin, funneling profits into higher-risk altcoins, a trend that often signals increased market speculation.

This surge continues a pattern that’s taken hold since the FTX crash in 2023: once Bitcoin’s rally cools, speculative interest flows into smaller, riskier assets in hopes of maximizing gains.

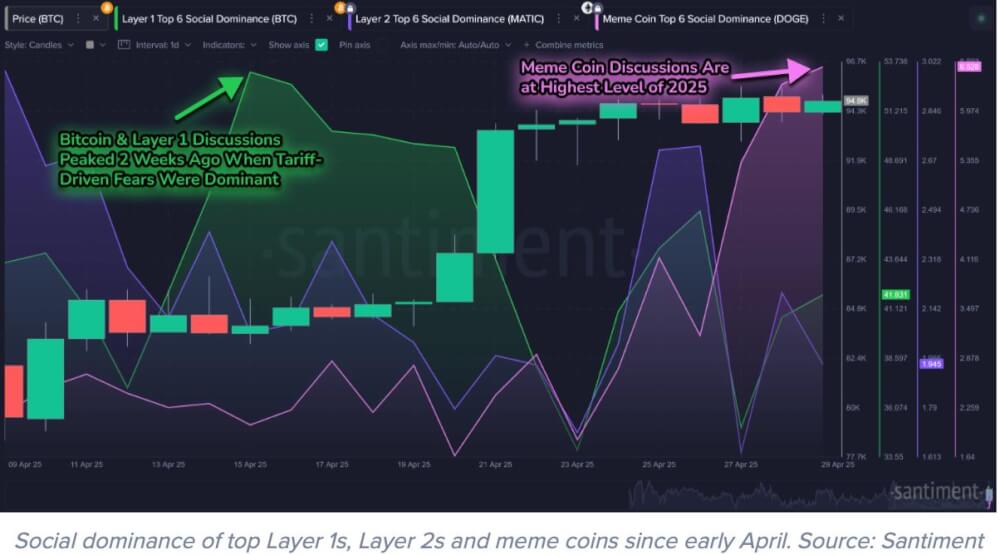

Meme Coins Dominate As Greed Signals Flash

Meme coins are once again at the forefront of speculative hype. Social media buzz around these tokens is soaring, even as interest in Layer 1s and Layer 2s diminishes.

According to Santiment, social dominance has shifted toward meme coins—a red flag for potential market overheating.

With buzzwords like “altseason,” “bull cycle,” and “buy the dip” trending, this crowd enthusiasm suggests a greed-driven market phase, often a precursor to volatility or sharp reversals.

Traders Urged to Watch for Sentiment Shifts

Historical data shows that altcoins perform best when retail sentiment is low, not euphoric. Overconfidence can lead to sudden corrections that catch traders off guard.

As we enter May 2025, it will be critical to monitor whether the current altcoin momentum continues—or if the crowd’s FOMO turns into the next exit signal.

The post Bitcoin’s Bounce Sparks Risk Appetite in Altcoin Markets appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·