The Bitcoin price and the entire crypto market have been on a tear since the outcome of the United States elections was announced in the early hours of Wednesday, November 6. The premier cryptocurrency specifically has breached and printed new all-time high prices over the past few days. Interestingly, the price of BTC has shown no signs of weakness going into the weekend, with the market leader forging a new record high above $77,000 on Friday, November 8. While the hot streak of the Bitcoin price can be attributed to the latest victory of former president Donald Trump in the US, on-chain data suggests that this rally has been a long time coming.

BTC’s Realized Cap Experiences Largest Increase In Two Years

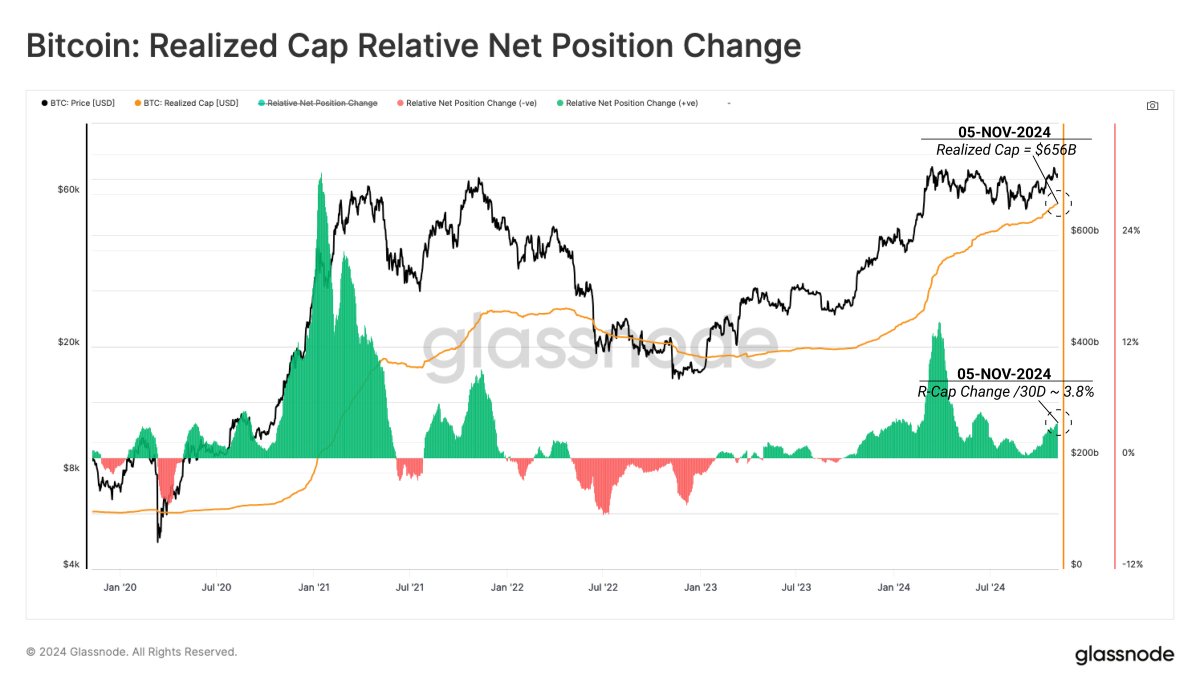

One of the latest on-chain metrics to offer an interesting insight into the meteoric rise of Bitcoin’s price is the realized cap indicator. In a November 8 post on the X platform, blockchain analytics firm Glassnode revealed that Bitcoin’s realized cap recently reached a new all-time high of $656 billion.

It is worth mentioning that the realized cap metric also represents the amount of capital flowing in and out of the flagship cryptocurrency. The latest increase reflects a net capital inflow of over $2.5 billion in the past month, suggesting the entry of new investors — both retail and institutional investors.

With the realized cap and Bitcoin price consolidating over the past few months, a sudden increase of the former to $656 billion suggests that the premier cryptocurrency might be moving from the “reaccumulation” phase to a markup phase. Ultimately, a continuation of the capital inflow trend could sustain the increase in the Bitcoin price over the next couple of months.

Bitcoin Price At A Glance

As of this writing, the price of Bitcoin is valued at around $76,700, having lost its hold above the historical $77,000 level. According to CoinGecko data, the market leader is up by an impressive 10% in the past week.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·